Editor’s Note: This is issue 106 of Ukrainian State-Owned Enterprises Weekly, covering events from Oct. 7-13. The Kyiv Independent is reposting it with permission.

Ukrainian SOE Weekly is an independent weekly digest based on a compilation of the most important news related to state-owned enterprises (SOEs) and state-owned banks in Ukraine. This publication was produced with the financial support of the European Union within the project “Supporting Ukraine in rebuilding and recovery” implemented by the KSE Institute. The contents of this publication are the sole responsibility of the editorial team of the Ukrainian SOE Weekly and do not necessarily reflect the views of the European Union.

Corporate governance of SOEs

The state wants to take away Naftogaz’s right to decide on its subsidiaries’ dividends. The draft law on the 2024 state budget (Draft Law No. 10000) proposes that entities in which 50 percent or more of shares are owned by Naftogaz must pay their 2023 dividends directly to the state budget. The amount will be determined according to the basic dividend pay-out ratios for that year, with a minimum of 90 percent, all due by July 1, 2024.

Naftogaz is carved out individually in this draft law, which is considered to be a poor practice. Ukraine used to resort to such carve-outs in the past, but it largely stopped using them in the recent years.

The draft law also imposes requirements on all SOEs directly owned by the state and their subsidiaries to pay dividends for 2023 directly to the state budget, following the same minimum 90 percent ratio, but only in case these SOEs fail to make a decision on profit allocation by May 1, 2024.

This suggests that, at least technically, these SOEs will make their decisions on dividend pay-out themselves, while Naftogaz does not even get that right. However, it is also unclear whether other SOEs may depart from the minimum 90 percent ratio.

It is important to note that the State Budget Law for 2023 contained the same general provision with regard to SOEs, but it did not single out Naftogaz and its subsidiaries.

Practices consistent with the OECD Guidelines on Corporate Governance of SOEs imply that dividends are consolidated at the level of the mother company. In contrast, a practice when SOE subsidiaries pay dividends directly to the state budget breaches the OCED’s level playing field principle for SOEs and private companies.

This practice results from Ukraine’s existing legal framework for SOEs, specifically, the Law on State Property Management. It contrasts Ukraine’s general corporate law applicable to private companies, in which the immediate owner decides on the dividends. In the case of Naftogaz’s subsidiaries, such an immediate owner is Naftogaz rather than the government. In that respect, such rules also contradict OECD guidelines specifically stating that SOEs’ operational practices should adhere to commonly accepted corporate norms.

As we wrote in Issue 82, Ukraine’s commitments under the IMF’s current program include adopting a law called to align the country’s corporate governance framework with the OECD Guidelines on Corporate Governance of SOEs (Draft Law No. 5593-d). One of the proposed improvements in Draft Law No. 5593-d is an appropriate dividend policy for SOEs, which implies eliminating the existing practice and establishing consolidated dividend pay-outs in cases such as the above.

Furthermore, as we reported in Issue 104, the White House has recently insisted that the Ukrainian authorities should adopt Draft Law No. 5593-d in alignment with OECD guidelines by the autumn of 2023 as a priority reform. For more information, see Issue 104.

Naftogaz’s major subsidiaries include Ukrnafta, Ukrgasvydobuvannya, Ukrtransgaz, and Ukrtransnafta.

As we reported in SOE Weekly’s Issue 90, Ukrnafta’s CEO Sergii Koretskyi said on Facebook that Ukrnafta earned about Hr 7 billion ($192 million) in net profit in January-April 2023. As we noted, this figure was most likely unaudited.

We had not been able to identify any official reporting on Ukrnafta’s profits. We had also not been able to find Ukrnafta’s financial statements for 2022.

HACC extends Kobolyev’s pre-trial restrictions. On Oct. 6, the High Anti-Corruption Court (HACC) said that it partially granted the request of the Specialized Anti-Corruption Prosecutor’s Office (SAPO) to prolong some of the pre-trial restraint measures for the former CEO of Naftogaz Andriy Kobolyev for another month.

We have not been able to find the HACC’s respective ruling in the public domain at the time of this writing.

According to the HACC’s release, Kobolyev must:

- come to the detective, prosecutor, investigating judge, or court at every request;

- notify the detective, prosecutor, and the court of any change of residence;

- refrain from communicating with persons specified in the court order; and

- deposit all passports for traveling abroad with the State Migration Service.

