Ukraine's central bank cuts interest rate in first change in 10 months

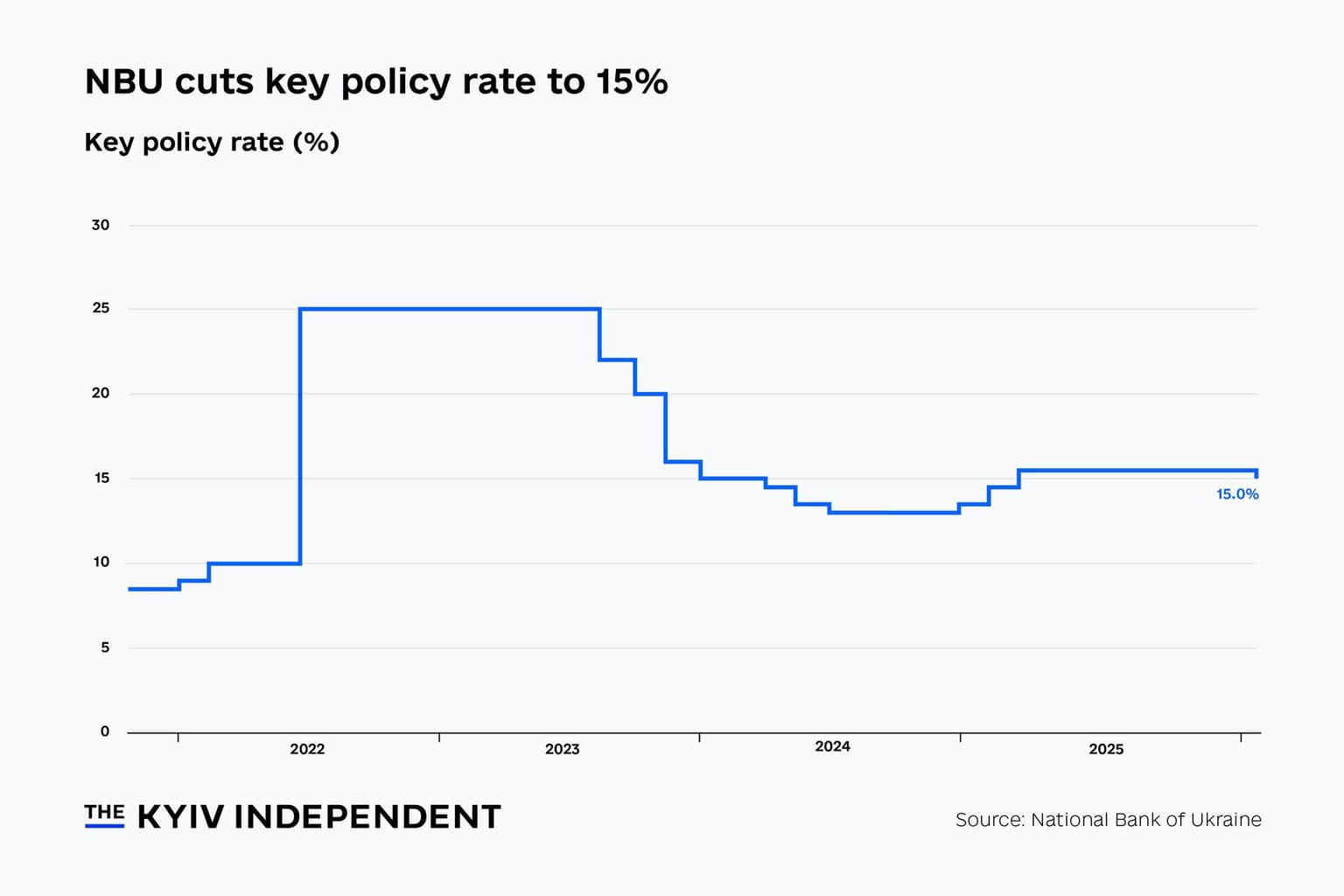

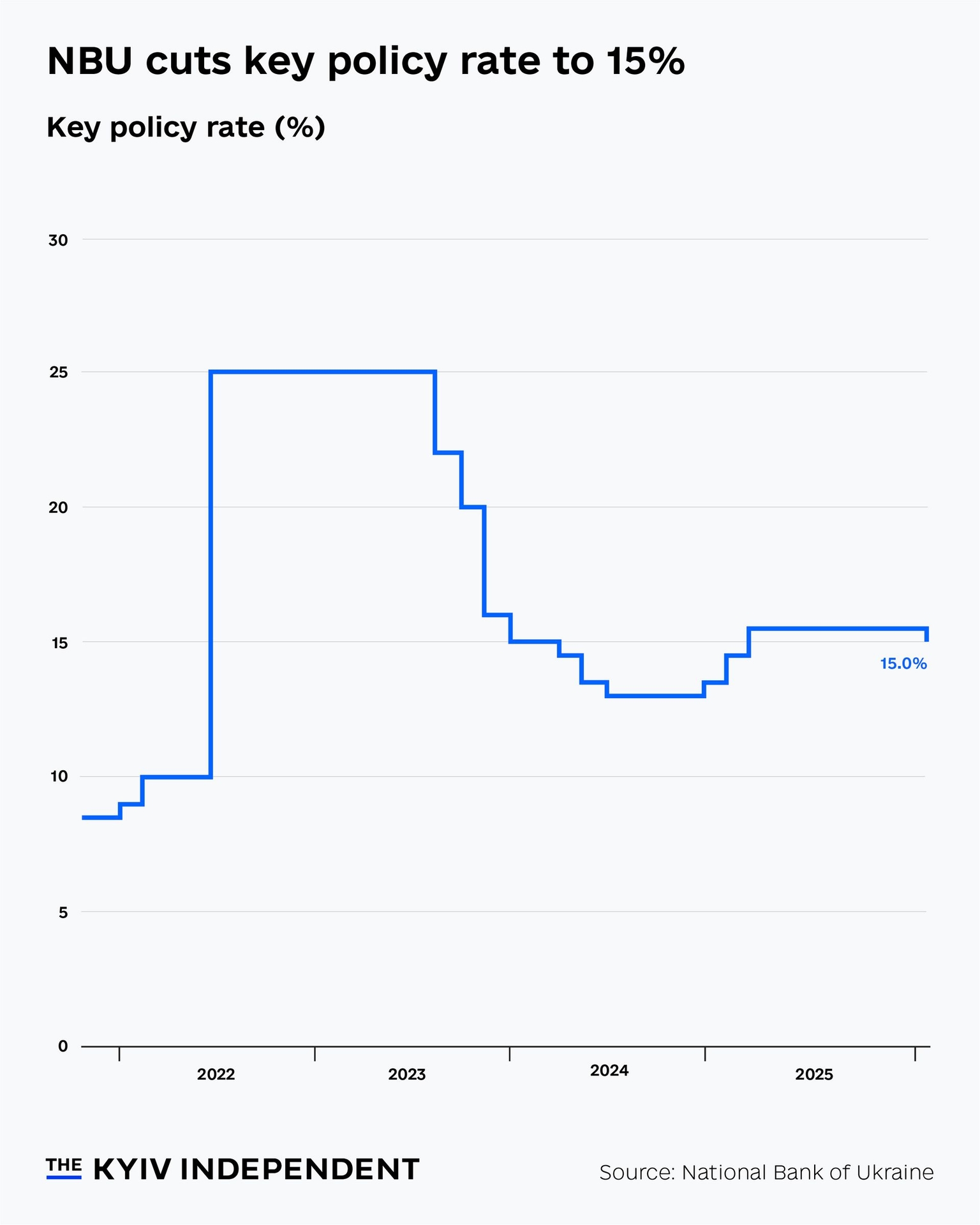

The National Bank of Ukraine (NBU) voted on Jan. 29 to cut its benchmark interest rate to 15%, the first change since March last year, as inflation cools and a new aid package from Europe eased pressure on the country's finances.

The central bank held the key rate at 15.5% in six consecutive votes over the course of 2025, a response to high inflation and uncertainty over the future of the country's finances.

But both these risks have now been tamed, the bank said in a press release. Inflation continued its downward trend, hitting 8% last month according to the NBU. On Dec. 19, the European Union agreed a 90 billion euro ($105 billion) lifeline to Ukraine, which will keep the country's finances afloat through 2026.

The logic of maintaining the high rate over 2025 was twofold: encourage saving over consumption to ease inflation, and increase the attractiveness of Ukraine's domestic currency, the hryvnia, to protect the bank's foreign exchange reserves.

The bank expects inflation to decline to 7.5% by the end of 2026, and reach its target inflation rate of 5% by mid-2028.

The bank also expects Ukraine's economy to grow by 1.8% in 2026.

Ukraine has witnessed two significant bouts of inflation since Russia's full-scale invasion in February 2022.

Inflation surged to 26.6% in October 2022 from 10.0% on the eve of the full-scale invasion. The bank responded by raising the key rate from 10.0% to 25.0% in June 2022, where it remained until July 2023.

A second bout of inflation peaked at 15.9% in May 2025, driven by a poor harvest in 2024, higher energy and labor costs, and robust consumer demand.

The key rate has not fallen below 13% since the full-scale invasion.