'Very cautious decision' — Ukraine's central bank leaves interest rate unchanged

The National Bank of Ukraine kept its benchmark interest rate unchanged at 15.5%, warning that inflation could intensify amid Russian attacks on the energy system and Kyiv's ongoing budgetary challenges.

"Despite a decline in inflation over the past months, inflation expectations remained high and inflationary risks rose, particularly those related to larger energy shortages and greater budgetary needs," the bank's Governor Andrii Pyshnyi said on Oct. 23 when announcing the decision.

Mykhaylo Demkiv, financial analyst at Investment Capital Ukraine, described the decision as "very cautious," adding that it was "a bit unexpected."

The bank had previously forecasted rate cuts in the last quarter of 2025, but now envisions that rate cuts will begin in the first quarter of 2026.

"I expect that they are waiting to see how it goes with the reparations loan, and see when it’s safer to cut," Demkiv told the Kyiv Independent.

The European Union is developing a plan to use $140 billion of Russia’s central bank reserves — immobilized at the beginning of the full-scale invasion — to help fund Ukraine, known as the reparations loan.

Ukraine received $13 billion in international external financing from August to October, and is expected to receive another $15 billion by the end of 2025, according to the bank. But the country faces an external financing gap of $60 billion for 2026 and 2027.

The EU is expected to announce on Oct. 23 whether it will start preparing the legal framework for the reparations loan.

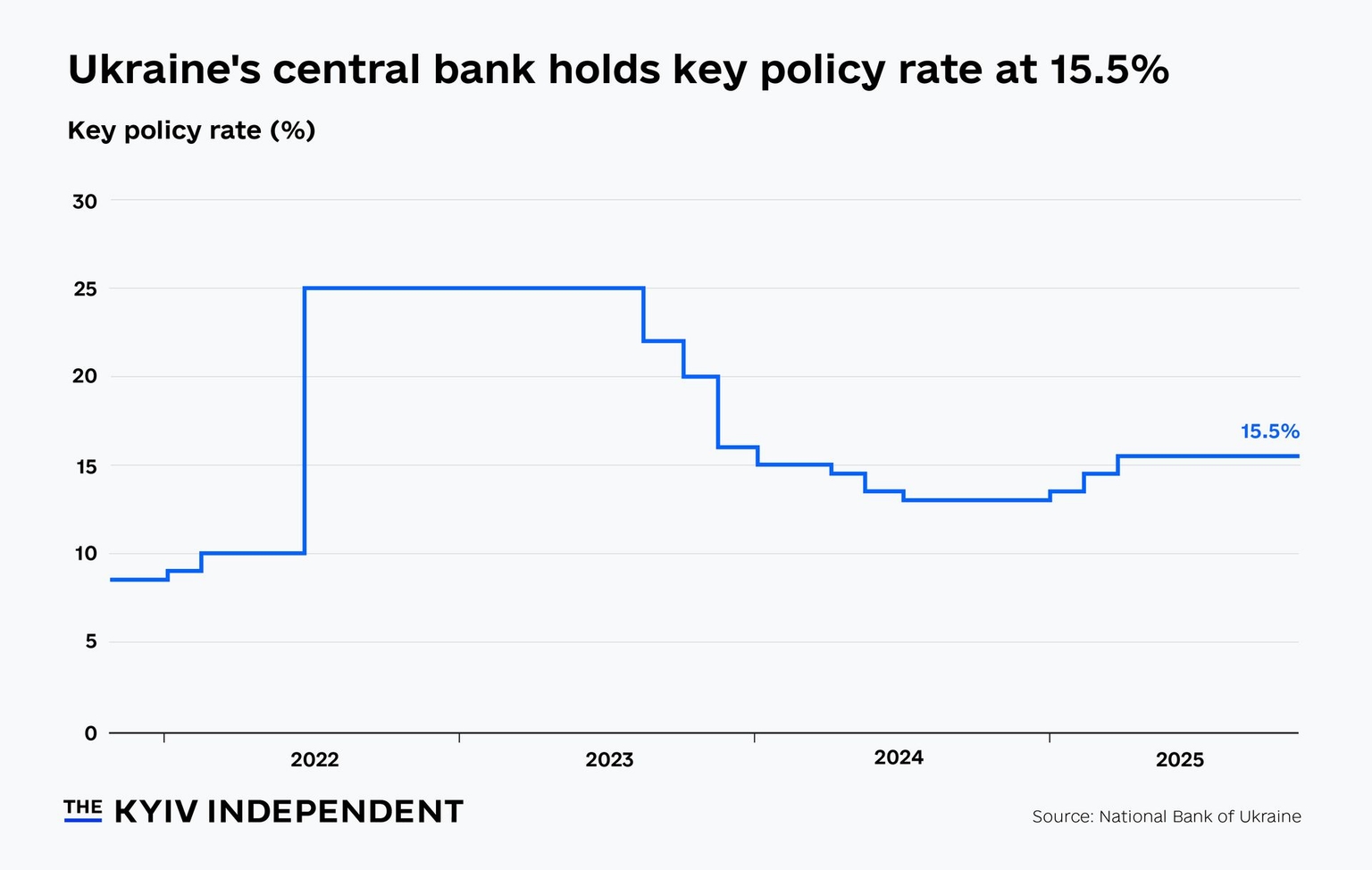

This is the fifth consecutive vote to hold the NBU’s policy rate at 15.5%, after it was raised from 14.5% to 15.5% in March 2025.

The bank said in a statement that the move will maintain the attractiveness of hryvnia assets, the sustainability of the foreign exchange market, and the steady decline in inflation towards the 5% target.

The decision comes after inflation declined faster than expected at the end of September to 11.9%, 1.2 percentage points lower than the bank’s July forecast of 13.1%.

The decline is due to an increase in the supply of vegetables on the back of larger harvests compared to last year, and lower price pressure in the fruit market, according to the bank.

The peak in May 2025 of 15.9% of inflation was driven by a poor harvest in 2024, higher energy and labor costs, and robust consumer demand.

The bank forecasts inflation to decline to 9.2% in 2025, 6.6% in 2026, and reach a target of 5% at the end of 2027.

Gross domestic product is forecast to grow by 2% in 2026 and 2.8% in 2027.

In addition to the key rate decision, the bank also downgraded the country's growth forecasts for 2025 from 2.1% to 1.9%, citing Russian attacks on energy, labor shortages, and inconsistent external financing as key risks to the Ukrainian economy, heavily hit by Russia's full-scale war.

Inflation skyrocketed to 26.6% in October 2022 from 10.0% on the eve of Russia’s full-scale invasion. The bank responded by raising the key rate from 10.0% to 25.0% in June 2022, where it remained until July 2023.

The key rate has not fallen below 13% since the full-scale invasion.