Why are Ukrainian banks so profitable during war?

A woman operates a cash machine lit by a traffic light in Kyiv, Ukraine on Nov.08, 2022. (Ed Ram/Getty Images)

Ukraine’s banks are flush with cash.

An influx of foreign aid, high interest rates on government bonds, pay rises for soldiers, and central bank policies after the start of the full-scale invasion boosted the sector's profits to 40.5 billion hryvnia ($1 billion) in the first three months of 2024, 19% higher than the same period last year.

The banking sector has turned its fortunes around after hemorrhaging money in the first few months of Russia’s full-scale invasion.

Back then, economic activity ground to a halt, international allies hesitated over foreign aid, and Russian troops occupied vast swathes of Ukrainian territory causing banks to lose over 10 billion hryvnia ($246 million) in March 2022.

The summer of 2022 eventually brought some positive news for banks. People returned to work as the frontlines retracted, fiscal aid flowed in, helping to pay for Ukrainian troops’ salaries, and the policies of the National Bank of Ukraine (NBU) curtailed inflation rates.

The sector managed to stifle the losses by July 2022 and turned a small annual profit of 24.7 billion hryvnia ($609 million). As the war dragged into 2023, it became clear that war-time monetary policies were benefiting Ukrainian banks. Profits surpassed pre-war levels to 83.2 billion hryvnia ($2 billion) by the end of the year.

The government took notice of the soaring profits and raised taxes on banks to 25% for 2024 up from 10%. Nevertheless, banks expect another solid year.

The banking sector’s stability is largely down to reforms and nationalization over the last decade that cracked down on redoubtable oligarchs running money laundering schemes. Just four banks collapsed in 2022 and only eight of the 63 banks operating in Ukraine saw losses so far this year.

“If we had the same system as we had in 2014, it would be a disaster,” Hlib Vyshlinsky, Executive Director at the Centre for Economic Strategy (CES), told the Kyiv Independent.

“In many cases, (banks) were Ponzi schemes or bad businesses.”

But it’s unclear whether or not the benefits of the profits are trickling down to Ukrainian citizens. Despite banks’ large liquidity, corporate lending is low and the majority are state-owned causing money to circulate around various government institutions.

Fiscal Policies

The NBU swooped into action to avoid an economic catastrophe reminiscent of 2014 and 2015 following Russia’s invasion of Donbas and annexation of Crimea when inflation hit levels not seen since the ‘90s.

The bank raised the key policy rate from 10% to 25% in June 2022 to reduce inflation and stabilize the foreign exchange market.

While borrowing costs have since dropped following the disbursement of critical U.S. aid in April, interest rates still remain high at 13.5% as do the yields on military bonds used to raise money for the war effort.

Banks have more liquidity thanks to the tens of billions of dollars in foreign aid passing through the banking system, the NBU told the Kyiv Independent. This year it is expected to reach $37 billion.

Despite banks’ low interest rates, individuals, including individual entrepreneurs, are taking advantage of the 100% security guarantee under martial law. If a bank goes bust, the deposit will be reimbursed to the full amount.

Bank deposits are flourishing, growing by Hr 15.8 billion ($389 million) from April to May, totaling Hr 1.2 trillion ($29.6 billion) on May 1, the press service of the Deposit Guarantee Fund reported.

But the high liquidity is not translating to a surge of corporate loans. Companies are not ready to invest in new facilities amid the ongoing war and a scarcity of war insurance, according to Vyshlinsky.

Simultaneously, banks see investments in the government as a safe and fruitful bet, raking in money from high interest rates on government bonds and certificates of deposit issued by the NBU.

“Because of the profit motive, the banks were interested in taking deposits and placing them into government bonds, enabling the state to borrow to cover part of its expenses,” Dmytro Yablonovskyi, an independent consultant in corporate governance, told the Kyiv Independent.

