Who buys Russian oil and gas?

(L-R) Indian Prime Minister Narendra Modi, Russian President Vladimir Putin, and Chinese President Xi Jinping during the BRICS summit in Kazan, Russia, on Oct. 23, 2024. (Alexander Zemlianichenko / POOL / AFP via Getty Images)

Summary:

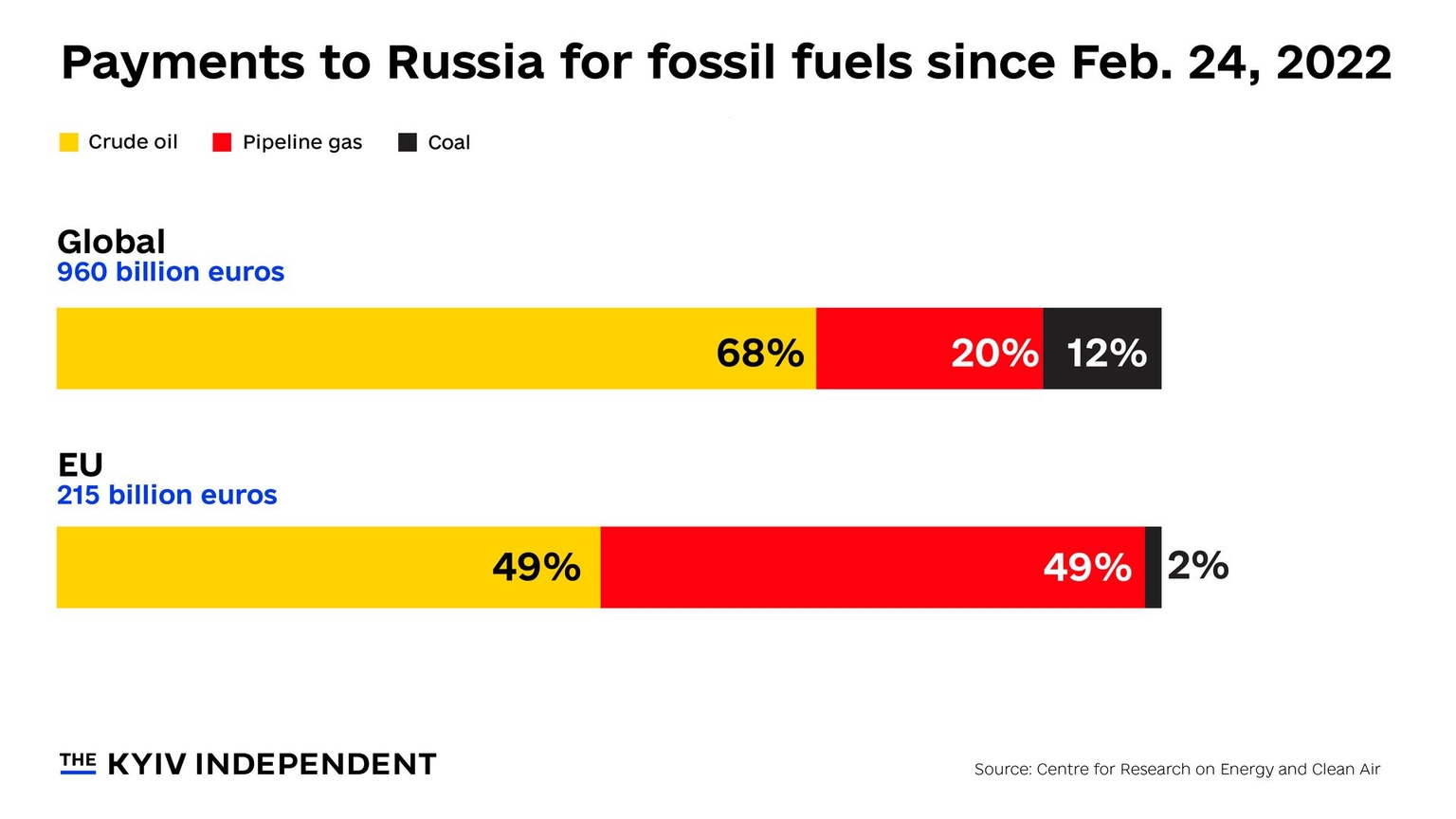

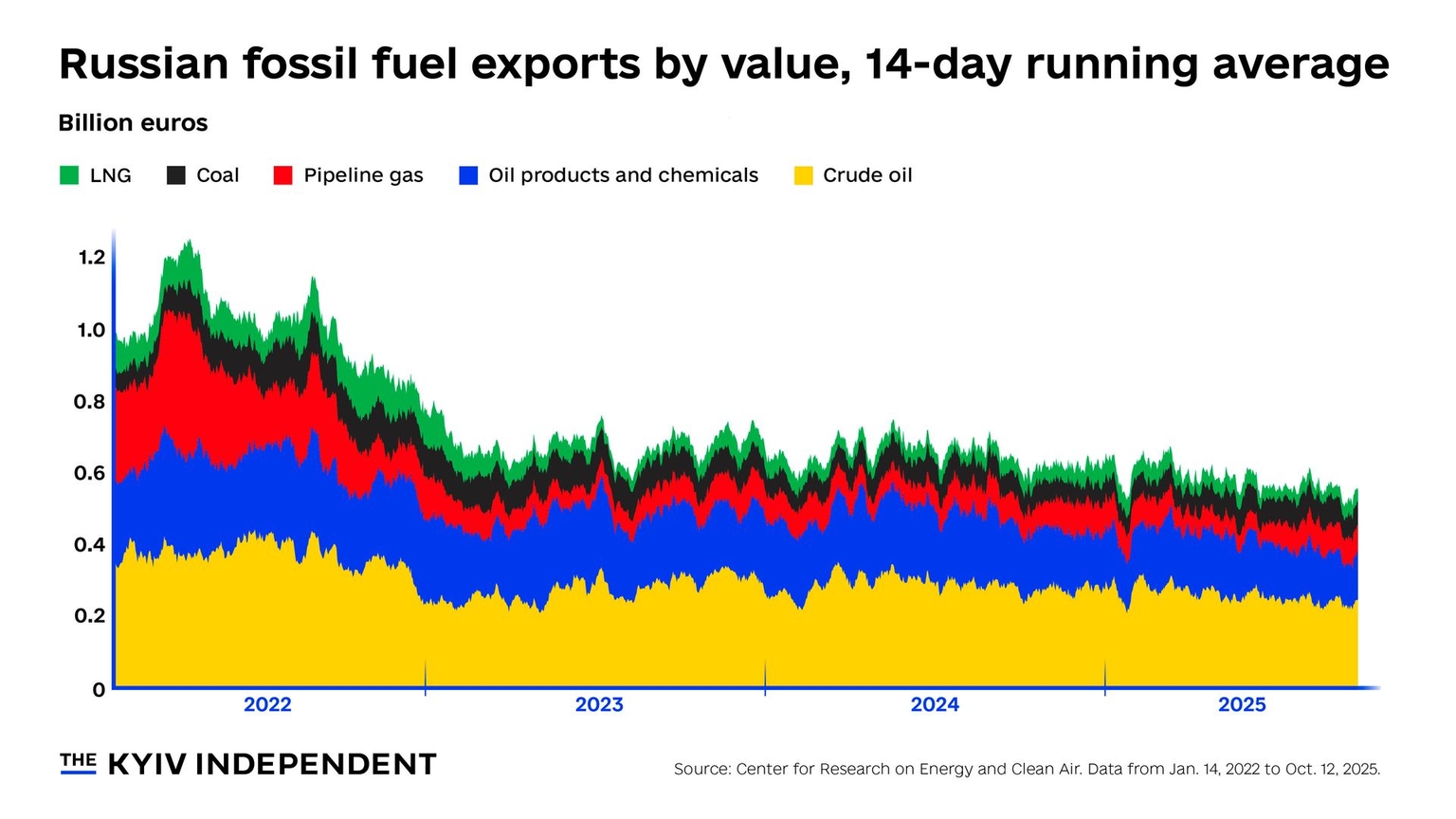

- Russia has earned 954 billion euros from exports of fossil fuels since the intensification of its war against Ukraine in 2022, 214 billion euros of which came from the EU

