Business is good for Ukrainian banks. Last year, the country’s banks brought in record profits of Hr 130 billion ($3.5 billion) with the five top state-owned banks making 61.5% of the total.

One of these banks is Oschadbank, the country’s second-largest state-owned bank after PrivatBank. In 2023, the bank posted record operating profits of Hr 12 billion ($316 million) against Hr 5.6 billion ($206 million) in 2021.

The bank serves more than 6.2 million active clients, including 224,000 micro, small, and medium-sized business clients and around 4,000 large companies, both state-owned and private. Its network comprises around 1,200 branches in Ukraine.

Since the start of the full-scale war, Oschadbank has focused primarily on ensuring that operations were uninterrupted, Sergii Naumov, the bank’s CEO, told the Kyiv Independent in an interview.

It has also had to transform itself into a hub connecting Ukrainian entrepreneurs with international programs and investments to adapt to war-time realities, Naumov said, adding that the shift has been successful.

Despite the risks associated with war, the bank has continued to provide loans to businesses to keep them running and growing. For the last nearly two years, the bank extended credit to small and medium-sized businesses worth around Hr 12.7 billion ($334 million), expanding its portfolio to nearly Hr 22 billion ($579 million).

In 2023, it provided critical financing to key sectors, mainly to businesses in agriculture, energy, transportation, machinery manufacturing, the oil and gas industry, the financial sector, and retail, totaling over Hr 17.9 billion ($471 million).

The total is a 45% increase compared to the 2021 figures and a 29% increase in the sum of new credit agreements signed in 2022.

As part of an interview series with Ukrainian business leaders on doing business during the war and their outlook for the future, the Kyiv Independent sat down with Naumov to discuss adapting to operating in a country at war and the changes the bank has made these last two years.

The Kyiv Independent: How has Oschadbank navigated nearly two years of full-scale war?

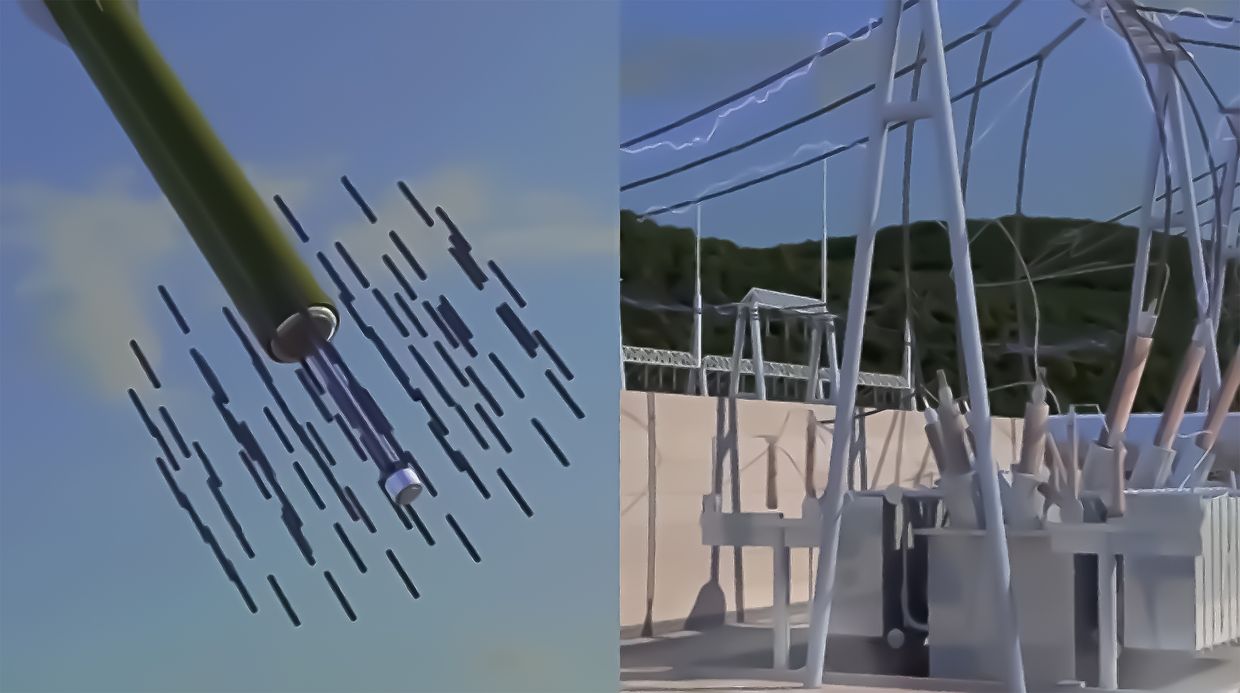

Sergii Naumov: Oschadbank's response has been marked by significant changes and adaptability. The bank underwent essential reforms to meet wartime requirements, ensuring stability in banking services. Despite initial challenges, the bank has remained resilient, enhancing online security after a severe DDoS attack in February 2022.

