Russia’s war may halve Ukraine's economy, increasing budget deficit by billions

After Ukraine ended 2021 with a historically high gross domestic product (GDP) of $195 billion, top officials issued optimistic forecasts for the coming year.

Then the war began, killing all of the country's economic plans.

As of late April, the Russian military has destroyed 30% of Ukraine’s infrastructure, causing $100 billion worth of damage.

Total losses to the economy, both direct and indirect, have already reached over $560 billion, according to the head of President Volodymyr Zelensky's office, Andriy Yermak.

Russia's full-scale invasion has forced more than five million people to flee Ukraine. Around 60% of small- and medium-sized businesses are currently closed or suspended.

According to World Bank estimates, Ukraine’s economy will contract by 45% in 2022.

“This is already terrifying,” said Deputy Director at the Center for Economic Strategy Maria Repko. “This means that we no longer have a third of our economy.”

According to Ukraine's State Statistics Service, inflation in Ukraine may quadruple to 15-20% by the end of the year.

The blocked ports of the Azov and Black seas killed maritime shipping and cut half of the country’s exports, as well as 90% of grain trade with foreign countries.

As of early May, around 4.5 million tons of grain were stuck at Ukrainian ports, according to Martin Frick, the World Food Programme director in Germany.

“(Logistics) were ruined. Old supply chains through the ports are not working and won’t resume operation in the nearest future,” said Repko.

In March, Ukraine exported just 5.97 million tons of goods worth $2.7 billion. Imports fell by two-thirds to 1.6 million tons worth $1.8 billion due to an unprecedented decline in consumer demand.

Russia’s invasion is already “sending shockwaves throughout the globe,” according to Kristalina Georgieva, managing director of the International Monetary Fund.

“The economic consequences from the war spread fast and far, to neighbors and beyond,” Georgieva said during her curtain-raiser speech to the IMF–World Bank Spring Meetings.

Russia’s war will be among the top reasons for the decline in global growth this year and the next, she said. The Fund will downgrade their forecasts for 143 economies, which account for 86% of global GDP.

Budget deficit

Fending off the war has cost big bucks for Ukraine.

According to Danylo Hetmantsev, the head of the Ukrainian parliament's finance and taxation committee, budgetary spending has quadrupled compared to that of peacetime. The monthly budget deficit currently ranges from $5-7 billion, most of which goes to the military and social support.

At the same time, the state's main sources of income are in trouble. Total budget revenues have fallen by 75%.

Dividends paid by state-owned enterprises, which previously covered 30% of all revenues, are going down. Other forms of income are also expected to decline. Before the war started, Ukraine's Finance Ministry planned to collect $18 billion of taxes on imported goods, $14 billion in value added tax, and $2.6 billion in excise taxes in 2022.

After one month of all-out war, the country's customs managed to collect only a fifth of the planned revenues – $240 million instead of the expected $1.3 billion.

In addition, the government has allowed businesses to switch to a simplified taxation system, allowing them to pay 2% of turnover instead of all other taxes, including income tax and VAT, among others.

In mid-March, the government dropped fuel VAT from 20% to 7% tax so farmers could buy enough for the season's sowing campaign and to enable the delivery of critical supplies like food and medicine.

The government is already planning to restore some taxes. A bill has been registered in the Verkhovna Rada proposing to raise VAT back up to 20%

According to Hetmantsev, import taxes will return soon as well, as this is already negatively affecting domestic producers who have resumed operations.

“These tax benefits have already reached their goal, filling our market and stores with goods,” he said. “Now we need to move to normal business and tax conditions.”

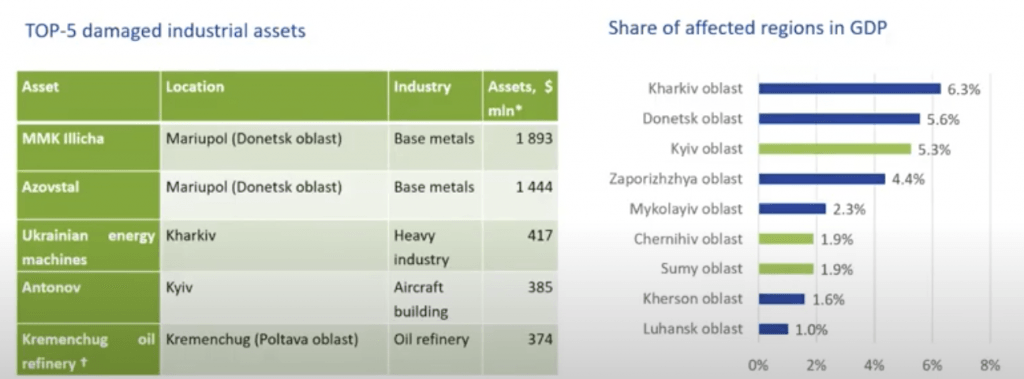

The Russian military destroyed or damaged many of the country’s 500 largest companies that accounted for 30% of the nation’s GDP.

As of mid-April, the total amount of destroyed assets reached $80 billion.

Although the National Bank decided to cover the March deficit with 2021 profits, the risks of deficit expansion in the future are high, according to Daryna Marchak, head of the center for analysis of public finance at the Kyiv School of Economics.

“Revenues will fall even more. Now the main focus should be on borrowing,” Marchenko said.

If the deficit is covered only via emission of the national currency, as opposed to foreign tranches, it will only lead to an increase in inflation.

According to Repko, Ukraine needs to attract grants, not loans, from international donors. If the government still decides to take loans, they must be long-term, with very low interest rates.

Reviving economy

Rebuilding ruined infrastructure and cities is among Ukraine's top priorities.

In order to achieve this, the country will need up to $1 trillion, according to Alex Nikolsko-Rzhevskyy, Professor of Economics at the U.S. University of Lehigh.

He proposes to use Russian assets as collateral for reconstruction loans.

For Nikolsko-Rzhevskyy, the question is not whether the West can collectively "afford a trillion-dollar bill," but of Russia's obligation to pay for its crimes.

“Only in this way a lesson will be learned and justice will be served,” said Nikolsko-Rzhevskyy.

The Ukrainian government is also working to keep the country's surviving companies afloat.

For this purpose, Ukraine's economy and finance ministries have launched an online platform to help businesses relocate to safer, western regions. Around 400 of 1,500 enterprises have managed to move their operations to western Ukrainian regions, according to Hetmantsev.

“We are fighting for every hundredth, every thousandth share of GDP that we are now losing,” he said. “This is a saved part of the economy.”