- Oil and gas account for 30–50% of Russian budget revenue and 20% of gross domestic product (GDP)

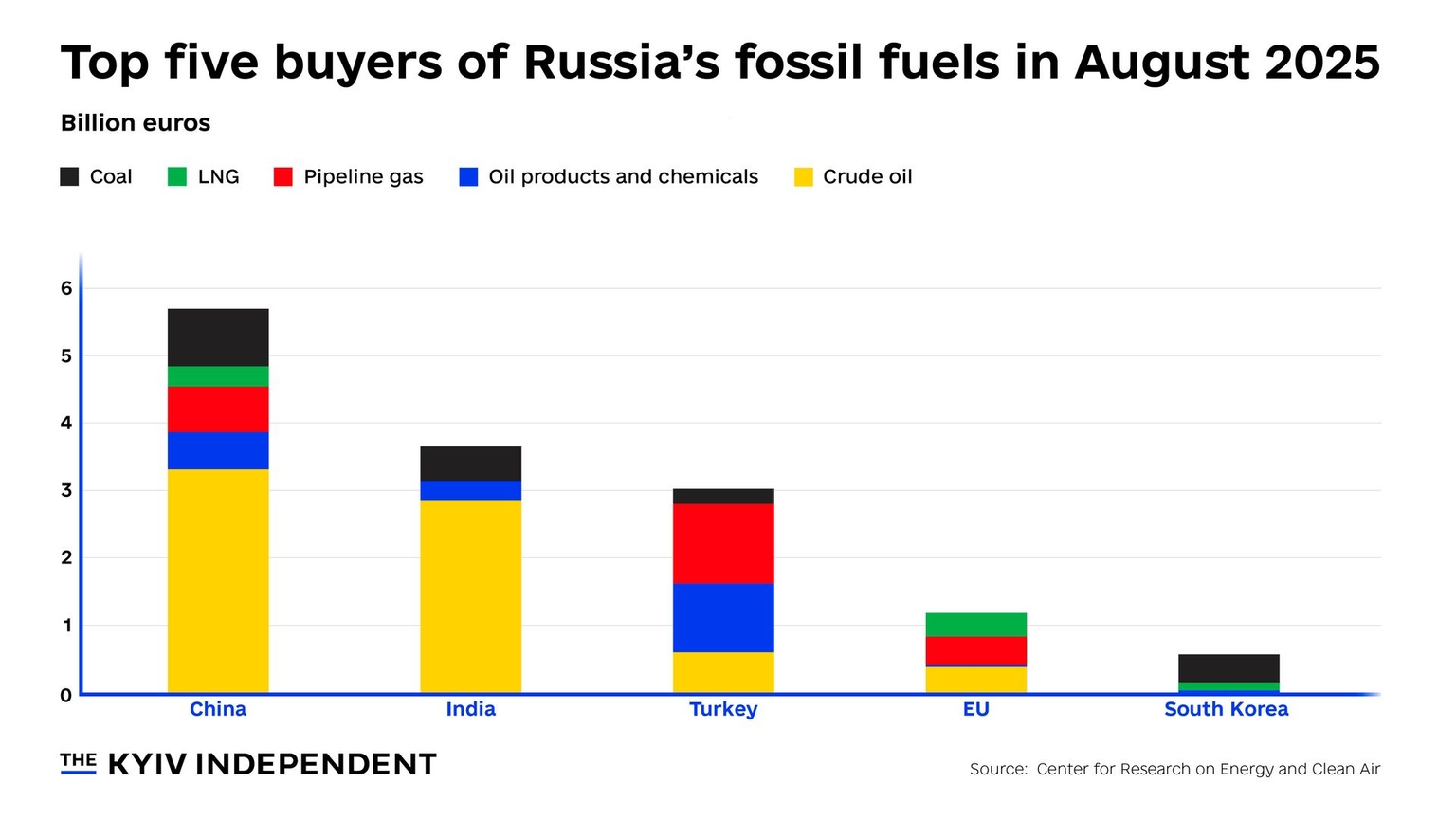

- China remained the largest buyer of Russian fossil fuels in August, accounting for 40% of exports; India was second, followed by Turkey (a NATO member)