According to the Miller law firm, which represents Kobolyev, the SAPO prosecutors asked for a two-month extension, but the court only granted one month. At the same time, the HACC cancelled the obligation to obtain a permit to travel abroad, although the obligation to surrender passports remained, and travel abroad is still restricted, Miller added.

In SOE Weekly Issue 104, we reported that, on Sept. 25, the HACC partially granted the request of the attorney for Kobolyev, reducing the bail amount from Hr 229 million ($6.3 million) to the Hr 107 million ($2.9 million) already paid. The HACC also extended the obligations for Kobolyev until Oct. 10. See more in Issue 104.

As we reported earlier, on Jan. 19, the National Anti-Corruption Bureau of Ukraine (NABU) and SAPO charged Kobolyev with illegally awarding himself a bonus of Hr 229 million for Naftogaz’s victory against Russia’s Gazprom in Stockholm’s court of arbitration in 2018.

For an extended background on the Kobolyev case, see SOE Weekly’s Issues 71, 72, 73, 77, 78, 79, 83, 84, 88, 91, 99, and 104.

For a detailed analysis of this case from a corporate governance perspective, see series of columns by SOE Weekly team members Andriy Boytsun, Oleksandr Lysenko, and Dmytro Yablonovskyi: Are Kobolyev’s bonuses a threat to corporate governance reform? Part 1, Part 2, Part 3, Part 4, and Part 5.

Naftogaz’s CEO Chernyshov interviewed. Naftogaz’s CEO Oleksiy Chernyshov was interviewed by LB.ua this week. We selected the key points.

On underground gas storage facilities:

- “The government set a target of collecting 14.7 billion cubic metres by the start of the heating season. Naftogaz exceeded the plan. Today, we already have 15.75 billion cubic metres. And by winter, we expect to cross the 16 billion cubic metres mark. Is this enough? I must assure you that these figures are absolutely sufficient to get us through the winter with confidence. We will also continue our own gas production.”

- “Gas storage is not only a matter of profit but also of security of supply, reserves, and volumes. Of course, there is also a commercial component that relates to potential spreads, i.e., the difference in prices in summer and winter. That is why the market is now motivating non-resident traders to store gas, particularly abroad. We understand that underground storage facilities in Europe are almost full. Therefore, non-residents use ours.”

As we reported in Issue 103, Naftogaz reported that it met the gas storage goals set by the Cabinet of Ministers ahead of schedule. Meanwhile, the former CEO of the Gas Transmission System Operator of Ukraine (GTSOU) Serhiy Makogon claimed that Naftogaz was manipulating data, and its announcement was misleading. See more in Issue 103.

On Oct. 6, Chernyshov reported that Ukraine’s underground gas storage facilities stored 2.2 billion cubic metres of natural gas from foreign customers. According to him, in the first nine months of 2023, despite the war and potential risks associated with it, Naftogaz Group’s non-resident customer portfolio grew to 148 companies.