Surprisingly, the full-scale war period has been the most stable time for Oschadbank's digital channels. The bank prioritizes physical accessibility, servicing clients through the largest network in the country. Recently, the bank introduced new mobile branches to deliver cash for pensions and social benefits and to provide other banking services near the front lines. The bank also provided two old mobile branches and 118 armored cars to the army and continued supporting the military.

Oschadbank's commitment involves maintaining a stable network, ensuring access to all regions, and providing crucial financial support. Our focus on business support includes the liberalization of lending policies, making the credit process faster. Collaborations with various local and international partners led to the development of unique loan products, making lending more affordable.

The bank is also transitioning into a hub connecting Ukrainian entrepreneurs with international programs and investments. This strategic shift aligns with our commitment to both commercial and social responsibility.

The Kyiv Independent: What have the Oschadbank's losses been since the beginning of the full-scale invasion?

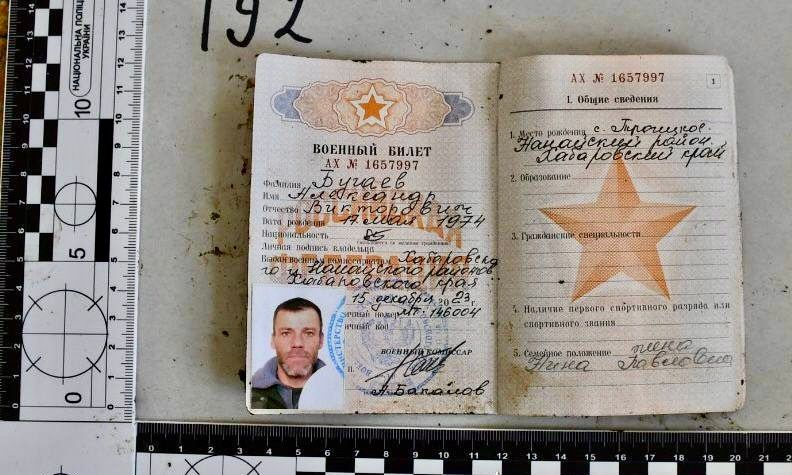

Sergii Naumov: The bank has not been immune to losses, but they pale in comparison to the immeasurable human losses, notably our 14 colleagues who sacrificed their lives defending the country.

The total negative impact of Russia's aggression on the bank is preliminary estimated at Hr 17.5 billion ($460 million), with distinguishable direct losses amounting to around Hr 14.4 billion ($379 million). These include expenses related to loan modifications, changes in the fair value of loans, and additional payments for staff support. Indirect losses, surpassing Hr 3 billion ($79 million), involve lost interest income and further losses stemming from the devaluation of the hryvnia due to the war.

Oschadbank is working with the state, the National Bank, and the Finance Ministry to refine the model for calculating losses as the war persists. The bank remains committed to its calculated estimate but it's difficult to determine the exact impact while the fight continues.

The Kyiv Independent: Do you plan to sue Russia for any losses, and how can these losses be compensated?

Sergii Naumov: We have a history of pursuing legal action against Russia. On Dec. 7, 2022, the French Court of Cassation concluded the consideration of our case and upheld our institution's position against Russia in a final appeal. This victory follows our earlier success in 2018, where Russia's request was also defeated, resulting in a $1.5 billion arbitration award related to the annexation of Crimea.

We meticulously calculated the losses incurred by our bank due to the annexation, brought the case to arbitration, and won.

We intend to employ a similar legal approach to address the losses resulting from the ongoing war. Being the first bank in Ukraine to appeal to the European Court of Human Rights, we are in the process of collecting evidence of the damages suffered. While the exact amount of these losses is yet to be determined, we are resolute in not forgiving any part of them. Our goal is to seek restitution for all losses inflicted upon our bank by Russia.

The Kyiv Independent: How will you navigate Oshadbank's development during the ongoing war?

Sergii Naumov: We have no intention of halting or limiting our business operations and it’s our goal to intensify our efforts.

The government approved strategic directions for state banks, outlining plans for martial law and post-war economic recovery. Foremost among them is supporting businesses and the population affected by Russia's aggression.

We are also directing efforts toward strengthening the agriculture sector to ensure food security and supply. Critical infrastructure, including the food industry, grocery retail, and related sectors, is a priority. We are also actively involved in projects that focus on reconstruction, particularly in significant areas such as transport, logistics, and enterprise reallocation.

One notable initiative of ours includes a substantial increase in financing for small and medium enterprises. We have played a crucial role in assisting businesses in dangerous regions to relocate to safer areas in western Ukraine, which allows them to continue operations despite the challenging circumstances on the front line.

This year, we want to develop a new four-year strategy. This strategic plan will encompass anticipated investments and explore the potential for privatization. Although the original plan for privatization was set before the war, the current situation put the plans on pause.

But even during a war, it can be a good time to strategize for the next four years and lay the groundwork for actions that will facilitate privatization when the conditions allow for it.