- A group of five EU states together spent 979 million euros in August, the fourth largest amount

- The EU remains the largest buyer of Russian natural gas

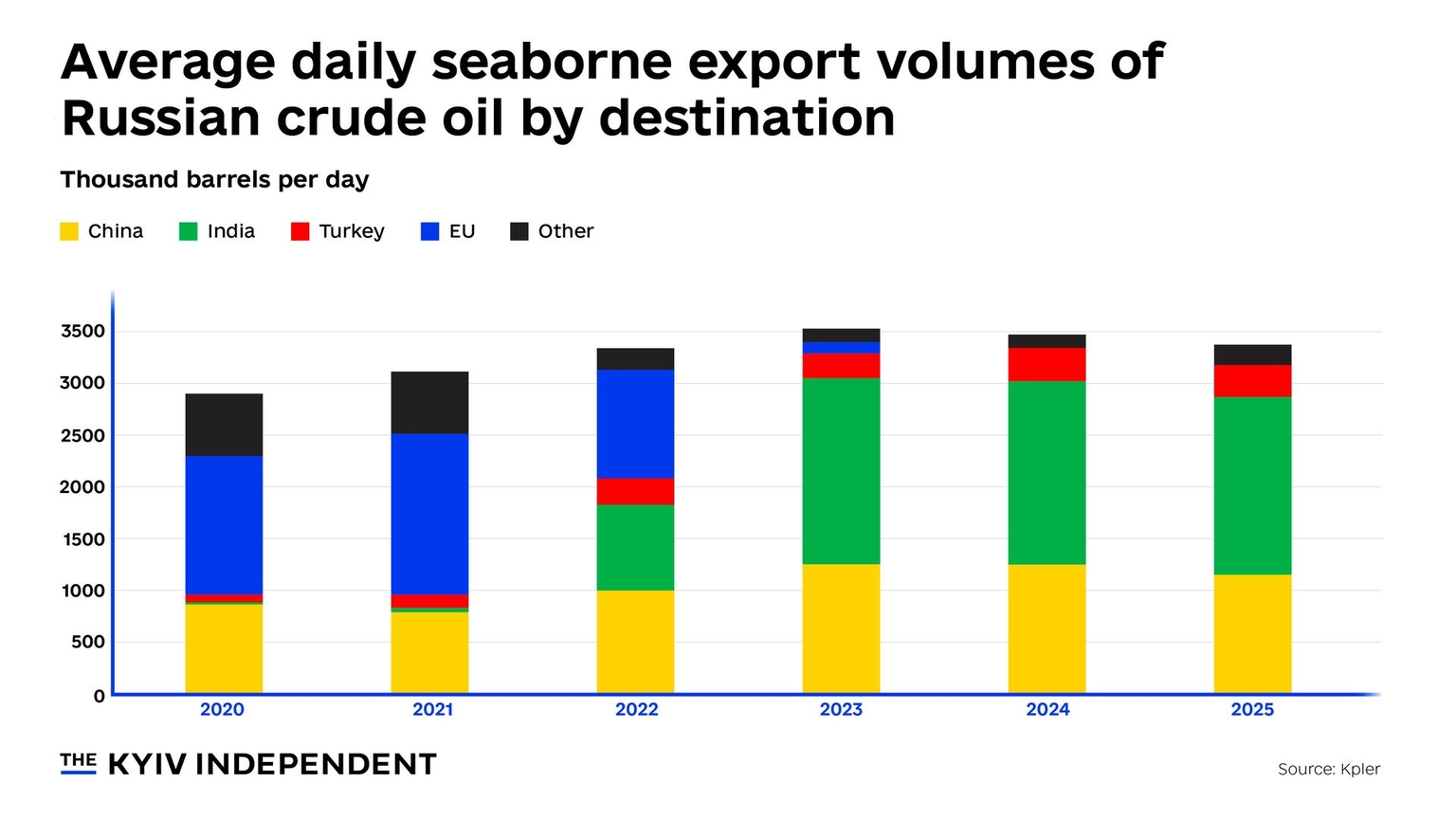

While China and India have rushed to buy up the oil and gas spurned by Europe in the wake of Russia’s 2022 intensification of its war against Ukraine, a handful of EU countries continue to import significant amounts even as the West examines wider restrictions on Moscow’s main source of revenue.

