Editor's Note: This story was sponsored by the Ukrainian think-tank Center for Democracy and Rule of Law (CEDEM).

What do a Snickers bar, an Oreo cookie, and Haagen-Dazs ice cream have in common?

Apart from being beloved sweet treats, these products are manufactured by companies that were named “international sponsors of war” by Ukraine’s National Agency on Corruption Prevention (NACP) for fuelling Russia’s economy and its war effort against Ukraine.

While some multinational corporations left Russia following the full-scale invasion in 2022, many stayed behind. Household names such as Unilever, Nestlé, and Mondelez offered a range of excuses for their continued presence in Russia. These companies are not targeted by international sanctions since they do not directly contribute to Russia’s war machine. But according to Ukrainian officials, they might as well be: the tax money that these companies pay into Russia’s coffers may be used to finance its military.

The sponsors of war list is a form of “soft sanctions” that harnesses the power of public pressure. Some companies left Russia after being listed, which the NACP claims as their success. In other cases, the Agency negotiated with companies, securing promises to cut ties with Russia. Some of these commitments are yet to be fulfilled.

The “soft sanctions” approach is praised by academia and civil society alike. Yet, some say Ukraine’s policy on isolating Russia’s economy is too arbitrary, and a centralized policy is needed to achieve victory on the economic front.

Multinationals’ Russia problem

At the start of Russia’s full-scale invasion of Ukraine, the thousands of international businesses operating in Russia faced immense pressure to leave the Russian market.

McDonald’s was one of the first massive corporations to cut ties, halting sales in March 2022 and announcing a complete withdrawal two months later.

Multinationals are an important part of Russia’s economy. According to the Kyiv School of Economics (KSE), which hosts the most comprehensive tracker of international businesses operating in Russia, these companies contributed $25 billion to the Russian GDP in 2021, and paid $2.9 billion in taxes in 2022, according to KSE and their NGO partner on the project, the B4Ukraine coalition.

According to KSE and B4Ukraine, the three most profitable sectors for multinationals in Russia are alcohol and tobacco, mass-market consumer goods, and automobiles.

