As Russia's war rages, Ukraine struggles to renegotiate $20 billion debt deal amid looming deadline

With Ukraine desperately seeking cash to fund its defense and wartime budget needs, the country is running out of time before an August 1 deadline to agree with creditors on what portion of its foreign debt will be written off as a so-called “haircut.”

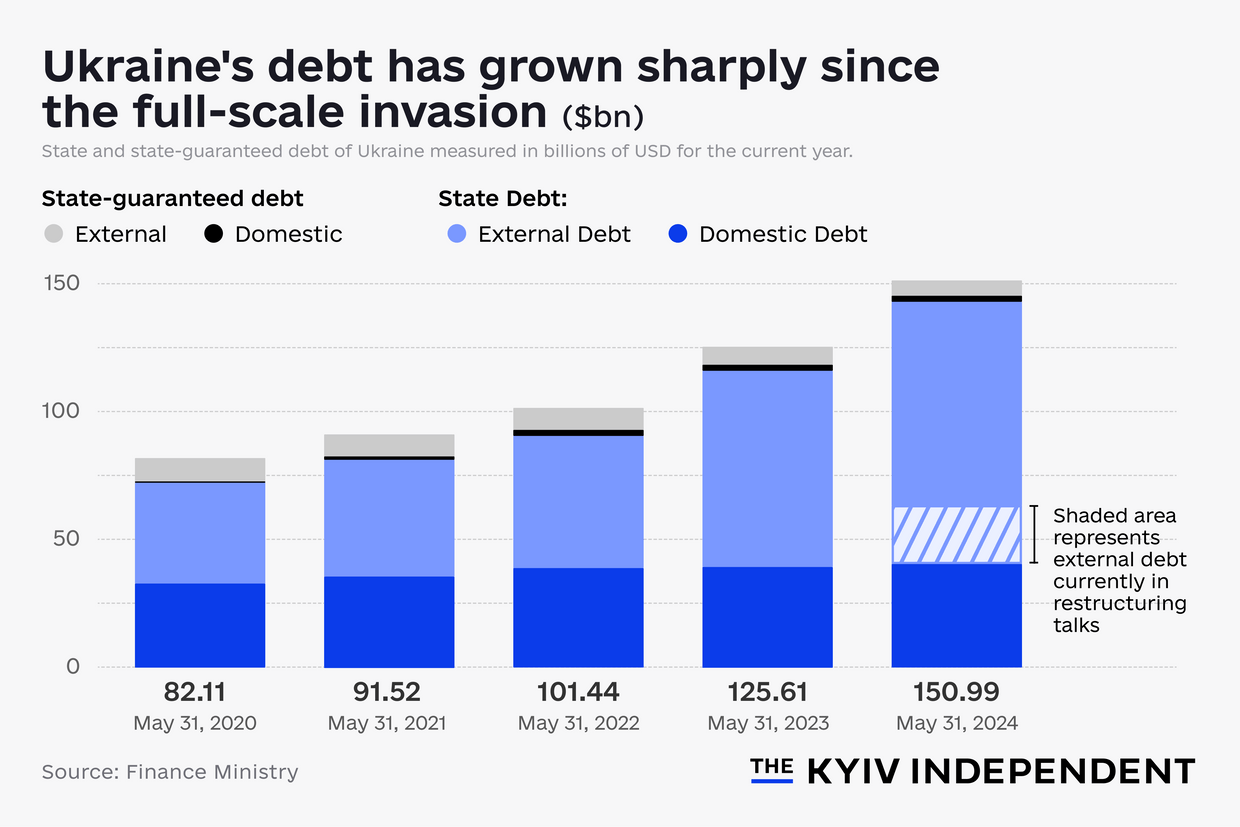

In 2022, Ukraine and its creditors agreed to halt payments owed on its debt when Ukraine’s budget came under severe stress from Russia’s full-scale invasion. With the war raging two years on, the deal to freeze payments on around $23 billion owed to private bondholders will expire at the start of August.

After a round of negotiations ended without an agreement to restructure this debt, Finance Minister Serhii Marchenko said on June 17 that he was “confident” an agreement would be reached with private bondholders before the deadline. The Finance Ministry reiterated this confidence in a statement to the Kyiv Independent on July 11.