Since an August summit with Russian President Vladimir Putin produced little progress, U.S. President Donald Trump has urged Europe and NATO to end imports of Russian oil and impose steep tariffs on its main buyers.

On Oct. 1, the Group of Seven countries said it was time to maximize pressure on Russian oil exports and target countries that continue to increase purchases — highlighting recent escalations by Russia, including violations of NATO airspace.

While the G7 statement did not name any countries in particular, in August 2025, the largest importer of Russian fossil fuels was China, accounting for 40% by value. India was second with a quarter of imports, and Turkey was third with 21%, according to a monthly analysis by the Center for Research on Energy and Clean Air.

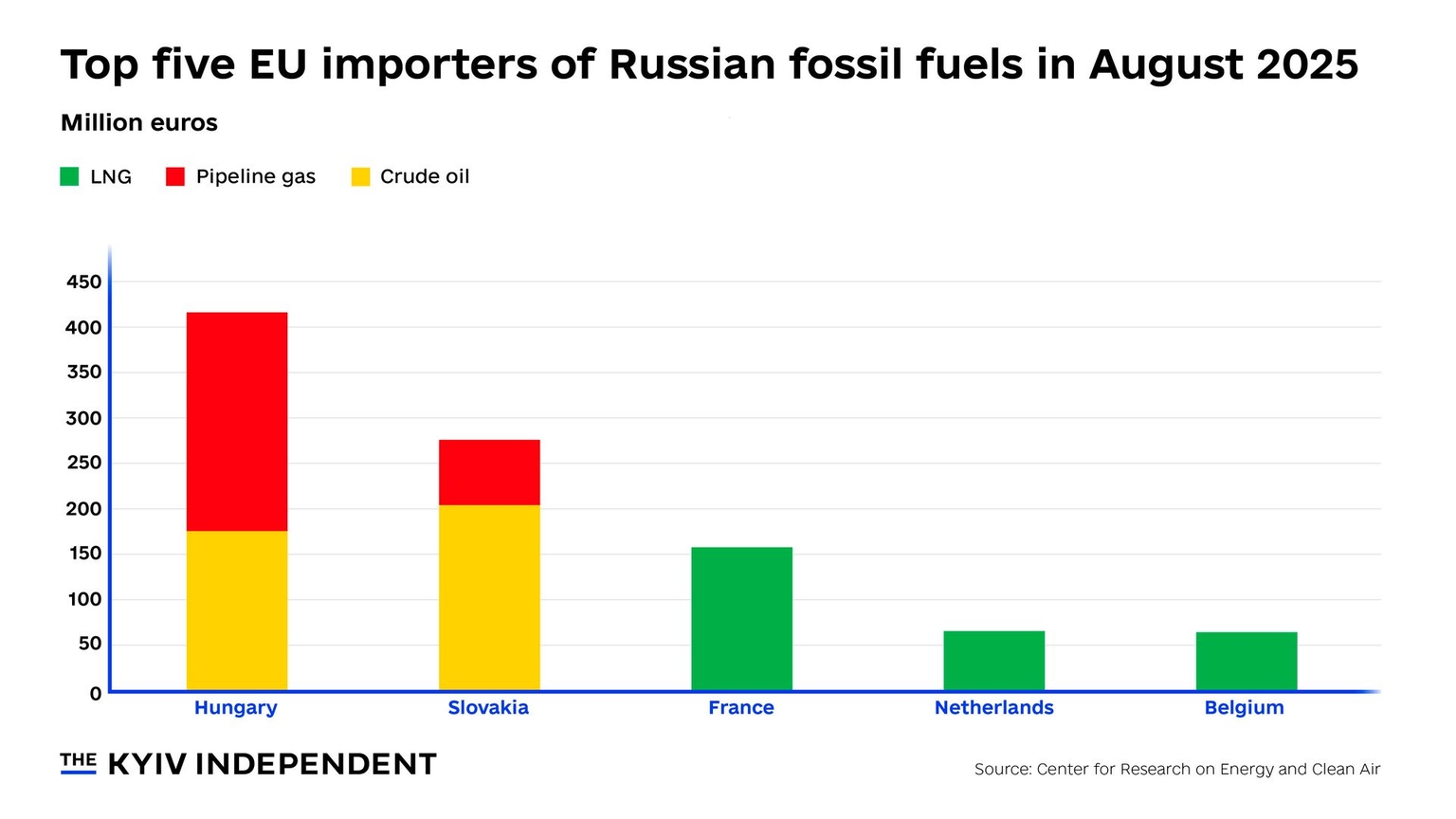

A handful of EU members were together the fourth largest buyer at 8%, CREA said. Those countries include Hungary as the largest EU importer, followed by Slovakia, France, the Netherlands, and Belgium.

"China and India are the primary funders of the ongoing war by continuing to purchase Russian oil, but inexcusably, even NATO countries have not cut off much Russian energy and Russian energy products," U.S. President Donald Trump told the U.N. General Assembly last month.

Russia relies on its fossil fuel revenue to fund its war against Ukraine. Since Feb. 24, 2022, Russia has exported some 958 billion euros worth of fossil fuels — 68% of which was oil, 20% gas, and 12% coal, according to the Russia Fossil Tracker project led by CREA. China was the largest buyer of Russian fossil fuels over that time, followed by the EU, India, and Turkey.

In 2024, the oil and gas industry generated 113 billion euros in tax for the Kremlin, a third of its revenue, which covered 83% of military expenditure, according to a recent CREA presentation.

For comparison, a total of 167.4 billion euros in aid to Ukraine was allocated by Europe between January 2022 and the end of June 2025, according to the Kiel Institute for the World Economy. The U.S. allocated 114.6 billion euros to Ukraine since 2022.