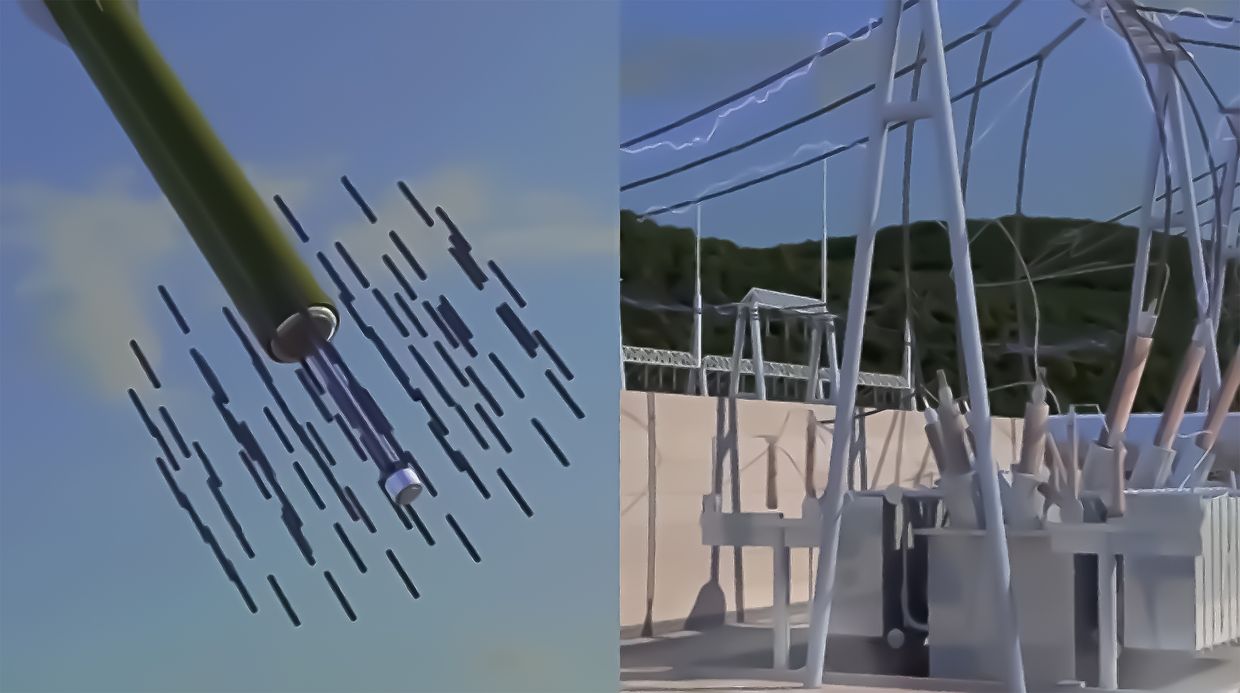

On defending against Russian missile attacks:

- “As for our underground facilities, they are probably the most secure enterprises in Ukraine. At least because they are physically located at a depth of up to 3,000 meters. So, the underground infrastructure is quite securely hidden.”

- “Questions may arise about the above-ground infrastructure or distribution. Naftogaz is actively working on basic protection, the so-called passive protection. It is taking a range of measures to protect its ground infrastructure. Of course, air defense is important in this. As we see, our defence capabilities are constantly growing.”

- “What Naftogaz Group has done directly has been at its own expense. And we will continue to do so. As for other external things, we must be aware that Ukraine today is objectively dependent on external assistance. Therefore, part of this assistance was aimed at protecting our energy infrastructure. But on the part of Naftogaz, these are its own resources.”

On the integration of Firtash's regional gas companies:

- “Regional gas companies are being integrated into Naftogaz Group. We have already integrated 16 of them. This represents a majority of natural gas volume and distribution in Ukraine, i.e., these are the largest regional gas companies. We will complete the process by the end of the year. This will allow us to ensure high-quality gas distribution and identify weaknesses. It will ensure stable supplies right now, this winter.”

As we reported in Issue 105, Naftogaz obtained gas distribution licences in six oblasts where Firtash’s regional gas companies used to operate. According to Gazmerezhi, a Naftogaz subsidiary, these are representative offices in Vinnytsia, Dnipropetrovsk, Ivano-Frankivsk, Mykolaiv, Sumy, and Khmelnytsky oblasts. See more on the previous waves of taking over Firtash’s gas distribution companies in our Issues 71, 98, 100, 104, and 105.

On the heating season:

- “We are preparing for this winter responsibly. The winter will be colder, but according to forecasts, including international ones, it is not expected to be severe and extreme. Therefore, we are confident enough to enter the winter. And the need to save money is a very important topic.”

- “Naftogaz is ready to provide all consumers with natural gas. And we have accumulated the appropriate volumes to do so.”

Privatization

SPFU sells VolynTorf for Hr 212 million. On Oct. 6, the State Property Fund of Ukraine (SPFU) reported that it sold the peat briquette plant VolynTorf.

The only bidder was Agribiostandard LLC, registered in Terebovlia (Ternopil oblast), whose main activity is the lease of agricultural machinery and equipment.

The price began at Hr 190.2 million ($5.2 million), and the investor offered Hr 212.2 million ($5.8 million). Together with 20% VAT, this adds up to Hr 254.7 million ($7 million).

The buyer must also continue to supply heat to VolynTorf’s customers. Within the next six months, all wage and budget arrears must be paid off and employees cannot be fired.

