Edward C. Chow: Irrelevance of Russian oil price cap

Editor's note: The opinions expressed in our op-ed section are those of the authors and do not purport to reflect the views of the Kyiv Independent.

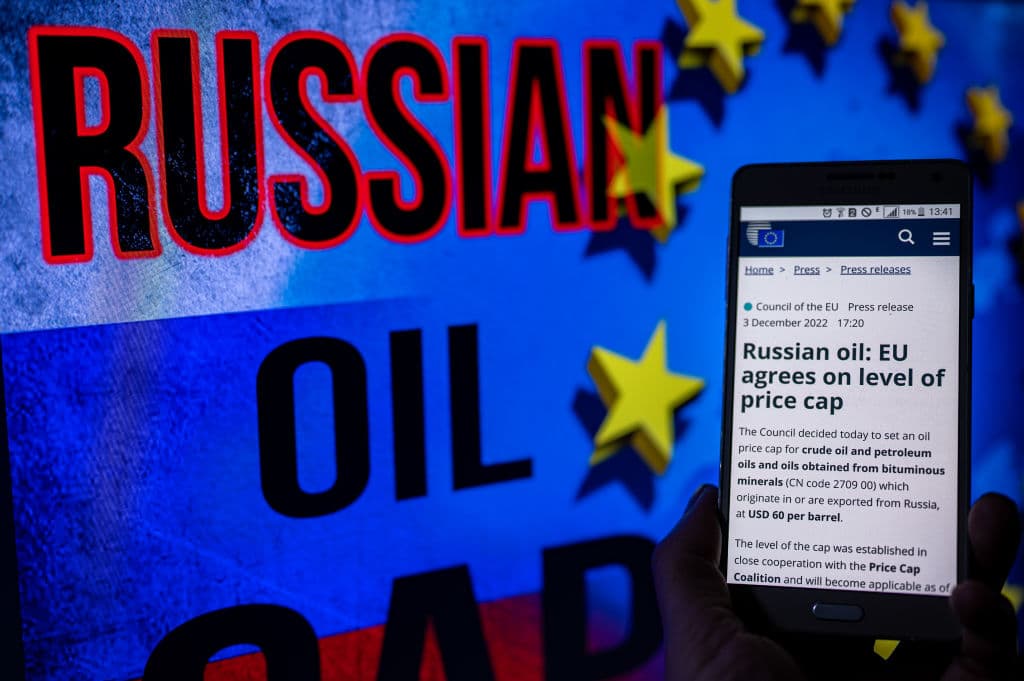

On Dec. 3, the European Union finally revealed its much-anticipated price cap on Russian oil. The concept was introduced by G7 leaders on June 28 at the urging of the U.S. after their summit in Germany.

Unfortunately, the announced cap of $60 per barrel is hugely anticlimactic as Russia recently sold its oil at a price of below $50. Even though the price cap is supposed to take effect on Dec. 5, the long delay allows seaborne cargos loaded before that date to be unloaded before Jan. 19.

In other words, nine months after Russia drastically escalated its war against Ukraine on Feb. 24 and five months after Western leaders broached this novel sanction against Russia’s principal export, what was announced is underwhelming and unlikely to impact Russia’s war calculations.

A price cap above $50 per barrel would not impact Russia’s oil export income.

Western leaders are conflicted between wanting to punish Russia for its brutal war against Ukraine and not reducing Russian oil exports so much as to cause a price shock. Their indecision has instead led to market anxiety on the severity of future oil sanctions, which has caused the price to rise despite no physical shortage.

Although the price of Brent, the international crude benchmark, has dropped below this year’s peak above $120 per barrel, the current price of around $80 is still significantly higher than below the $70 level a year ago before the U.S. sounded the alarm on Russia’s impending attack on Ukraine.

Consequently, despite offering steep price discounts to nontraditional buyers, Russia has suffered little in its oil export volume or earnings.

Enforcing a price cap on other countries with no interest in restricting Russian oil, such as India, China, and Turkey, was always going to be difficult. Western leaders have compounded the problem by setting the so-called cap above the market price for Russian crude.

They showed themselves to be more concerned about the availability of Russian oil than in limiting Russia’s ability to wage war – not the signal one wishes to send to Moscow.

Indeed, $60 per barrel may become a floor for Russian crude oil rather than a cap since the G7 and EU now endorse it as an acceptable price.

However, it may also fray Western unity on sanctions against Russia since EU members, such as Hungary, Slovakia, Italy, and Bulgaria, which have traditionally relied on Russian oil, might ask, “If other countries can buy Russian oil at $60, why can’t we?”

Defenders of the price cap might say that the level can be lowered if Russia does not change its behavior. To this, one might reasonably ask: How many more atrocities must Russia commit before this happens?

Would it not be better to start with a much lower cap and offer to raise it incrementally if Russia stops targeting civilians and civilian infrastructure, returns kidnapped Ukrainians, including children, gives back plunder from occupied territories, and withdraws to pre-Feb. 24 lines and from Ukrainian territories occupied since 2014?

If the objective is to deepen the discount Russia has to offer to move its crude, leaving in place the EU embargo on imports of Russian oil which was agreed to in June, then going forward with prohibitions against shipping, insurance, and other services would have done a better job without the price cap.

The history of oil sanctions teaches us that they increase the incentive for shady deals. An extra $5 discount on a typical $2-million-barrel seafaring cargo translates to $10 million of extra profit for a trader willing to risk evading sanctions.

Even the UN oil-for-food program for Iraq under Saddam Hussein was scandal-ridden. Russians are masters in this game and were major traders of Iraqi oil. The Middle East is becoming a major hub for trading Russian oil despite that oil competing with that from the Persian Gulf.

There is always a price that will move oil. Oil sanctions have proved ineffective in changing the behavior of petrostates like Iran and Venezuela.

The oil price cap was offered as an elegant solution, but it is largely irrelevant as it is currently designed. Having followed a tortuous path to an ultimately ineffective sanction on Russian oil, Western leaders are left with the same hard choices they have had since Feb. 24 on how to stop this terrible war quickly. Oil sanctions alone cannot achieve this outcome.

In a war, there is no substitute for military power. By unilaterally forgoing options such as a no-fly zone or a naval escort for essential Ukrainian imports and exports, by supplying Ukraine with sufficient modern armaments only after they prove necessary on the battlefield rather than anticipating those needs, and by still holding back weapons with sufficient reach to strike Russian logistic and supply centers, the West has left escalation dominance to Russia.

This war will only end when Putin’s Russia understands it will never be allowed to win and that prolonging its war will cost more for Russia than Ukraine. Then, and only then, will Russia, not Ukraine, sue for peace.