Ukraine state-owned enterprises weekly — Issue 112

Editor’s Note: This is issue 112 of Ukrainian State-Owned Enterprises Weekly, covering events from Nov. 18-24. The Kyiv Independent is reposting it with permission.

Ukrainian SOE Weekly is an independent weekly digest based on a compilation of the most important news related to state-owned enterprises (SOEs) and state-owned banks in Ukraine. This publication was produced with the financial support of the European Union within the project “Supporting Ukraine in rebuilding and recovery” implemented by the KSE Institute. The contents of this publication are the sole responsibility of the editorial team of the Ukrainian SOE Weekly and do not necessarily reflect the views of the European Union.

Corporate governance of SOEs

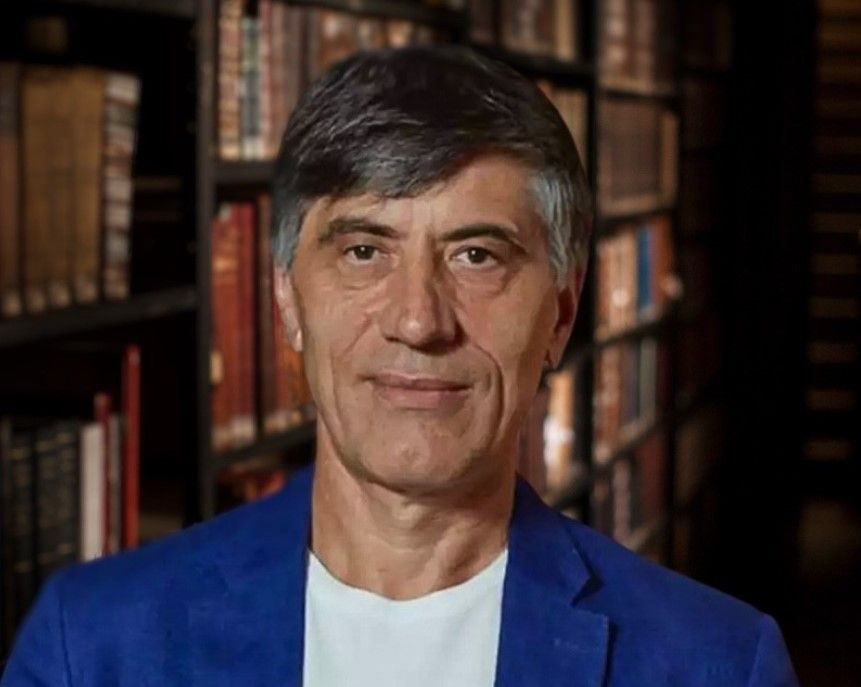

Verkhovna Rada appoints a new chief for SPFU. On Nov. 21, the Verkhovna Rada appointed Vitaliy Koval, governor of Rivne Oblast, as the head of the State Property Fund of Ukraine (SPFU).

According to Chesno, Vitaliy Koval had been a governor since 2019. He was also a candidate for mayor of Rivne from the Sluha Narodu party in 2020. In the first round of the mayoral elections, Koval received 13.52% of the vote, taking the third place.

In 2020, Koval was elected as a member of the Rivne City Council from Sluha Narodu.

He is also a member of the National Olympic Committee of Ukraine and the first vice president of the Greco-Roman Wrestling Federation of Ukraine.

In 2006-2019, he headed and co-founded enterprises in the agricultural, transport, and construction industries: Atlant-Trans LLC, InvesttradeService LLC, RGS-Logisticgroup LLC, BBB Montazh LLC, and Sanako LLC.

We are not aware if Koval has any investment banking or state property management experience.

As we reported in Issue 110, Davyd Arakhamia, head of the Sluha Narodu faction in parliament, wrote that the Verkhovna Rada was planning to appoint Koval as the new head of the SPFU.

Later, Prime Minister Denys Shmyhal formally proposed the candidacy of Koval to the Rada.