According to the SPFU, VolynTorf is a profitable company specializing in the production of peat briquettes. VolynTorf generated Hr 90.4 million ($2.5 million) in revenue in the first half of 2023 and Hr 200 million ($5.5 million) in revenue for the whole of 2022. The company earned Hr 6.2 million ($170,000) in net profit in the first half of 2023 and Hr 10.6 million ($291,000) in net profit in 2022.

As of June 30, VolynTorf had no overdue accounts payable. Current accounts payable amounted to Hr 20.2 million ($555,000), including Hr 8.9 million ($244,000) in settlements with the state budget and Hr 2.6 million ($71,000) in payroll.

In total, the facility has 109 units of real estate (production, warehouse, administrative premises, etc.) with a total area of over 21,000 square meters. The company employs 302 people and has 164 vehicles on its balance sheet. VolynTorf also includes a separate division, Manevychi Peat Plant.

Peat is not a strategic fuel for Ukraine’s energy sector. According to the State Statistics Service, its total share in the country’s energy balance is less than one percent, so the SPFU wants to privatize these companies.

In SOE Weekly Issue 96, we reported that the SPFU sold another peat briquette plant, RivneTorf, earlier for Hr 205 million ($5.6 million), a more than fourfold increase from the starting price of Hr 47.1 million ($195,000). For more detail, see Issue 96.

As we reported in Issue 102, the SPFU put VolynTorf up for privatization with a starting price of Hr 190 million ($5.2 million) on Sept. 12.

UMCC resumes shipments of ilmenite to the European market; SPFU plans to determine the starting price for UMCC’s privatization. The United Mining and Chemical Company (UMCC) started shipping ilmenite concentrate from its branch, Irshansk Mining and Processing Plant, to the Czech Republic in October, the SPFU reported.

The company is contracted to supply 30,000 metric tons of ilmenite concentrate to the European market by the end of 2023. The customer is TiO2, a company that produces titanium pigment, which is widely used in consumer goods, the SPFU said.

According to the SPFU, these are the first shipments of ilmenite from Irshansk in 2023. Due to martial law, disrupted logistics, and constant shelling in 2022, the products sat in the company’s warehouses for almost a year, making it hard to mine new ore.

UMCC’s executive board has been told to prioritize growing exports and expanding the geography of direct supply contracts. By the end of 2023, the company plans to ship about 105,000 metric tons of ilmenite concentrate to the European and American markets, according to Yegor Perelygin, the newly appointed first deputy CEO.

The SPFU plans for UMCC to be one of the first big companies privatized. The starting price will be determined with BDO Corporate Finance, the SPFU’s advisor on the privatisation of UMCC.

In SOE Weekly Issue 105, we reported that the SPFU changed the UMCC’s executive board, dismissing first deputy CEO Yaroslava Maksymenko and replacing her with Yegor Perelygin.

As we reported in Issue 33 two years ago, the UMCC privatization auction was scheduled to take place on Aug. 31, 2021. Later, in SOE Weekly Issue 41, we reported that the SPFU cancelled that privatization auction, which had only one qualified bidder.

The media then published a list of participants allegedly interested in UMCC assets. Some of them said that the asset was not well prepared for privatization, and they did not consider the auction terms fair. Others claimed that the starting price was inadequate. It was reportedly impossible to estimate the company’s mineral deposits.

The SPFU’s Auction Commission set Oct. 29, 2021 as the new auction date.

In Issue 49, we said that the SPFU cancelled the Oct. 29 2021 auction as well. The SPFU then explained that it only received two auction applications, one of which did not meet the requirements. The SPFU’s Auction Commission then set a new auction date again for Dec. 20, 2021.

As we reported in Issue 56, BDO Corporate Finance, the SPFU’s adviser on the privatization of UMCC, said that international companies were not prepared to participate in the UMCC auction despite their interest in these assets. BDO said that this was because there were no warranties that would protect the prospective buyers’ investments. As of Dec. 14, 2021, the Cabinet of Ministers had not approved the privatization terms of the UMCC auction that would include such warranties.

In Issue 57, we reported that in late December 2021, the SPFU postponed UMCC’s privatization auction for the third time. Just like in October 2021, the SPFU said that it received two auction applications, one of which did not meet the requirements of the applicable law.