While Russian government revenues from oil and gas fell 21% year on year to 6.6 trillion rubles ($80.18 billion) in the first nine months of 2024, due to weaker prices and ongoing Ukrainian strikes on Russian energy infrastructure, the Kremlin is still securing substantial income for its budget.

China spent 5.7 billion euros on Russian fossil fuels in August, 58% of which was crude oil, 15% coal, 12% pipeline gas, and 10% oil products. India spent 3.6 billion euros in total, 78% of which was crude oil, 14% coal, and 8% oil products. Turkey spent 3 billion euros, 39% of which was pipeline gas, 34% oil products, 20% crude oil, and 7% coal. The EU spent 1.2 billion euros, of which 66% was gas — pipeline and liquefied natural gas (LNG) — and 32% crude oil.

Sanctions

Until an EU embargo on seaborne imports of Russian crude oil came into force in December 2022, followed by oil products two months later, the bloc had been the main buyer of Russian fossil fuels — spending 71 billion euros on Russian oil alone in 2021, according to the European Commission. The EU in August 2022 banned Russian coal imports, which had been worth 8 billion euros annually.

From December 2022, a price cap of $60 per barrel was also imposed on seaborne Russian crude oil shipments to third countries by the EU, the U.K., and the G7 in order to undermine Russia's ability to fund the war.

Despite an absence of EU sanctions on Russian gas, the bloc's imports have fallen 78% since the fourth quarter of 2021 to 8.167 billion cubic meters in the third quarter of 2025, according to the Bruegel think tank.

The EU has nevertheless still spent some 214 billion euros on imports of Russian fossil fuels since 2022.

In August, the EU remained the largest buyer of both pipeline gas and liquefied natural gas from Russia, according to CREA. The bloc accounted for half of Russia's total LNG exports and 35% of its pipeline gas exports.

Over the past decade, oil and gas have accounted for between 30–50% of total Russian federal budget revenues, according to the Oxford Institute for Energy Studies. On average, the industry contributes about a fifth of the country's GDP. Eighty-five percent of the Russian state’s oil and gas revenues come from oil-related taxes, and 15% from gas-related taxes.

