Major companies' online services crash in Ukraine over reported technical failures

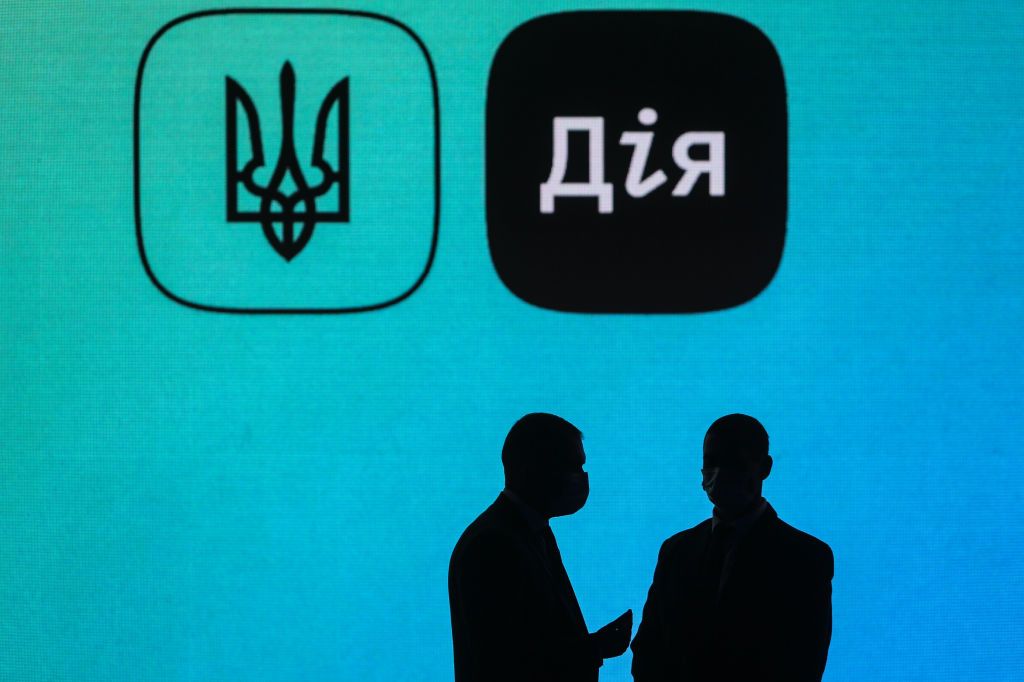

Diia, Ukraine's state mobile application for government services, and online services of several major companies are temporarily inaccessible due to technical failures, the media reported on April 26.