Currently, the NBU and Ukrainian banks hold close to 1.4 trillion hryvnia ($34 billion) in domestic government debt securities.

Growing public sector and transactions

Faced with a massive enemy, Ukraine’s military has increased drastically since 2022 by hundreds of thousands of employees, although exact figures vary from different sources, coinciding with a salary raise for soldiers.

Ukraine now spends 80 billion hryvnia ($2 billion) per month on military personnel, according to Vyshlinsky. He notes that many soldiers earn more than they did in the private sector, with monthly salaries for frontline troops over $1,200, while those who previously worked in the shadow economy now have an official salary and bank account.

State-owned Oschadbank CEO Serhii Naumov told the Kyiv Independent that surging card transactions helped expand net commission income by 203 million hryvnia ($5.7 million) compared to the same period last year.

With over 6 million refugees out of the country, many are using the cards of their friends and families abroad causing banks to profit off of transactions. Others at home are also taking money out to exchange for stable currencies like dollars or euros.

Another state-owned bank, PrivatBank, the largest bank in Ukraine, has zero interest rate accounts and a relatively high commission on cash withdrawals, according to Vyshlinsky.

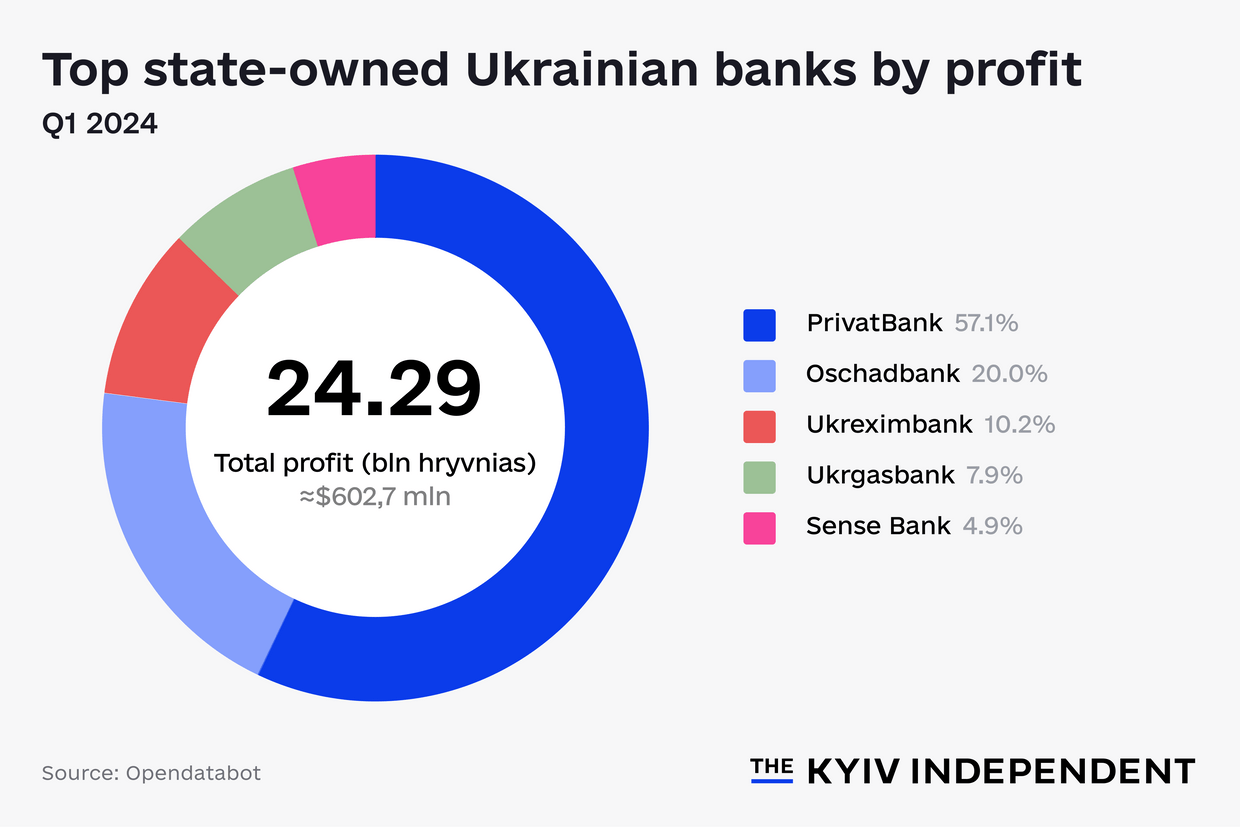

Privatbank, formerly owned by notorious oligarch Ihor Kolomoisky until nationalization in 2016, made up 34.2% of total banking profits in the first quarter of 2024. The bank holds the largest number of cardholders and current accounts in Ukraine, providing it with additional cheap money.

“It is also state-owned, which can signify reliability for many depositors who may be willing to deposit money with the bank even at lower rates,” Yablonovskyi said.

Higher banking taxes

The government caught wind of the banking sector’s gold rush leading President Volodymyr Zelensky to retroactively increase taxes on profits for 2023 from 15% to 50% on Dec. 3. This year it’s set at 25%.

“There was an understanding in the market that the extra profits earned were largely not due to banks' commercial skills but attributable to current fiscal and monetary policy,” Yablonovskyi said.

Considering state-owned banks dominate the sector, profits largely go back into the Finance Ministry, Vyshlinsky said. Three of Ukraine’s state-owned banks took the top five positions, with Privatbank earning 34.2% of the sector’s total profits.

However, he added there are some “inefficiencies” resulting in money passing through several hands.

