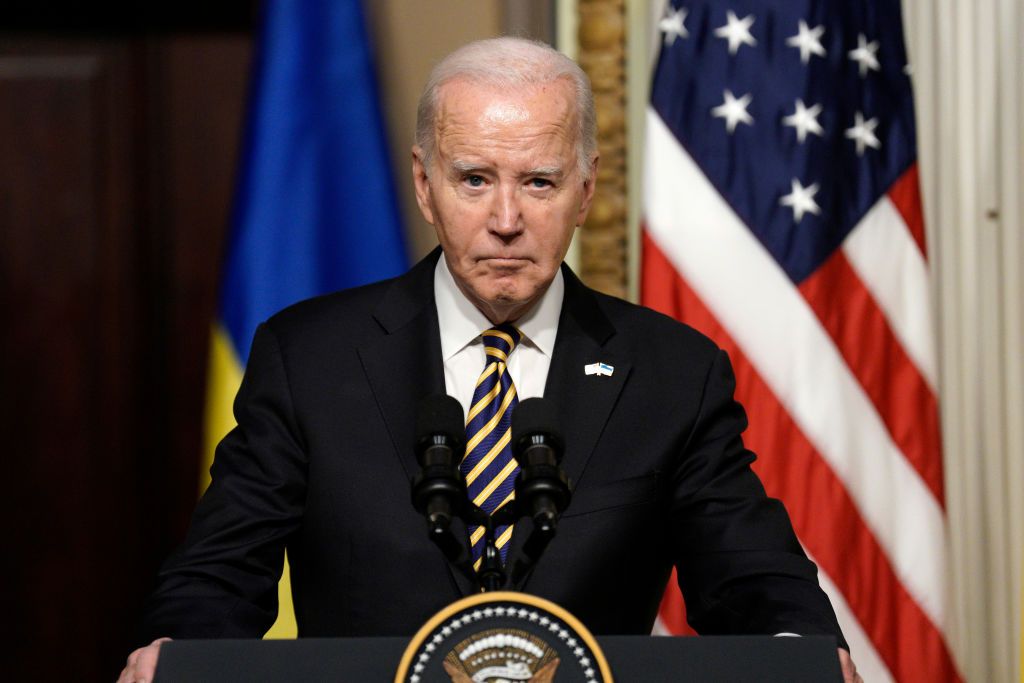

U.S. President Joe Biden's administration backs legislation that would allow the confiscation of some frozen Russian funds and funneling them to Ukraine, Bloomberg reported on Jan. 10, citing three documents it had obtained.

Western countries have immobilized around $300 billion of the Russian central bank's assets since the start of the full-scale invasion. Washington, Brussels, and Kyiv have long discussed legal ways of channeling these funds to aid Ukraine's reconstruction efforts.

Despite appeals by U.S. lawmakers, the White House had been hesitant on outright seizure of the assets, as such a step carries a number of legal and economic pitfalls.

It appears that the Biden administration began warming to the idea recently. A November memo from the National Security Council to the U.S. Senate welcomed "in principle" a bill that would allow the confiscation of funds, Bloomberg reported.

"The bill would provide the authority needed for the executive branch to seize Russian sovereign assets for the benefit of Ukraine," the document reportedly said.

Congressional officials cited by Bloomberg noted that the measure could be included in the proposed $61-billion supplemental package for Ukraine, though both chambers of Congress would have to back its inclusion.

Senate Republicans have so far blocked the overall $111-billion funding requests, including money for Ukraine, chiefly due to other domestic concerns. A hardline faction of House Republicans opposes the aid in principle, however.

Using Russia's own funds instead of U.S. money could alleviate Republican worries about financial burdens, and House Speaker Mike Johnson, a member of the Republican Party, voiced interest in the plan.

The White House also reportedly seeks to align its position with the Group of Seven (G7) allies, namely in the EU, where around two-thirds of Russian frozen assets are held. In comparison, only around $5 billion are held in U.S. institutions.

The European bloc has been wary of confiscating Russian sovereign funds, instead discussing ways of providing Ukraine with a windfall tax on profits generated by the frozen assets.

In October, Belgium announced it would create a $1.8 billion fund for Ukraine, financed by the tax revenue from interest on frozen Russian assets.

The World Bank assessed early in 2023 that the total cost of Ukraine's reconstruction would amount to $411 billion. Ukrainian Foreign Minister Dmytro Kuleba commented earlier this week that the full amount of Russian assets could cover over 80% of recovery costs.