In Issue 101, we reported that the former head of the SPFU, Rustem Umerov, stepped down to replace Oleksii Reznikov as defense minister on Sept. 6.

NABU updates its suspicion for SPFU’s former head Sennychenko – he is now also suspected of laundering Hr 10 billion. On Nov. 24, the National Anti-Corruption Bureau (NABU) and Specialized Anti-Corruption Prosecutor’s Office (SAPO) said that they had renewed suspicions against all members of the criminal group led by Dmytro Sennychenko, the former head of the SPFU. They are now also suspected of legalizing the proceeds of crime in excess of Hr 10 billion ($277,000).

According to NABU, Sennychenko’s accomplices included:

- a person close to the head of the SPFU (co-organizer) – the NABU did not name the suspect but, according to the media, it is Andriy Hmyrin;

- an adviser to the head of the SPFU – Yuriy Lypko;

- two acting CEOs of Odesa Portside Plant (OPZ) in different periods – Mykola Parsentyev and Mykola Synytsia;

- the acting CEO of United Mining and Chemical Company (UMCC) – Artur Somov;

- two owners of the company that won the auction for the supply of gas to OPZ – Oleksandr Horbunenko and Volodymyr Kolot, co-owners of Agrogaztrading; and

- two other accomplices – Pavlo Prysyazhnyuk, investment banker (according to Censor.Net’s sources, Prysyazhnyuk was Sennychenko’s “curator” from the authorities) and another defendant.

As we reported in March 2023, NABU and SAPO said that they exposed a criminal group run by Sennychenko. See more about this case in SOE Weekly’s Issue 80.

In Issue 81, we reported that the court imposed a pre-trial restraint on two defendants in this case, Lypko and Synytsia.

As we reported in Issue 83, the suspects in this case, including Sennychenko, were placed on the wanted list.

SPFU presents a roadmap for the implementation of Land Bank. On Nov. 20, the SPFU said that it had presented what the Land Bank will look like to an inter-ministerial working group.

According to the SPFU, this group includes representatives of the Justice Ministry, the Agrarian Policy Ministry, relevant committees of the Verkhovna Rada, the State Service of Ukraine for Geodesy, Cartography and Cadastre (StateGeoCadastre), and Prozorro.Sale.

The roadmap was not publicly available at the time of writing.

The SPFU plans to consolidate state land in several stages. First, the farmland of SOEs in liquidation may be transferred to the Land Bank. The next stage is about the land of SOEs that are free of any encumbrances and restrictions. The third and fourth stages would include the land of distressed SOEs that require an individual approach.

The first two phases can be completed in two or three months if all the authorities work together in a consolidated manner, the SPFU said.

The SPFU also believes that the Land Bank would become one of the strategic assets to stay state-owned and will go into the Ukrainian Sovereign Wealth Fund.

As we reported in June, the SPFU was working out plans to launch a land bank to centralize all state-owned agricultural land into a single entity for long-term leasing. For more detail, see SOE Weekly’s Issue 93.

As we reported in Issue 100, the Cabinet of Ministers transferred 25 SOEs, previously managed by the National Academy of Agrarian Sciences, to the SPFU. We also wrote about the SPFU’s plans to launch the first open auctions for leasing of state agricultural land in 2024.

Cabinet reappoints the three state representatives on Oschadbank’s supervisory board for a second term. On Nov. 17, the Cabinet of Ministers reappointed three state representatives of Oschadbank’s supervisory board: Yulia Pashko (nominated by the Finance, Tax, and Customs Committee of the Verkhovna Rada), Rosa Tapanova (nominated by the Cabinet of Ministers), and Oleksandr Rodnyansky (nominated by the president of Ukraine).

According to SMIDA, Rodnyansky and Tapanova have been state representatives on the board since 2021; Pashko has served since 2019.

As we wrote in SOE Weekly’s Issue 111, the supervisory board of Oschadbank started its work and elected Volodymyr Lavrenchuk as its new chair on Nov. 14.