Banks have largely accepted the tax increase without complaints and transferred a record 76.6 billion hryvnia ($1.9 billion) to the state budget last year. The only gripe was over the government introducing the law retroactively.

“Predictability of the tax system is an integral part of a healthy business climate and this is what businesses in Ukraine are seeking for,” Oleh Horokhovskyi, cofounder of online bank Monobank, told the Kyiv Independent.

On paper, the profits look like a win-win. The government has more money to spend on the war effort from the tax hike while the banks are still swimming in cash.

Horokhovskyi notes that higher profits allow Monobank to lend more and also provide a large cash back program to its customers. Higher lending boosts customer spending and reinforces the economy, he said.

But Vyshlinsky believes that the profits themselves did not necessarily help the average Ukrainian citizen. Rather than profit sharing, the money passes through various state bodies with people skimming some off in the process, he claims.

“If the NBU pays a high interest rate on deposit certificates, it decreases profits of the national bank that are then paid as extra budget revenue of the Finance Ministry,” he said. “With some shares residing in the hands of those who were in the process.”

Will profits continue?

Banks and financial experts largely foresee profits increasing again this year. Both Oschadbank and Monobank are optimistic, although the latter noted that banks’ profits rely on the prosperity of their clients and depend on Ukraine’s overall economic stability.

In Yablonovskyi’s opinion, banks also need to have diverse sources of income, a strong customer base, and be cost-efficient in order to retain profitability. They need to prove to investors that the record profits were not just a side effect of Ukraine’s fiscal policy, he said.

He also stresses the need for the state to sell its nationalized banks. Vyshlinsky agrees, claiming that state-owned banks are run inefficiently but are seen by the NBU as a safe pair of hands compared to oligarch owners like Kolomoisky.

For now, Ukraine has said investors are interested in two state-owned banks: SenseBank and Ukrgasbank. For the two giants, Privatbank and Oschadbank, it is unlikely they will be sold until after the war.

However, Vyshlinsky believes there is an inertia from state-owned supervisory boards and CEOs to sell the banks and references the failure to privatize Ukrgasbank in the years leading up to the start of the full-scale invasion.

“Nobody has any real interest in changing the status quo,” he says.