Ushakov’s comments follow Russian President Vladimir Putin's May 11 invitation for direct talks with Ukraine in Istanbul starting May 15.

The assault began around 2 a.m. on May 11, with Russian forces deploying 108 Shahed-type attack drones and decoy UAVs from multiple directions, Ukraine’s Air Force said.

Zelensky called a ceasefire the essential first step toward ending the war.

The number includes 1,310 casualties that Russian forces suffered over the past day.

"Think of the hundreds of thousands of lives that will be saved as this never ending 'bloodbath' hopefully comes to an end... I will continue to work with both sides to make sure that it happens."

"An unconditional ceasefire is not preceded by negotiations," French President Emmanuel Macron told reporters on May 11.

U.S. State Department Spokesperson Tammy Bruce called for "concrete proposals from both sides" in order for Washington to "move forward" in peace negotiations.

"If they speak to each other in Russian, he doesn't know what they are saying," one Western official told NBC News. Michael McFaul, former U.S. ambassador to Russia, called Witkoff's approach "a very bad idea."

Tougher sanctions "should be applied to (Russia's) banking and energy sectors, targeting fossil fuels, oil, and the shadow fleet," the leaders of Ukraine, the U.K., France, Germany, and Poland said in a joint statement.

"Russia is ready for negotiations without any preconditions," Putin claimed in an address marking the end of the three-day Victory Day ceasefire. He invited Ukraine to begin talks in Istanbul on May 15.

The American-made weapons cannot be exported, even by a country that owns them, without approval from the U.S. government.

While serving as a bishop in Peru, Robert Prevost, now Pope Leo XIV, called the full-scale war "a true invasion, imperialist in nature, where Russia seeks to conquer territory for reasons of power."

Speaking to CNN on May 10, Peskov commented on the latest ceasefire proposal from Ukraine and Europe, responding that Russia needs to "think about" it, but is "resistant" to pressure.

Speaking at a press conference in Kyiv on May 10, President Volodymyr Zelensky rebuked the idea of a demilitarized zone in the war and emphasized the importance of first securing a ceasefire.

Ukrainian State-Owned Enterprises Weekly - Issue 56

Editor's Note: This is the 56th issue of Ukrainian State-Owned Enterprises Weekly covering events from Dec. 11-17, 2021. The Kyiv Independent is reposting it with permission.

Corporate governance in SOEs

The Cabinet of Ministers replaces the Guaranteed Buyer’s acting CEO a few weeks after appointment.

The Cabinet of Ministers dismissed the recently appointed acting CEO of the Guaranteed Buyer, Vadym Ulyda, on Dec. 9.

As we reported in SOE Weekly (Issue 54), Ulyda was appointed as acting CEO as recently as Nov. 13 and filed his resignation letter on Nov. 30. Ulyda said he was resigning due to health problems.

Andriy Pylypenko became the new acting CEO. Prior to this appointment, Pylypenko was the Director of Personnel Management and Legal Affairs at Khmelnytskoblenergo.

Lawmaker Oleksiy Honcharenko (European Solidarity) accused Pylypenko of having a conflict of interest. According to the lawmaker, Pylypenko owns a company producing renewable energy, which the Guaranteed Buyer purchases.

According to the media, on Dec. 14, Pylypenko declared ownership of the Solargrad solar power plant project in Kyiv Oblast. A full 100% of the authorized capital of Solargrad LLC belongs to Pylypenko’s wife Olena. In addition, their family is a creditor (investor) of Ecobudenergy, a 1.1 MW solar power plant in Khmelnytskyi. This plant owes Pylypenko’s family Hr 4.95 million.

For an extended overview of the recent developments at the Guaranteed Buyer, see SOE Weekly (Issue 52).

The Ministry of Economy explains why SOE assets appear to have plunged by almost Hr 400 billion.

As we reported in SOE Weekly (Issue 51), the Ministry of Economy published the Unified Monitoring of Efficiency of State Property Management for the first half of 2021. The SOE Weekly team analyzed the data. Then, according to the monitoring, Ukrainian SOEs had Hr 1,261 billion in assets – a decrease of Hr 392 billion (24%) compared to the estimated value of assets at the end of the first quarter of 2021.

At Ekonomichna Pravda’s request, the Ministry of Economy explained that state-owned assets appeared to go down by Hr 392 billion in the first half of 2021 because Naftogaz had not provided the necessary information on time, and its assets had to be omitted from the half-year report.

The Ministry added that as of today, it already received the information that it needed from Naftogaz, which has been taken into account. As a result, the total value of assets of Ukrainian SOEs was reported to be Hr 1,667 billion (which is nearly as much as at the end of the first quarter of 2021 when it was Hr 1,653 billion).