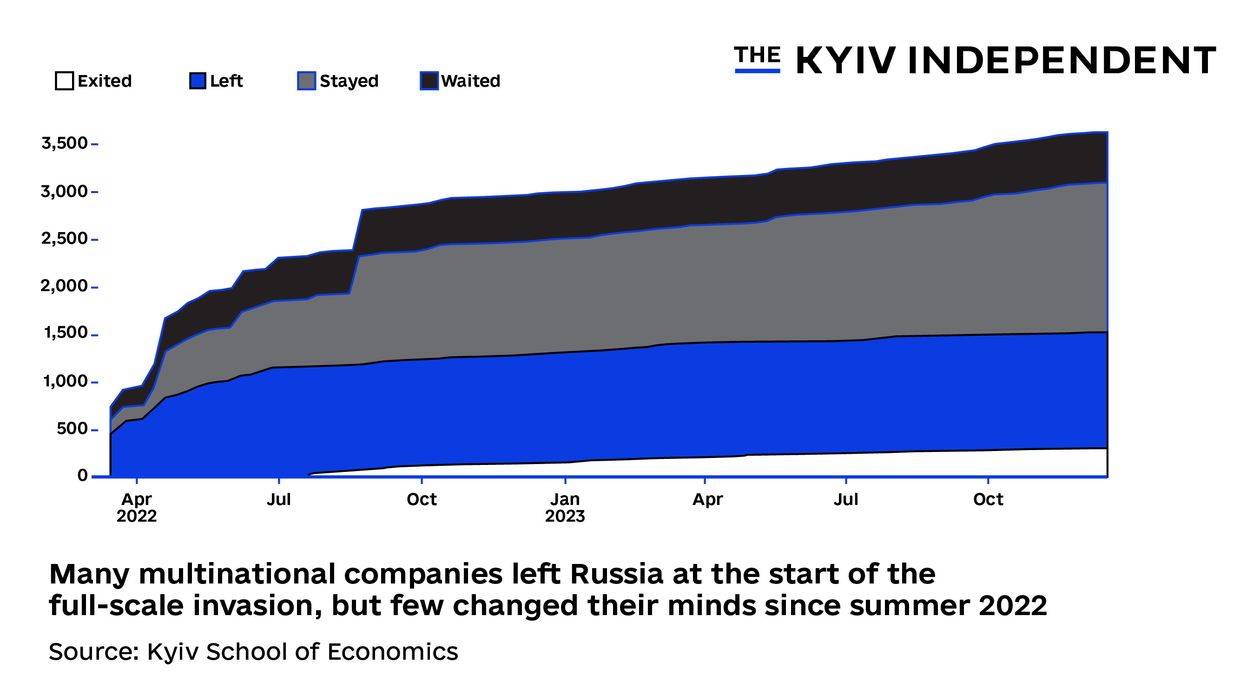

According to the KSE, after April 2022, the flood of companies leaving Russia turned into a drip. The KSE chart shows that most companies decided on whether to leave by summer 2022 at the latest.

Shutting the door on Russia isn’t always simple, even for the companies that want to. A recent investigation by the New York Times showed that Russian dictator Vladimir Putin is making withdrawal difficult and costly for foreign companies and enriching Russia in the process.

More than 1,600 foreign companies have continued business as usual in Russia. When challenged about their continued presence, some companies such as Unilever claim only to sell essential goods, while Nestlé cited worries about abandoning their staff, and Carlsberg claims to be unable to find buyers for their business.

These excuses proved thin. Dutch brewer Heineken sold its entire Russian business for the symbolic sum of one euro, showing that withdrawal is possible if a company is ready to take a financial hit. Unilever continued to sell ice cream, under the guise of “essential goods.”

The Kyiv Independent reached out to Unilever, Nestle, and Carlsberg but hasn’t gotten a response as of publication time.

Ultimately, most companies are cynical and profit-driven, and we cannot expect otherwise, says Glib Kanievskyi, co-founder of StateWatch, a Ukrainian transparency watchdog. Any tools that seek to isolate Russia economically must take this into account.

Who are ‘sponsors of war’?

The International Sponsors of War list, launched in summer 2022, is an initiative that seeks to turn public opinion against multinationals that stay in Russia and use public pressure to incentivize withdrawal.

Of more than 1,600 foreign companies that stayed in Russia according to KSE, only 45 are listed as sponsors of war. According to Agia Zagrebelska, who oversees the sanctions policy direction at the NACP, there are three main criteria for inclusion: a substantial amount paid in taxes to Russia, any direct connections to the military, and broken promises to withdraw from Russia.

She says the NACP receives suggestions about companies from the public and civil society organizations such as StateWatch. These suggestions are then reviewed in line with the Agency’s criteria.

Some listed companies, like Unilever, snack titan Mondelez, and supermarket chain Auchan, are known worldwide for their consumer goods. Thirteen companies are based in China, a key Russian ally and its largest trading partner.

Of the three most profitable sectors identified by KSE and B4Ukraine, the NACP has widely listed alcohol and tobacco, and mass-market consumer product companies, but the automobile sector is still untouched – no Western automobile companies are on the list.

The list's purpose is to go after a “gray zone” of companies that are not eligible for sanctions, says Zagrebelska. While there are no legal consequences to being listed, the risk of reputational damage can be enough to change company behavior.

Zagrebelska says the list allows consumers to make informed choices about their purchases, thus enacting a “direct democracy” where the public can vote with their wallets.

‘Soft sanctions’ in action

The NACP points to several companies that stopped dealing with Russia as signs of a successful policy. For instance, British manufacturing group Mondi was listed as a sponsor of war in February 2023, given their sizeable operations in Russia. They were removed from the list in November 2023 following a complete withdrawal.

While Zagrebelska admits that it is difficult to prove that the sponsors of war list had a decisive impact, she says the NACP is confident it pushes companies in the right direction.

In other instances, the NACP negotiated extensively with companies. Three Greek shipping companies saw their status change four times as they made and broke promises to the NACP. Finally, the companies were removed for good when they committed to stop shipping Russian oil entirely.