The Kyiv Independent: What scenarios are you considering for the period following the end of the war, whenever possible?

Sergii Naumov: Our strategy envisions different outcomes depending on the nature of the post-war landscape. The different possible scenarios we are planning for include localized conflict resolution, protracted instability, or a comprehensive armed recovery and reconstruction phase.

Depending on the scenario, our plans entail varying levels of investment, with priorities dictated by the needs of the time. Whether directing resources towards supporting businesses or collaborating with the government, our strategies will be fine-tuned to the circumstances.

We also recognize the need to align our domestic regulations with European Union standards and we want to harmonize our processes, regulations, and laws with those of the European Central Bank. This strategic alignment will position us to integrate seamlessly with broader regional frameworks and adhere to international standards, which will contribute to our operations' long-term stability and resilience.

The Kyiv Independent: As a CEO, what advice can you offer entrepreneurs and international companies for planning in 2024?

Sergii Naumov: Given the current international events and our goal of being a more global presence, I often advise potential international partners. My main advice is to act proactively before the war ends. Investing in our economy now positions companies to secure advantageous opportunities.

I always emphasize the importance of being the first to invest in Ukraine, as those who act promptly will have access to the most favorable conditions. My advice to local businesses, who are also investors in their own right, is to plan for the future without hesitation. I encourage them to expand their businesses quickly and to consider taking advantage of financing options offered by banks.

Even while acknowledging the current scarcity of investment projects, I have also advised businesses to think about expanding.

The Kyiv Independent: Is it possible for businesses to get funds for development now during the war?

Oschadbank is ready to provide financial support with available liquidity, and we are actively engaging with international programs and collaborating with local and international partners to stimulate recovery and development.

We already have 13 contracts with local authorities: Nine with regional military administrations and four with municipalities. These agreements outline our shared goals for industry development, and local governments are allocating budget resources to compensate interest rates for businesses that align with our objectives. For example, we support enterprises with energy security by reimbursing expenses related to the purchase of generators.

My overarching advice is to continue working diligently and recognize that economic strength is crucial in winning the war, not just on the battlefield.

The government is also providing support through state programs. Programs like 5-7-9% loans that mainly target small and medium enterprises have proven beneficial and have helped compensate for losses during this challenging period.

The government is also looking to simplify various licensing procedures to facilitate business operations. The overarching expectation is that major businesses contribute to the country's economic well-being and adhere to ethical and transparent practices.

Due to the use of guarantee instruments from international financial organizations and state support programs as part of interest compensation, our loan portfolio of micro, small and medium-sized enterprise clients increased by Hr 8.2 billion ($224 million) in 2022 and Hr 4.5 billion ($118 million) in 2023, which amounted to almost Hr 22 billion ($602 million).

In 2023, we also provided critical financing to key sectors, primarily supporting enterprises in agriculture, energy, transportation, machinery manufacturing, the oil and gas industry, the financial sector, and retail, totaling over Hr 17.9 billion ($471 million). This represents a 45% increase compared to the 2021 figures and a 29% growth over the sum of new credit agreements signed in 2022.

The Kyiv Independent: How do you assess the current business climate in Ukraine, especially considering your interactions with entrepreneurs and major companies?

Sergii Naumov: I wouldn't characterize the current business climate as a disaster. I've actually observed improvements even amid the full-scale war.

A notable positive aspect is the unity among businesses, the state, and society, all rallying around the common goal of victory. This unity fosters collaboration across various sectors, including banking.

As a bank, we are concerned about the risk associated with providing loans and we are constantly monitoring our non-performing loans (NPL) portfolio. It was encouraging to see that during 2023, we were able to release provisions, which is an indication of a lack of new problematic loans at a net level. Businesses have become more disciplined and responsible in their financial dealings with banks, which is a positive development.

While some businesses may hesitate to expand or consider relocating investments abroad, most are staying and actively working towards development. Some industries are posting record profits, not just in the banking sector. The responsible payment of taxes by businesses contributes significantly to supporting Ukraine's military and national defense efforts.

Despite economic challenges, such as a decline in GDP, international support is instrumental in sustaining the economy. But businesses are adapting, with many seeking development opportunities and participating in various programs, including those supporting business development on the front lines.

The Kyiv Independent: In your opinion, what expectations do businesses currently have from the government or the state?

Sergii Naumov: Businesses are primarily looking for fair treatment from the government. While we acknowledge that the situation is far from ideal, the fundamental expectation is to be treated fairly and not face undue pressure or corruption. There is a collective desire among businesses for a more normal situation, avoiding excessive influence or unfair interference from law enforcement bodies.

While it cannot be claimed that everything is perfect, there has been a notable improvement, and the overall trend is positive. The unity within society, driven by a shared goal of achieving victory, has played a crucial role in fostering a more conducive business environment.

Despite the challenges, the prevailing sentiment is one of improvement and a collective determination to overcome obstacles for Ukraine's greater good and victory.