Note that the Ministry of Economy publishes the data broken down by the ownership entity, but not by the enterprise. It also does not publish full data on the SOEs’ balance sheets, profit and loss, or cash flow items. Hence, it is not possible to calculate many of the standard ratios for the SOE portfolio, such as return on equity (ROE) or liquidity, nor the ratios for individual SOEs.

Doing so would allow us to see which specific SOEs contributed to the aggregate performance of the SOE portfolio. Detailed data on individual SOE performance is published on ProZvit with significant delays and is incomplete. It is therefore not yet possible to juxtapose the data from the two sources for deeper analysis.

In SOE Weekly (Issue 38), we reported the results of the Unified Monitoring of the Efficiency of State Property Management for the first quarter of 2021.

In SOE Weekly (Issue 35), we reported the results of the Unified Monitoring of the Efficiency of State Property Management for 2020.

NSSMC publishes ESG annex to the Corporate Governance Code.

The National Securities and Stock Market Commission (NSSMC) developed and approved an ESG Annex to the Corporate Governance Code (ESG stands for Environmental, Social and Corporate Governance.)

According to NSSMC, the Annex summarises how to apply corporate governance legislation by describing the following key points:

- the rationale for implementing best ESG practices;

- what is of interest to investors in terms of ESG practices;

- performance and reporting standards that companies can use for their ESG practices;

- guidelines on how companies can implement the recommendations of the Corporate Governance Code.

Just like the Corporate Governance Code, the Annex is based on the G20/OECD Principles of Corporate Governance and reflects the recommendations given in the final report on sustainable finance in emerging markets and the role of securities regulators of the Growth and Emerging Markets Committee, International Organization of Securities Commissions (IOSCO).

NABU and AMCU expose collusion in Hr 500 million public procurements.

Materials obtained by detectives of the National Anti-Corruption Bureau of Ukraine (NABU) during a pre-trial investigation helped the Antimonopoly Committee of Ukraine (AMCU) establish that a group of seven companies used concerted anti-competitive actions when bidding to supply Hr 500 million worth of software to state-owned companies in 2016-2019.

According to AMCU, the companies involved in the collusion include Infopulse Ukraine, Sapran Ukraine, SAP Ukraine, Brig-Retail, Ageles, Benoi, and Itelligence. On Dec. 15, the AMCU fined these companies a total of Hr 105.3 million and prohibited them from participating in public procurement tenders for three years.

The software procurement tenders in question had been announced by PrivatBank, Energoatom, Ukrgazvydobuvannya, the IT Center of Ukrzaliznytsia, the Mint of the National Bank of Ukraine, and Polygraph Combine Ukraina.

SOE updates

Energy sector

Naftogaz loses money in the first three quarters (unaudited).

According to its unaudited condensed consolidated interim financial statements, the Naftogaz Group posted a loss of Hr 4.37 billion for the first three quarters of 2021. In the first three quarters of 2020, the company lost four times as much money, Hr 17.03 billion.

Naftogaz and its subsidiaries’ revenue for the first nine months was Hr 136.7 billion, a 31% increase from the same period last year. According to the company’s consolidated reporting, revenues mainly rose in exploration and production, which made Hr 36.4 billion, an 84% increase, and trading, which made Hr 42.7 billion, a 72% increase.

Ukrenergo loses $1 billion in the third quarter (unaudited).

According to a report published by Marlin, in the first three quarters of 2021, Ukrenergo made a net loss of Hr 2.7 billion. In the same period in 2020, the company lost Hr 28.5 billion, almost ten times as much.

Ukrenergo blamed the seasonal increase in the generation of renewable energy sources. Ukrenergo has an obligation to spend part of its revenue to pay the feed-in tariffs.

In SOE Weekly (Issue 54), we reported that according to Marlin, enterprises overseen by the Ministry of Energy posted combined net losses of Hr 6.2 billion in the first three quarters of 2021. The third quarter saw the biggest losses, Hr 4.6 billion. The largest losses in the third quarter were incurred by Ukrenergo (Hr 3 billion).

As we reported in SOE Weekly (Issue 48), Ukrenergo made a net profit of Hr 307 million in the first half of 2021. (This suggests all Ukrenergo’s losses of the first nine months are explained by the third quarter alone.)

Note that the above results are based on intermediate, unaudited financial reporting. The audited annual results will provide a more reliable picture, which may differ from that produced by the intermediate results.

The government plans to transfer Hr 27 billion to local authorities to repay debts to Naftogaz.

On Dec. 15, the Cabinet of Ministers approved a procedure to provide Hr 26.7 billion to local governments’ budgets to repay the debts (of the regional heating companies) to Naftogaz.

The government has a memorandum with local authorities laying out how to use these sums. According to Ekonomichna Pravda, Prime Minister Denys Shmyhal said that mayors undertook not to increase the heat tariff until the end of the heating season.

