The United States opposed a joint G7 effort to lower the $60-per-barrel price cap on Russian oil exports during last week's meeting of finance ministers, the Financial Times reported on May 27, citing three unnamed officials familiar with the talks.

The price cap, introduced by the G7 and EU in December 2022, bans Western companies from shipping, insuring, or otherwise servicing Russian oil sold above $60 per barrel.

The mechanism was designed to limit the Kremlin's ability to finance its war against Ukraine.

The Canadian G7 presidency had proposed including language in the meeting's final communique that would call for tightening the existing price cap, according to the publication.

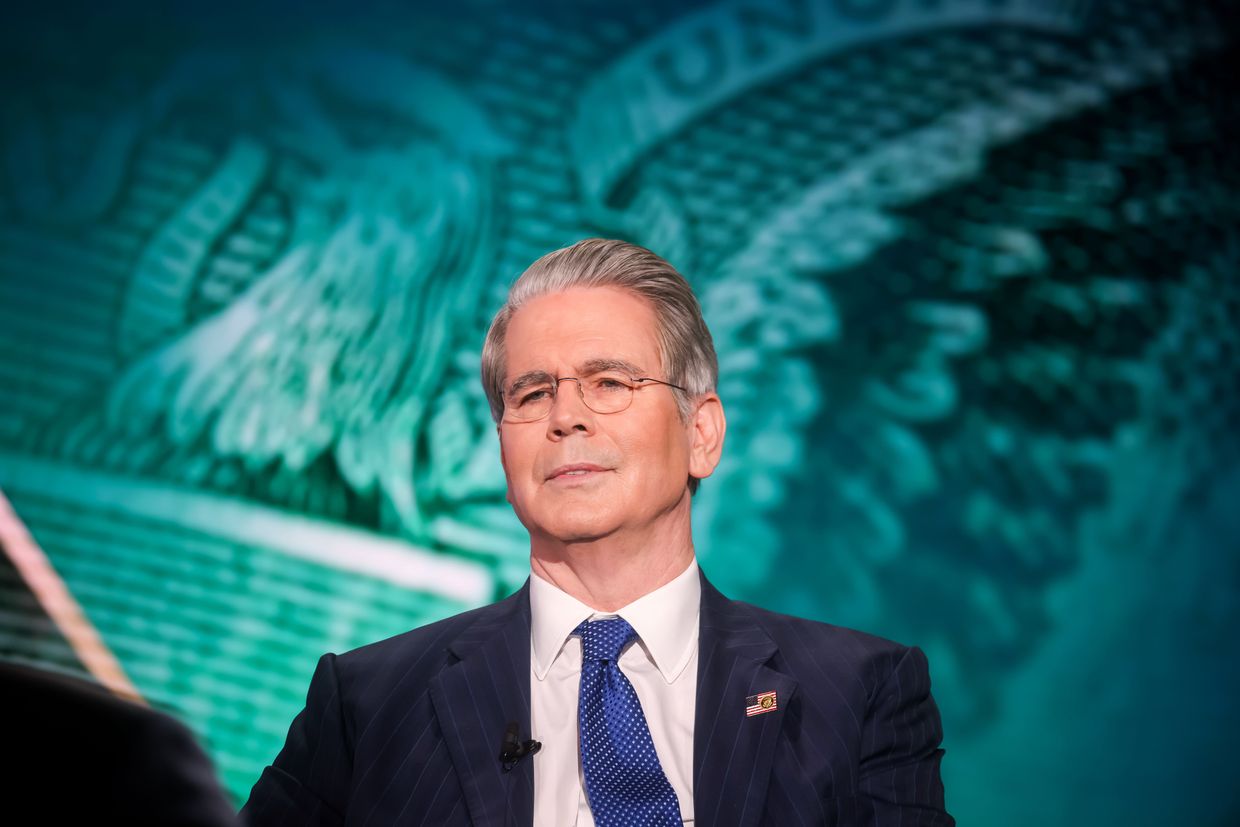

The move received backing from the European Union and G7 members France, Germany, Italy, and the U.K. However, the proposal was dropped after U.S. Treasury Secretary Scott Bessent reportedly declined to support it.

The European Commission had planned to propose reducing the threshold to $50 per barrel ahead of the meeting, according to Reuters.

The Financial Times reported that some EU countries — including Hungary and Greece — were still weighing their support for lowering the cap further, possibly to $45, as part of the EU's upcoming 18th sanctions package.

Russia's Finance Ministry has leaned on oil and gas taxes to finance growing military expenditures, including aggressive campaigns against Ukrainian cities and infrastructure.

U.S. President Donald Trump's stance on U.S. sanctions against Russia has been unclear.

Trump told reporters in the Oval Office on May 19 that he would not impose further sanctions against Russia "because there's a chance" of progress towards a ceasefire.