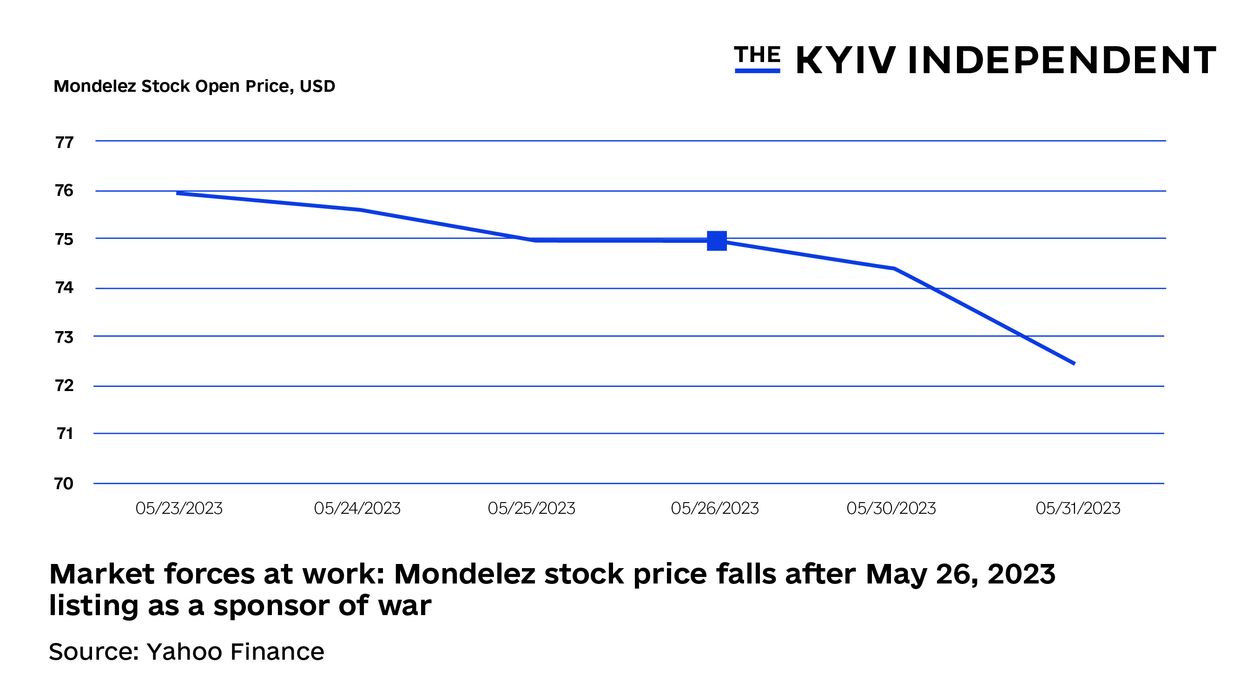

The stock price of Mondelez, the company behind Oreos, Toblerone, and Milka, tumbled by almost five percent after it was labeled a sponsor of war in May 2023. Mondelez has continued its operations in Russia, and its stock price has not recovered.

The snack maker’s financial troubles were likely exacerbated due to a boycott by clients in Sweden and Norway such as Scandinavian Airlines since June 2023. The Nordic companies cited the listing as a sponsor of war as the reason for their decision. Mondelez claimed they were unfairly “singled out.”

The Kyiv Independent reached out to Mondelez but hasn’t heard back as of publication time.

Wrangling with banks

One of the NACP’s most high-profile clashes was with Hungary’s OTP Bank, which operates in Russia and Ukraine and was listed as a sponsor of war in May 2023.

Viktor Orban, Hungary’s prime minister known for pro-Russia stances, was outraged by the listing, and Hungarian diplomats pushed back hard, threatening to derail EU sanctions and Ukraine aid discussions in Brussels.

According to NACP’s Zagrebelska, OTP Bank made significant concessions in discussions with EU and Ukrainian officials and demonstrated a concrete plan for withdrawing from Russia, after which the bank was removed from the list in October 2023. She could not share any details of the plan, which is set to be announced in January 2024, with the Kyiv Independent.

Kanievskyi of StateWatch was skeptical of the NACP's claim of victory over OTP Bank. He said the likelier explanation is that NACP backed down after internal and external pressure. Passing EU sanctions was more important to the Ukrainian government, he said.

A Ukrainian official who worked closely on negotiations over OTP Bank but was not authorized to speak on the record said the NACP listing caused “a lot of fuss.” They said that the listing of OTP Bank held up the 11th EU sanctions package for up to four weeks and that Ukraine’s Ministry of Foreign Affairs was frustrated with the NACP’s position.

Similar discussions are ongoing about Raiffeisen, an Austrian bank with huge operations in Russia. The bank’s status as a sponsor of war was suspended last week, and Zagrebelska said that NACP is awaiting concrete documentation to show its commitment to withdrawing from Russia.