The Minister of Finance, Serhiy Marchenko, noted that the funds from the rent (apparently, royalties for gas and/or other extractables) should be transferred to a special fund, which will then make the expenditures.

Marchenko also added that the State Audit Office should confirm the authenticity of the actual charges.

Ukrenergo’s transmission system development plan approved.

The National Energy and Utilities Regulatory Commission (NEURC) approved the transmission system development plan of Ukrenergo for 2022-2031.

The plan provides for the construction of 1,670 kilometers of new power lines and 61 substations, as well as increasing the transforming capacity of substations. An estimated Hr 65.7 billion will be spent on existing and future projects.

Centrenergo advances Hr 700 million to state-owned coal mines to pay miners’ salaries.

The Ministry of Energy said that it had agreed with Centrenergo management that the company would transfer about Hr 700 million to state-owned coal mining companies before the end of the week.

The Ministry of Energy called on the miners’ unions to make sure that mine managers implement a rule under which 80% of all funds must go to pay miners’ salaries.

In addition, the Ministry of Energy promised to allocate another Hr 90 million from the state budget funds that it saved on other expenditure items for miners’ salaries in December.

In SOE Weekly (Issue 55), we reported that the Ministry of Energy said that on Dec. 8 that it transferred Hr 300 million to state-owned coal mines to pay salaries to miners. The Ministry of Energy also asked the Cabinet of Ministers to re-allocate another Hr 90 million for miners’ salaries due to savings from the Ministry’s other budget-funded programmes.

Then, the Ministry said that it was working together with Centrenergo on additional advance payments to state-owned coal companies, since these funds can be used to pay salaries.

In SOE Weekly (Issue 40), we reported that the State Treasury Service of Ukraine, at the initiative of the Ministry of Energy, had already given 10 state-owned coal mines Hr 653 million to pay wage arrears to miners in August.

It appears that the Ministry is effectively redistributing cash from one SOE to others. If the private suppliers cannot receive such advance payments from Centrenergo, this appears to be a discriminatory operation.

Actions favoring certain SOEs, such as state-owned coal mines in this instance (or disfavouring others, such as Centrenergo in this instance), violate the level playing field principle of the OECD Guidelines on Corporate Governance of State-Owned Enterprises.

As far as we understand, the Ministry of Energy already spent Hr 653 million in August and Hr 1 billion in November-December on wage arrears and/or upcoming salaries of coal miners. In addition, it has asked for another Hr 1 billion for the same purpose.

The August payments were implemented as a re-allocation of costs between two items on the state budget – “Measures to liquidate non-viable coal mining enterprises” to “Restructuring of the coal industry.”

In other words, instead of spending money to liquidate or restructure the loss-making coal mines, the government decided to spend the same money on covering their operating costs.

Note that the Cabinet’s Resolution “On approving the criteria for assessing the eligibility of state aid to business entities in the coal industry” includes a clause allowing the state aid to cover coal mines’ operating expenses until Sept. 1, 2022.

According to the OECD Guidelines on Corporate Governance of SOEs, providing state aid to SOEs to cover their operating expenses violates the level playing field principle.

Infrastructure

President hands over an airline and unfinished terminal at the Boryspil Airport to the Ministry of Infrastructure.

According to the President’s Office, President Volodymyr Zelenskyy agreed to the Ministry of Infrastructure’s proposal that it should manage the State Aviation Enterprise "Ukraina" and its unfinished terminal at the Boryspil International Airport.

The State Aviation Enterprise "Ukraina" provides special flights to Ukrainian senior officials and delegations.

Privatization

International companies not prepared to participate in the UMCC auction.

BDO Corporate Finance, the State Property Fund’s adviser on the privatization of the United Chemical and Mining Company (UMCC), said that international companies are not prepared to participate in the privatization auction of UMCC despite their interest in the property.

The adviser said that this is because there were no warranties that would protect the prospective buyers’ investments. As of Dec. 14, the Cabinet of Ministers has not approved privatization terms of the UMCC auction that would include such warranties.

The terms had been drafted and proposed to the Cabinet by the State Property Fund (SPF) in October. The application deadline for the UMCC auction was on Dec. 9, and the auction is to take place on Dec. 20. This will be the SPF’s third attempt to sell UMCC.

Providing representations and warranties by the seller to the buyer is standard practice in M&A deals, including privatizations. However, the practice is not used during privatization in Ukraine.

In addition, other countries also use privatization terms that impose significant investment commitments rather than simply a commitment to buy the asset. This practice is meant to encourage strategic investors rather than speculators or insiders, but it has not been successfully used in Ukraine.

In SOE Weekly (Issue 33), we reported that the UMCC privatization auction was scheduled to take place on August 31.

Later, in SOE Weekly (Issue 41), we reported that the SPF canceled that privatization auction, since only one bidder qualified after the received applications were checked. The SPF Auction Commission set Oct. 29 as the new auction date.