As we reported in Issue 85, the Cabinet appointed four new independent members of Oschadbank’s supervisory board back in April 2023. It is unclear why the board needed seven months to start its work only now. See Issue 111 for more detail.

Banks

Ukrainian banks make a profit of Hr 110 billion in the first three quarters of 2023, state-owned banks at the top of the list. Opendatabot wrote that Ukrainian banks made a total profit of Hr 109.85 billion ($3.1 billion) in the first nine months of 2023. This is 1.4 times as much as what they made in the entire year before the full-scale Russian invasion, 2021. That year, Ukrainian banks’ profits were Hr 77.53 billion ($2.2 billion).

According to Opendatabot, there are 63 banks operating in Ukraine. Only 10%, with most of them owned by private Ukrainian capital, lost money in 2023; their total losses are Hr 160 million ($4.4 million).

The top 10 banks by profit are all still the same. That includes all the five state-owned banks, four banks with foreign capital, and one with private Ukrainian capital. They make 87.5% of the total profit of all banks in the country, Opendatabot added.

PrivatBank is still the undisputed leader, with profits of Hr 43.4 billion ($1.2 billion) in the first three quarters, twice as much as the same period in 2021 (Hr 21.21 billion, or $590 million).

Oschadbank is in second place among all Ukrainian banks, with Hr 15.18 billion ($422 million) against Hr 0.85 billion ($23 million) in 2021.

In other words, the state-owned PrivatBank and Oschadbank earned over half (52%) of the total profit of all Ukrainian banks in the first nine months of 2023.

The recently nationalized Sense Bank is third with Hr 5.58 billion ($155 million), up from Hr 2.46 billion ($68 million) in 2021. As we reported earlier, Sense Bank, previously owned by sanctioned Russian oligarchs Mikhail Fridman, Petr Aven, and Andrey Kosogov, was nationalized in late July 2023. See more in SOE Weekly’s Issue 98.

Ukreximbank earned Hr 3.59 billion ($99 million) in first nine months of 2023, compared to Hr 1.75 billion ($48 million) in the same period of 2021. Ukrgasbank earned Hr 2.92 billion ($81 million) against Hr 1.75 billion ($49 million), respectively.

Overall, the share of state-owned banks’ profits increased to 63.4% of the total profits of Ukrainian banks in the third quarter of 2023.

Energy sector

Naftogaz raises 200 million euros from EBRD to strengthen Ukraine’s energy security. On Nov. 22, Naftogaz reported that it signed a loan agreement with the European Bank for Reconstruction and Development (EBRD). The agreement is to be state-guaranteed, and it will enter into force after the guarantee would have been issued.

This signing brings to fruition an agreement initially made in June 2023 at the Ukraine Recovery Conference in London, between EBRD President Odile Renaud-Basso and Ukraine’s Prime Minister Denys Shmyhal, the EBRD explained.

As we wrote earlier, in June 2023, Ukraine signed memorandums with the EBRD to provide 600 million euros to support Ukraine’s energy sector – funds would go to Ukrenergo, Naftogaz, and Ukrhydroenergo. See SOE Weekly’s Issue 94 for more detail.

Defense

Cabinet approves UDI’s financial plan for 2024 – a “good profit” expected. On Nov. 17, the Cabinet of Ministers approved the financial plan of Ukrainian Defense Industry (UDI) for 2024.

Financial plan indicators were not publicly available at the time of writing.

According to Oleksandr Kamyshin, minister for strategic industries, the plan envisages a significant increase in revenue and a “good profit." He did not specify the planned financial indicators.

As we wrote earlier, in June 2023, Ukroboronprom was officially transformed into a joint-stock company called Ukrainian Defense Industry (UDI). We also reported that Ukroboronprom’s CEO Yuriy Husiev resigned, and the Cabinet appointed Herman Smetanin as the CEO of newly established UDI. See SOE Weekly’s Issue 95 for more detail.