Loopholes

In the summer of 2022, the embargo on imports of seaborne Russian crude oil and oil products to the EU, as part of the bloc’s sixth package of sanctions, was only agreed after weeks of wrangling over "temporary exemptions" for landlocked member states reliant on the Druzhba pipeline, namely Hungary, Slovakia, and the Czech Republic.

A grace period of six months for oil and eight months for oil products was included to phase out the imports in an "orderly fashion." But rather than reduce reliance on Russian imports, Hungary and Slovakia exploited their exemption from the EU embargo, which was intended to give them time to diversify imports, according to CREA.

Hungary spent 416 million euros on Russian fossil fuels in August, and Slovakia 276 million euros.

The rest of the bloc, meanwhile, imported billions of euros worth of petroleum products from Turkey, which became the largest buyer of oil products from Russia in 2023, according to a 2024 investigation by CREA and the Center for the Study of Democracy. In the year after the implementation of the EU ban on Russian oil products in February 2023, Turkey's imports of them more than doubled to 17.6 billion euros — generating an estimated 5.4 billion euros in tax revenues for the Kremlin.

Turkey, a member of NATO since 1952, spent 3 billion euros in August on Russian fossil fuels, accounting for 21% of Russian exports, according to CREA.

Secondary tariffs?

In March, the seemingly benign initial approach to Russia of Trump’s second presidency gave way to threats of 25%–50% secondary tariffs on buyers of its oil within a month if Moscow refused to conclude its decade-long war against Ukraine, as reported at the time.

In July, the EU, however, went ahead without the U.S. and reduced the price cap on Russian crude oil to $47.60 per barrel, from $60 per barrel, after Slovak Prime Minister Robert Fico finally gave his assent.

In mid-July, Trump went as far as to threaten "very severe tariffs" if Russia did not end the war in 50 days — only to shorten the deadline two weeks later to Aug. 8.

On Aug. 6, the Trump administration doubled American tariffs on Indian goods to 50%, effective Aug. 27, "due to India's direct or indirect importation of Russian Federation oil" — despite the country, the fastest-growing major economy in the world, having reduced imports of Russian oil in July.

Despite Trump’s deadline elapsing without action from Moscow, he announced the same day a summit with the Russian leader on Aug. 15 in Alaska, without Ukrainian President Volodymyr Zelensky.

Trump said in a Sept. 13 post on social media that he was ready to impose "major sanctions" against Russia — including 50% to 100% tariffs on its main supporter, China — once NATO had agreed and halted oil imports from Russia. This would be of "great help" in ending the deadly war, he wrote.

Trump's recent threats against countries buying Russian crude have so far had little to no effect, Kpler crude oil analyst Muyu Xu told the Kyiv Independent.

While some Indian state-owned refineries briefly paused purchases of Russian spot crude in early August, after Trump vowed to raise tariffs to 50%, trade soon resumed, Xu explained. "Russian crude plays a critical role in India's refining system, both in terms of price and crude quality," she added.

"As a result, India's imports of Russian crude dipped slightly in September, but we expect a rebound in October," Xu said. Unless the U.S. imposes secondary sanctions, the major buyers of Russian crude — namely India, China, and Turkey — are expected to continue importing as long as they can, according to Xu.

"At the same time, these countries are working to diversify their crude sources, both as a precautionary move against potential stricter U.S. measures and, in India's case, possibly as part of a trade agreement with Washington," Xu said.

In 2024, Russia remained the second-largest exporter of crude oil, accounting for 11% of world exports, and the third-largest producer, according to the Energy Institute. The country is also the second largest producer of natural gas with a 15% share of world output, after the U.S., with 25%.

In September, the EU proposed an earlier total ban on imports of Russian LNG by January 2027 as part of its 19th package of sanctions against the country. The package requires unanimous approval from all member states. France was the bloc's largest importer of LNG in August, spending 157 million euros, according to CREA.

Meanwhile, the EU is looking to reach an agreement this month on an earlier ban on Russian fossil fuel imports as part of its long-term Repower EU plan — which is separate from temporary sanctions — reportedly including ending imports of crude oil and petroleum products from the start of 2026 and gas flows a year later.