The media then published a list of participants allegedly interested in UMCC assets. Some of them said that the asset was not well prepared for privatization, and they didn't consider the auction’s conditions fair. Others claimed that the starting price was inadequate. It was reportedly impossible to estimate the company’s mineral deposits.

In SOE Weekly (Issue 49), we reported that the SPF cancelled the UMCC privatisation auction. The SPF then explained that it only received two auction applications, one of which did not meet the requirements. The SPF Auction Commission then set a new auction date, Dec. 20.

The sale of Elektronmash fails, new auction at half the starting price date set.

According to ProZorro.Sale, the Elektronmash privatization auction was recognized as not having taken place, as the winner of the auction failed to sign the contract on time.

On Dec. 7, the Kyiv Regional Office of the State Property Fund (SPF) provided Lorten Group, the winner of the auction, with a draft sale and purchase contract for Elektronmash. The contract had to be signed by Dec. 13, but there was no response from the buyer as of Dec. 14.

The auction has been declared as one that has not taken place. The buyer has lost its security deposit of Hr 6.67 million, which will be transferred to the state budget.

The next Electronmash privatization auction has been set for Jan. 14.

Note that according to the privatization law, the next auction will start at half the starting price in the previous auction, Hr 33.4 million, or as little as 3% of the highest bid and the second-highest bid offered in the previous auction.

In the previous auction, the highest bid was Hr 970 000 000.01; the second highest bid, Hr 970 000 000.00; the third highest bid, Hr 560 000 100.00; and the fourth highest bid, Hr 560 000 000.00. This possibly abnormal behaviour of the bidders may be a good ground for the Antimonopoly Committee of Ukraine (AMCU) to enquire into possible collusion among the bidders.

Most Popular

After 3 years of full-scale war in Ukraine, Europe announces plan to ban all Russian gas imports

Journalist Roshchyna's body missing organs after Russian captivity, investigation says

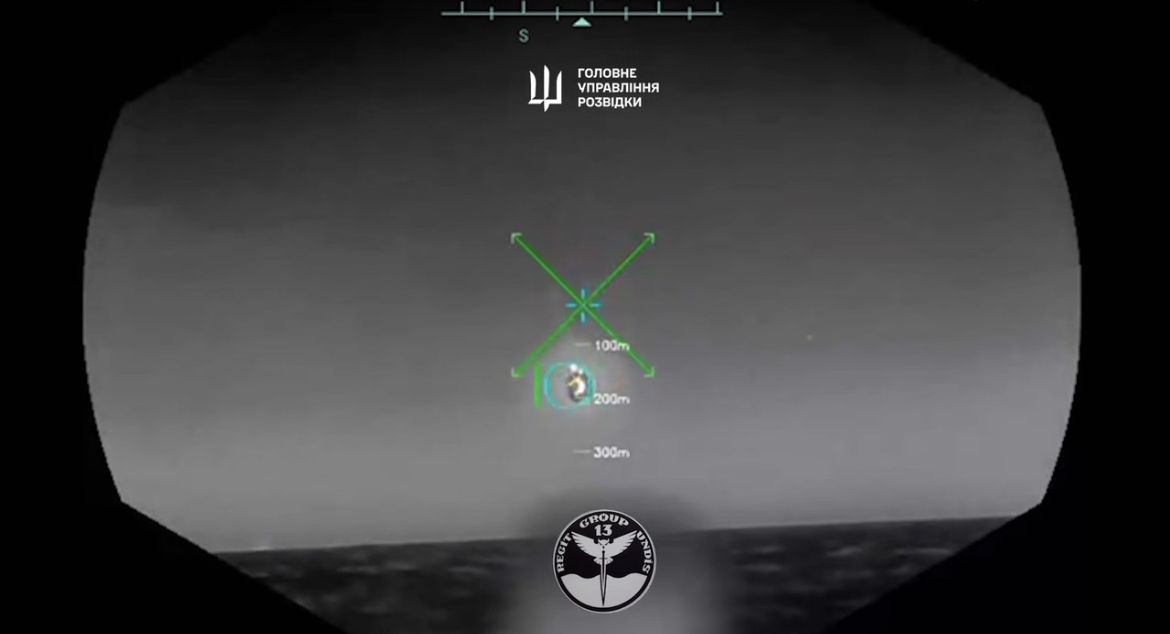

Ukrainian sea drone downs Russian fighter jet in 'world-first' strike, intelligence says

'Justice inevitably comes' — Zelensky on deaths of high-ranking Russian officials

Ukraine is sending the war back to Russia — just in time for Victory Day

Editors' Picks

How medics of Ukraine’s 3rd Assault Brigade deal with horrors of drone warfare

As Russia trains abducted children for war, Ukraine fights uphill battle to bring them home

'I just hate the Russians' — Kyiv district recovers from drone strike as ceasefire remains elusive