Once again, the NACP’s decision to remove the bank coincided with Austria’s approval of the latest EU sanctions package. Kanievskyi said the NACP folded to pressure, but Zagrebelska maintained her confidence that Raiffaisen will take concrete steps to withdraw from Russia. She also noted that the bank’s status is only suspended, meaning it can be easily reinstated.

Reflecting on the OTP and Raiffeisen cases, Andrii Onopriienko, a policy expert at KSE, recognized that the sponsors of war list is ultimately a political process that uses these negotiations to try and find a favorable compromise for Ukraine.

On OTP and Raiffeisen, the jury is still out. Should the banks’ promises to exit Russia prove empty, the deterrent power of the list may be weakened. On the other hand, if OTP and Raiffeisen show a real commitment to withdrawing from Russia, the “soft sanctions” and negotiation approach may be vindicated as a powerful tool of economic warfare.

Dealing with the devil?

Another source of criticism has been the inclusion of companies that continue to do business in Ukraine. Philip Morris, one of the “big four” tobacco companies, was listed among sponsors of war in August 2023, having announced a $30 million factory project in Lviv Oblast just two months before.

Japan Tobacco International (JTI), another “big four” cigarette maker is also one of the biggest multinationals still active in Russia and Ukraine, and was also listed as a sponsor of war in August 2023.

Kanievskyi questioned the coherence of listing Philip Morris as a sponsor of war and continuing close cooperation with the company. Many companies on the list maintain significant operations in Ukraine, including Unilever, Nestlé, and Mondelez.

According to Kanievskyi, the cause is a lack of a unified policy and legislative framework.

On the Philip Morris deal, Phil Chamberlain from the campaigning organization Expose Tobacco said that preying on countries in difficult situations to get a better deal was straight out of the “Big Tobacco” playbook. According to Chamberlain, a lack of coherent policy only makes it easier for multinationals to take advantage of the war to increase profits.

According to Hlib Kolesov, a lawyer with the Ukrainian think-tank Center for Democracy and Rule of Law, it is hypocritical of tobacco companies to be contributing to Russia’s economy as they claim to support Ukraine amid war.

“On the one hand, tobacco companies position themselves as good partners of Ukraine, investors in its economy, in recovery, but, on the other hand, the same tobacco companies earn money in Russia and pay huge taxes to the budget of the Russian Federation,” Kolesov told European Pravda.

Yet, Ilona Sologoub, an economist and head of the VoxUkraine think tank, recognized the challenges faced by Ukraine’s government in elaborating a coherent policy in this area.

Ultimately, Sologoub agreed with the NACP’s “gray area” logic. She said that “soft sanctions” fill a valuable gap, targeting companies that cannot be sanctioned because of the possible negative impact on Ukraine’s economy.

For NACP’s Zagrebelska the presumable “whitewashing” efforts by Philip Morris and other companies are too little, too late. She said she was confident that consumers can see through the efforts and will continue to pressure companies to exit Russia.

The Kyiv Independent requested a comment from Philip Morris but hasn’t heard back as of publication time.

Coordinated policy

Experts were broadly positive about the sponsors of war list and its contribution to Russian economic isolation. “There is no perfect solution,” said KSE’s Onopriienko, “but it is an all-out war. We all do our part.”

Kanievskyi, whose organization StateWatch collaborates extensively with the NACP, emphasized the lack of central government policy as the biggest challenge for Ukraine in this area.

He said that in the early months of the all-out war, companies were more afraid of reputational damage for staying in Russia, while now many are ready to take the risk. For him, this highlights an urgent need for a centralized policy on sanctions and other economic restrictions from the authorities. Ultimately, he says a lack of a clear policy undermines the communications efforts of the NACP which is crucial to the list's success.

A lack of centralized policy also led to tensions over OTP Bank, with different Ukrainian government agencies pushing for different outcomes, as recounted by the Ukrainian official who worked closely on internal and external negotiations and who is not authorized to speak with the media.

The NACP and partners are looking to develop new initiatives to isolate Russia economically and increase the effectiveness of sanctions. A newly launched project tracks electronic components used in Russian weapons that continue to bypass sanctions. Zagrebelska said that in early 2024, the Agency plans to launch a mobile application allowing consumers to spot products by companies listed as sponsors or war.

In the meantime, Kanievsky underscores the importance of having a coordinated policy on the sponsors of war list. Lacking proper guidance from the central government, Ukrainian officials and civil society may struggle to do their part in isolating Russia’s wartime economy.