With only one qualified applicant for the auction, the attempt was declared invalid for the third time. Another attempt would be made in the future.

SPFU wants to sell the state’s 66.65% stake in the Ocean Plaza shopping mall, previously owned by the sanctioned Rotenbergs, with a starting price of Hr 1.3 billion. On Oct. 5, the SPFU reported asking the Cabinet of Ministers to include the shares in Ocean Plaza, a major shopping mall in Kyiv, in the list of large-scale privatization assets.

These shares were previously owned by two sanctioned Russian oligarchs, Arkady Rotenberg and his son Igor. Preparations are underway to sell off the 66.65% stake in the authorized capital of Investment Union Lybid LLC, which owns Ocean Plaza.

In October and November, the SPFU and Lybid LLC’s another private shareholder who owns the other 33.35%, will conduct five audits of the property in preparation, the SPFU said.

On Sept. 8, Vasyl Khmelnytsky, who had previously owned a stake in Ocean Plaza, said that he had sold it to his long-time business partner Andriy Ivanov.

According to the SPFU, the book value of the entire asset (100%) for the most recent reporting period, 2022, is Hr 1.98 billion ($54 million). The SPFU will recommend a starting price equal to the book value of the state share (66.65%) for 2022, or Hr 1.32 billion ($36 million).

Oleksandr Fedoryshyn, acting head of the SPFU, hopes to hold the auction in early 2024, saying another shareholder (apparently, Andriy Ivanov – SOE Weekly) is interested in buying out the rest.

However, Ivanov said later that he did not intend to participate in the auction. “Considering the risks associated with the war, such an investment seems inexpedient at the moment,” Ivanov said in a commentary for Forbes Ukraine. The previous owner of the minority stake, Vasyl Khmelnytsky, also told Forbes Ukraine that he did not intend to participate.

Earlier, on 9 June 2023, the Cabinet of Ministers transferred the 66.65% share in Investment Union Lybid LLC to the SPFU. Previously, these corporate rights were owned by sanctioned Russian oligarchs Arkady and Igor Rotenberg, but in March 2023, the HACC ruled to recover them in favour of the state, the SPFU said.

Confiscation of Russian assets, nationalization, and asset seizure

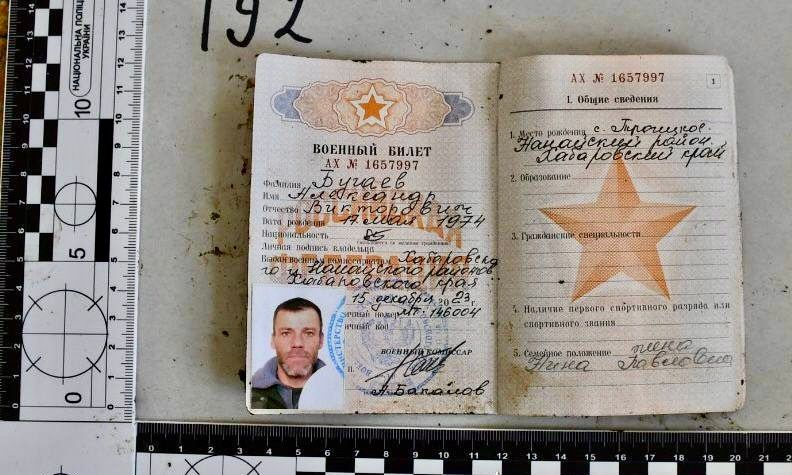

HACC’s Appeals Chamber confirms seizure of the assets from Russian oligarch Molchanov. On Oct. 10, the Appeals Chamber of the High Anti-Corruption Court (HACC) reported that it confirmed the legality of the decision to seize the company AEROC, owned by the LSR Group of sanctioned Russian oligarch Andrei Molchanov.

The Appeals Chamber upheld the HACC’s ruling, which recovered 100% of the share capital of AEROC in the amount of Hr 437.44 million ($12 million) for the state. The ruling cannot be appealed.

According to the State Bureau of Investigation (DBR), AEROC owns two aerated concrete plants in Kyiv oblast.

In SOE Weekly Issue 97), we reported that the Justice Ministry filed a lawsuit with the HACC to seize Molchanov’s assets.

As we reported in Issue 100, the HACC ruled to seize the assets of Andrei Molchanov.