Infrastructure

Ukrzaliznytsia’s financial plan for 2024 approved – losses of almost Hr 13 billion forecast, break-even measures proposed. On Nov. 20, Ukrzaliznytsia announced that the Cabinet of Ministers approved its financial plan for 2024.

The Cabinet’s resolution was not publicly available at the time of writing.

The financial plan forecasts losses of Hr 12.6 billion ($350 million). Ukrzaliznytsia’s said that these losses would be covered by a “break-even plan." The release did not specify what this means.

The company projects Hr 103.2 billion ($2.8 billion) in revenue, Hr 98.6 billion ($2.7 billion) of which will be net income from the sale of goods and services. Revenue from freight transportation is expected to be Hr 80.1 billion ($2.2 billion), and revenue from passenger transportation, Hr 9.3 billion ($258 million).

Total expenses are planned at Hr 115.8 billion ($3.2 billion), including a 13% increase in the cost of goods sold, mainly due to the need to increase wages and electricity tariffs. EBITDA is planned at Hr 11.8 billion ($327 million), meaning an EBITDA margin of 12%.

There should be Hr 38 billion ($1.05 billion) in capital investments, mainly to rebuild damaged infrastructure and build cross-border connections with the EU.

Ukrzaliznytsia expects to contribute Hr 24 billion ($667 million) to the state budget (apparently, in tax payments, as no dividends can be planned with projected losses), 5% more than what is expected in 2023.

Ukrzaliznytsia’s CEO Yevhen Lyashchenko said that the financial plan does not envisage raising funds from the state budget, whose priority is to finance the country’s defense capability. “Among other things, the financial plan provides for an increase in the salaries of railway workers, which currently do not correspond to their contribution to the defense capability and functioning of the Ukrainian economy, compared to other industries,” Lyashchenko said.

“This financial plan was developed and submitted for consideration in the third quarter of 2023, when the ports were completely blocked. We have already developed our proposals on how to break even. In particular, given the trend of the previous two months of this year, we made a more optimistic forecast for cargo transportation. We are also planning (to ask the Infrastructure Ministry for) uniform tariffs, to make them more transparent and bring them in line with the European model. We continue to work on cost optimization.”

As we reported in SOE Weekly Issue 72, Ukrzaliznytsia took losses of Hr 10.8 billion ($300 million) in 2022. The loss from passenger transportation was Hr 13.3 billion ($369 million), suggesting that the company’s other segments, such as cargo transportation, made a profit of Hr 2.5 billion ($69 million).

In Issue 70, we reported that on Dec. 30, 2022, the Cabinet of Ministers approved Ukrzaliznytsia’s consolidated financial plan for 2023. According to that plan, Ukrzaliznytsia expected to lose Hr 20.2 billion ($561 million) in 2023 due to the large social burden and restrictions on cargo transportation (see Issue 72).

As we wrote in Issue 80, in March 2023, after his appointment as Ukrzaliznytsia’s new CEO for the next two years, Lyashchenko got several key tasks, one of which was for the company to break even.

In Issue 90, we reported that Ukrzaliznytsia would receive a $25 million grant from the World Bank.

In Issue 91, we reported that Ukrzaliznytsia would also receive a 6.7-million-euro grant from the European Investment Bank (EIB) to support the company’s operations during Russia’s full-scale war against Ukraine.

As we wrote in Issue 92, Ukrzaliznytsia signed a 200-million-euro loan agreement with the European Bank for Reconstruction and Development (EBRD) as part of the Emergency Support to Ukrainian Railways project.

In Issue 101, we wrote that Ukrzaliznytsia would receive a 100-million-euro loan from EIB.

As we wrote in Issue 103, in September 2023, Lyashchenko said that Ukrzaliznytsia was reaching break-even and would finish the first nine months of 2023 with a profit.

Privatisation

Prozorro.Sale reports over Hr 2.7 billion in budget revenues from small-scale privatization in 2023. On Nov. 20, Prozorro.Sale wrote that its system replenished the state and local budgets by Hr 2.7 billion ($75 million) from small-scale privatization of state and municipal property.