Media: Europe continues to import over $14 billion of Russian raw materials

Since the beginning of the full-scale invasion of Ukraine, the European Union has continued to import billions of euros worth of "critical" raw materials from Russia, media outlet Investigate Europe highlighted in a report on Oct. 24.

Between March 2022 and July 2023, statistics show that European countries imported 13.7 billion euros ($14.5 billion) worth of critical raw materials from Russia.

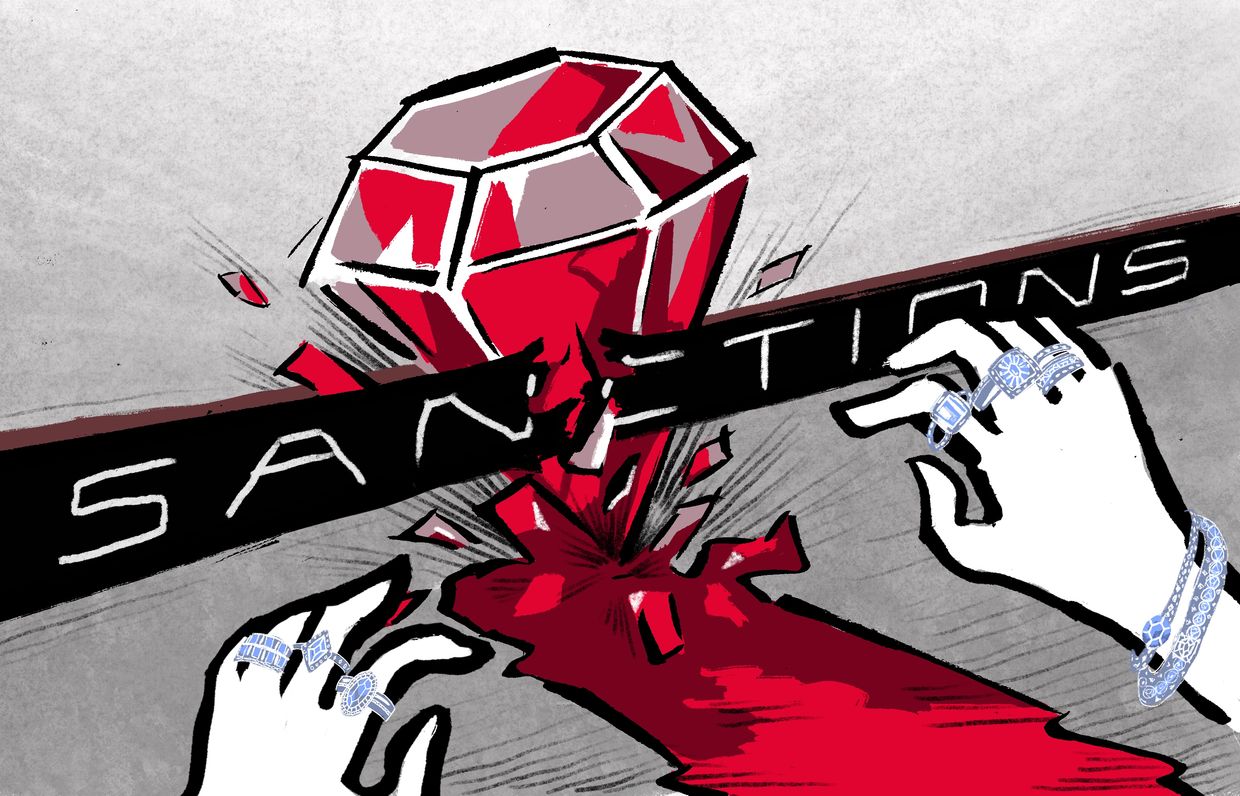

While certain raw materials like oil, coal, and steel fall under EU sanctions, there are 34 minerals that the EU considers to be "critical" and have therefore avoided restrictions, the report said.

However, Investigate Europe pointed out that the U.S. and U.K. have sanctioned several Russian mining businesses directly since the start of the full-scale invasion, "further isolating the EU in its double standards."

The EU designates minerals like copper, nickel, and titanium as being "crucial to Europe’s economy" due to their importance in producing everyday goods and technologies.

The report warned that these imports, on which many sectors like aerospace, electric car manufacturing, and defense are hugely reliant, "not only fund Russia's war economy, but also benefit Kremlin-backed oligarchs and state companies."

Some of these oligarchs have been personally sanctioned, while their actual businesses face "no restrictions."

For example, the world's largest titanium producer, Vsmpo-Avisma, is part-owned by Russia's state-owned defense conglomerate, Rostec. Both companies share "close Putin ally" Sergei Chemezov as chairman, who is under EU sanctions.

Rostec has also been targeted with sanctions, but Vsmpo-Avisma has not, and sold "at least $308 million of titanium into the EU via its German and UK branches between February 2022 and July 2023," the report revealed.

The story of Vsmpo-Avisma is far from the exception, Investigate Europe explained. Companies owned by sanctioned oligarchs that produce nickel, platinum, and aluminium are also still exporting via EU-based subsidiaries.

However, research suggests that "imposing tariffs or severing ties too quickly could lead to a global price surge which would harm European buyers while benefiting Moscow."

"The monetary value of what Russia would lose from the EU import ban, might be smaller than the effect on the EU production,” Tymofiy Mylovanov, president of the Kyiv School of Economics, told Investigate Europe.

A complete ban on critical raw materials is therefore unlikely to appear in the EU's 12th sanctions package, which is currently being worked on.