However, a document published by the ministry when the first round ended showed that there was significant work remaining for the negotiators if Ukraine is to avoid a hard default on its debt.

“Both sides expressed a strong desire to reach a deal, but based on the public information they disclosed, the gap between their initial positions was quite large,” said Olena Bilan, chief economist at Kyiv-based investment bank Dragon Capital. Negotiators will need “substantial concessions on both sides to reach a deal.”

An added challenge is that restructuring agreements heavily rely on projections of Ukraine’s future macroeconomic figures, which are difficult to predict in wartime, one bondholder noted to the Kyiv Independent, who asked to remain anonymous due to the ongoing discussions. That might mean bondholders decide to extend the current freeze further.

“For a country in war, it's very, very difficult to produce a macro framework. You can't really be sure about the numbers. I would say it's much better to wait until the war ends to clarify the situation,” the bondholder said.

Where do the talks stand today?

The some $23 billion at the center of these negotiations represents about 15% of Ukraine’s total government-backed debt. But while governments in the G7 and Paris Club agreed to postpone payments owed to them until 2027, private bondholders have not extended their freeze past the August expiration.

Bondholders involved in the talks are major institutional asset managers and other long-term investors, including France’s Amundi SA, UK-based Amia Capital LLP, and U.S. firms BlackRock Inc. and Pimco. The negotiators represent around a fifth of the debt under discussion.

Ukraine’s negotiating team is looking to reduce the total amount owed and extend the repayment timeline.

Bondholders are willing to make concessions in order to avoid a default, but exactly how much debt will be left – and what the new repayment schedule will look like – is what the parties are currently haggling over.

After 12 days of negotiations, Ukraine’s Finance Ministry published a “cleansing document” on June 17 outlining the proposals from both sides.

Ukraine’s proposal suggests a cut of up to 60% of the debt, while the creditors offered only a 22.5% reduction and a shorter repayment timeline than Ukraine’s proposal.

“I know we are asking private creditors for a substantial effort on their part, but without a restructuring, Ukraine will not be able to sufficiently finance our defense and embark on our bold recovery,” Marchenko said in a statement.

“We are confident that a satisfactory restructuring agreement can be reached in the upcoming weeks and before the current payment freeze expires,” the statement continued.

As part of a $15.6 billion aid deal with the IMF, which is being given to Ukraine in portions from 2023 to 2027, Ukraine must meet benchmarks set by the IMF – including reducing its debt and cutting funding needs so that it can better finance its budget. Since the full-scale invasion, Ukraine’s ratio of debt-to-GDP has grown rapidly. According to Marachenko’s statement, the IMF supports Ukraine’s restructuring proposal.

Bondholders have publicly said that the write-down proposed by Ukraine is above market expectations and could damage Ukraine's investor base in the future.

As part of the IMF’s program, the IMF regularly releases forecasts for Ukraine’s economic prospects, which have set goalposts that shape the negotiations.

What happens next?

Ukraine can either reach a new restructuring deal, or negotiate an extension of the freeze to buy more time. Otherwise, the country must begin payments within a 10-day grace period of August 1 or officially default.

“I would say the probability of a default is close to zero,” said Dragon Capital’s Bilan. “It’s not in the interest of Ukraine at all, it’s not in the interest of the bondholders. Nobody wants it.”

For bondholders, a default would cause the value of their bonds to plunge.

Since Ukraine isn’t currently making payments, the largest impact to the country would be a reputational hit. Defaults usually restrict a country’s access to international financial markets. However, lenders are already unwilling to lend to Ukraine due to the ongoing war and economic uncertainty.

Even after a default, Ukraine would still need to restructure this debt. A default could make future talks much more difficult if institutional investors offload the bonds once their price falls to other buyers. And when Ukraine returns to international markets, raising money for reconstruction efforts would be more difficult.

While Bilan believes a successful restructuring deal is the most likely outcome, some believe the parties will instead choose to extend the freeze.

This could be a shorter-term extension to give the talks more breathing room or a longer extension like the one granted by the G7 creditors.

“It’s very late now. It will be difficult to meet the deadline,” said the bondholder who spoke with the Kyiv Independent. “I think the private creditors will just say, let's extend the service suspension.”