Ukrainian banks continue posting record profits, earning nearly Hr 120 billion ($2.9 billion) in the first seven months of 2024. The result is 22% higher than the same period last year, analytics website Opendatabot reported.

As the Kyiv Independent previously reported, Ukrainian banks are enjoying an influx of cash, largely the result of war-time policies rather than commercial skills, according to banking experts.

The government has reacted to the sector’s profits by retroactively increasing taxes on profits from 2023 from 15% to 50% in early December. Ukrainian banks paid 1.8 times more income tax than in 2023, coming in at Hr 25.83 billion ($630 million).

This year, taxes on profits are set at 25%. Banks remain highly profitable and will continue to be so this year and next year, although likely at the same level, Serhii Fursa, deputy managing director at investment firm Dragon Capital, told the Kyiv Independent.

Lasting higher profits could translate to another tax increase, according to Volodymyr Landa, senior economist at the Center for Economic Strategy (CES).

“Successful financial results increase the likelihood of a tax increase for banks. Either retrospectively, as in 2023, or for future periods,” he told the Kyiv Independent.

The International Monetary Fund (IMF), the Finance Ministry, and the National Bank (NBU) have opposed another tax hike recently proposed in parliament. But Ukraine’s budget deficit and anticipated financing problems next year may mean Kyiv is left with little choice, Landa said.

Banks largely derive their income from securities transactions, mostly Ukrainian sovereign bonds, which make up 55% of their income, according to Landa. This is followed by fee and commission income that accounts for 16% of profit structure, and transactions with individuals and legal entities at 6-7% of banks’ income.

Banks also have more liquidity thanks to the tens of billions of dollars in foreign aid passing through the banking system, the NBU previously told the Kyiv Independent. This year it is expected to reach $37 billion.

Despite banks’ low interest rates, individuals, including individual entrepreneurs, are taking advantage of the 100% security guarantee under martial law. If a bank goes bust, the deposit will be reimbursed to the full amount.

Bank deposits are flourishing, growing by Hr 28.9 billion ($705 million) from June to July, totaling nearly Hr 1.3 trillion ($29.6 billion) on July 1, the Finance Ministry reported. Previously, deposits grew by Hr 21.9 billion ($534 million) from May to June.

Ukraine’s largest banks are state-owned, a hangover from reforms over the last 10 years that nationalized oligarch-owned institutions. The leading bank continues to be PrivatBank, formerly owned by oligarch Ihor Kolomoisky until 2016, which accounted for 40% of all the banking sector’s profits, or Hr 37.16 billion ($906 million), which is an 8% increase from 2023.

As state banks comprise 63% of the sector’s profits, it is unlikely that Kyiv will increase taxes again, Fursa said. Instead, the state could take the money as dividends. But even this wouldn’t generate enough money to cover the budget deficit.

“Even if (Ukraine) introduces new taxes, it will generate Hr 30 billion ($731 million). That’s about five percent of the new budget deficit that we have this year,” he said.

“You could generate almost half of this sum by dividends,” he added.In total, the top five state-owned banks earned a total of Hr 58.84 billion ($1.4 billion), more than any other banking division. Collectively, they paid Hr 14.6 billion ($356 million) in taxes. PrivatBank alone paid Hr 12.13 billion ($296 million) in taxes, an increase of 1.5 times compared to last year.

Ukrainians still largely prefer state-owned banks which are seen as reliable for depositors, Dmytro Yablonovskyi, an independent consultant in corporate governance, previously told the Kyiv Independent.

