FT: G7 developing plans to support Ukraine in securing funds by leveraging Russian assets as financial safety net.

Group of Seven (G7) countries are developing strategies to issue debt to support Ukraine, utilizing Russian assets a safety net for repayment, the Financial Times reported on Feb. 3.

According to G7 officials familiar with the discussions, the proposed plan involves Kyiv's allies raising debt to provide financial support for Ukraine and demanding that Russia repays the debt. If Russia does not repay the debt, the countries would then seize frozen Russian assets.

Structuring the debt support in this way would enable allies to raise funds for Ukraine without the immediate need to resolve legal questions about the grounds on which nations could seize Russian assets

“One of the things that this would do is put off the question of what happens to the Russian sovereign assets, even though they would be used as collateral,” an official with knowledge of the negotiations told the Financial Times.

Despite appeals by lawmakers, some countries have been hesitant on the outright seizure of the assets, as such a step carries a number of legal and economic pitfalls. The United States, Germany, and France, as well as the European Central Bank, have also expressed that seizing assets could have financial stability implications.

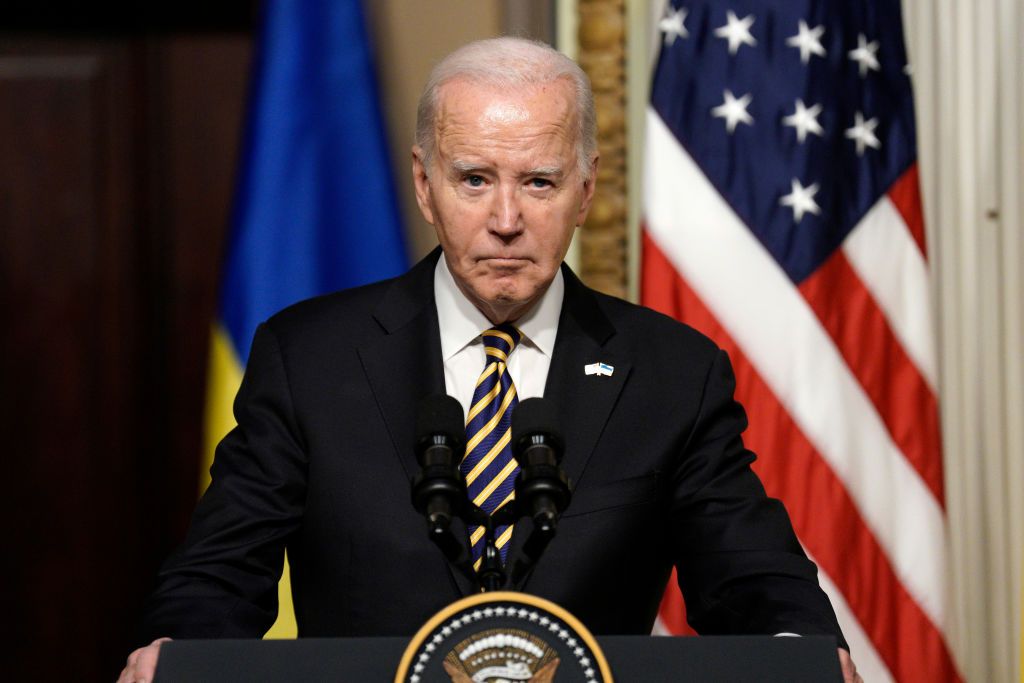

Earlier this month, U.S. President Joe Biden's administration backed legislation that would allow the confiscation of some frozen Russian funds and funneling them to Ukraine.

“Using the assets as collateral to raise debt is an attempt to find a compromise between different viewpoints around the table, both within the EU and . . . the G7,” an official told FT.

Western countries have immobilized around $300 billion of the Russian central bank's assets since the start of the full-scale invasion. Washington, Brussels, and Kyiv have long discussed legal ways of channeling these funds to aid Ukraine's reconstruction efforts.

G7 nations have pledged that Russian assets held in their jurisdictions would remain frozen until Moscow pays war reparations to Ukraine.

The World Bank assessed early in 2023 that the total cost of Ukraine's reconstruction would amount to $411 billion. Ukrainian Foreign Minister Dmytro Kuleba commented earlier this month that the full amount of Russian assets could cover over 80% of recovery costs.

.