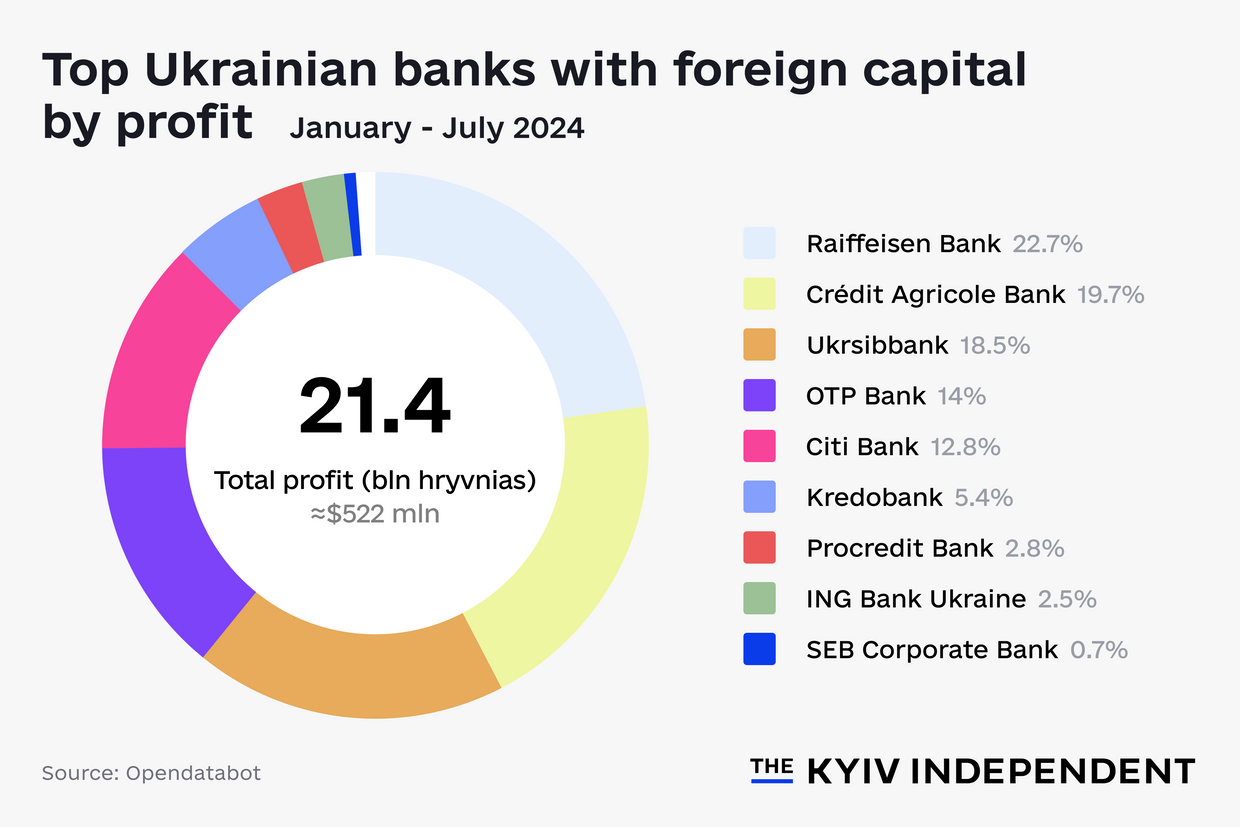

Banks with foreign capital follow state-owned banks, contributing to 23% of the sector’s profits with Hr 21.4 billion ($522 million). Austrian giant Raiffeisen Bank was the top earner with Hr 4.87 billion ($119 million), around 28% higher than last year.

The bank paid Hr 1.63 billion ($40 million) in taxes while as a whole banks with foreign capital contributed Hr 7.26 billion ($177 million), an increase of 1.7 times from 2023.

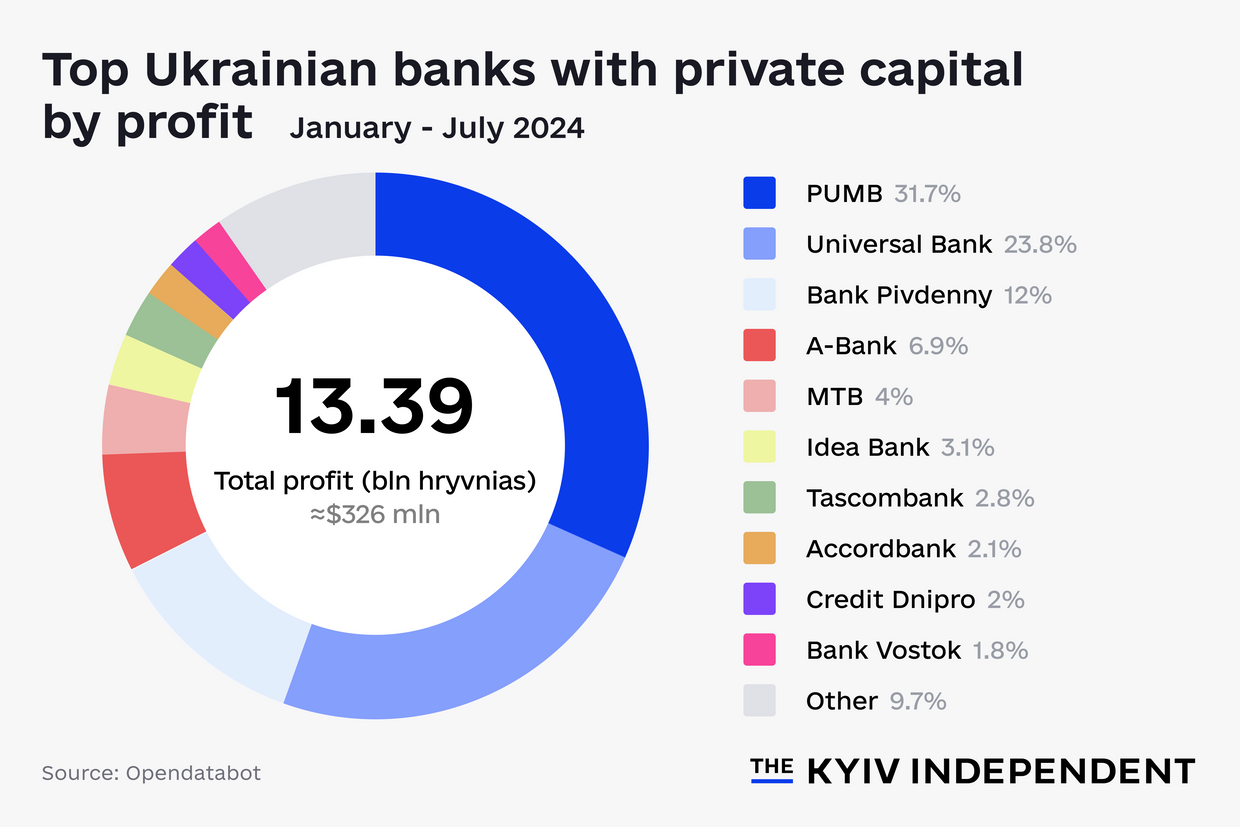

Lastly comes banks with private capital. They increased their profits by 29% to Hr 13.39 billion ($326 million), accounting for 14% of total profit. FUIB brought in the most cash with Hr 4.24 billion while MTB bank increased profits by 13 times to nearly Hr 540 million ($13 million), the largest growth of all banks.