Editor’s Note: This is issue 75 of Ukrainian State-Owned Enterprises Weekly, covering events from Feb. 11-17, 2023. The Kyiv Independent is reposting it with permission.

Ukrainian SOE Weekly is an independent weekly digest based on a compilation of the most important news related to state-owned enterprises (SOEs) and state-owned banks in Ukraine. This publication was produced with the financial support of the European Union within the project “Supporting Ukraine in rebuilding and recovery” implemented by the KSE Institute. The contents of this publication are the sole responsibility of the editorial team of the Ukrainian SOE Weekly and do not necessarily reflect the views of the European Union.

Corporate governance of SOEs

Anthony Marino elected as the chair of Naftogaz’s supervisory board. On Feb. 10, the new supervisory board of Naftogaz, Ukraine’s state-owned oil and gas company, elected Anthony Marino as the board chair.

According to Naftogaz, Marino is an exploration and production specialist with over 38 years of experience in the oil and gas sector. He served as executive director, president, and CEO of Vermilion Energy, an international hydrocarbon exploration and production company with a market capitalization of $4 billion.

Marino also currently serves as president and CEO of the newly established energy company Tenaz Energy. During 2002-2020, he served on supervisory boards or boards of directors of six companies and organizations.

In SOE Weekly (Issue 72), we reported that on Jan. 24, the Cabinet of Ministers appointed six members to Naftogaz’s supervisory board. The new supervisory board includes the following independent members: Tor Martin Anfinnsen, Anthony Marino, Richard Hookway, and Ludo Van der Heyden. The state representatives include Rostyslav Shurma, deputy head of the President’s Office, and Nataliya Boyko, energy advisor to Prime Minister Denys Shmyhal.

According to Naftogaz’s charter, the supervisory board must consist of seven members: independent members, who must constitute a majority of the board, and state representatives. This means that another board member is yet to be appointed. This can be either an independent member or a state representative. The Cabinet has not indicated why no such member has been appointed yet, or who that person will be.

Former First Deputy Minister of Economy to direct strategy at Ukrnafta. On Feb. 13, Denys Kudin, who had recently stepped down as first deputy minister of economy, was appointed to head the department for strategy, development, and government relations at Ukrnafta, Ukrainian oil and natural gas extracting company owned by Naftogaz, Ukrnafta’s CEO Serhiy Koretskiy said.

Kudin worked with Koretskiy for the WOG chain of petrol stations in 2013-2018. Kudin served as the first deputy minister of economy since November 2021. Before that, he was the first deputy head of the State Property Fund of Ukraine (SPFU).

After stepping down from the Ministry of Economy, he wrote on his Facebook page about his plans to “focus entirely on the fuel front.”

In SOE Weekly (Issue 68), we reported that the shares of Ukrnafta, Ukrtatnafta, Motor Sich, AvtoKrAZ and Zaporizhzhiatransformator (ZTR) were seized “for the needs of the state” and transferred to the Ministry of Defense on Nov. 6.

The seizures were made under the law on the transfer, forced alienation, or seizure of property under martial law or state of emergency, which obligates the state to eventually return the seized assets to the owners or give them fair compensation.

Naftogaz owns 50% + 1 share of Ukrnafta. These shares were not seized. A group of companies informally known as the Privat group, associated with oligarchs Ihor Kolomoiskyi and Hennadiy Boholyubov, owned about 42% of the shares.

The remaining shares were held by some 11,000 dispersed shareholders, including the company’s former or current employees, investment funds, and pension funds. All these shares were seized by the state along with those of the Privat group.

After the seizure, the state replaced the supervisory boards and executive management at most of these companies. On Nov. 7, the Ministry of Defense as Ukrnafta’s new shareholder appointed a new supervisory board of the company.

Former CEO of the WOG chain of petrol stations Serhiy Koretskyi became the CEO of both Ukrnafta and Ukrtatnafta on Nov. 8 and 10, respectively.

Ukrgasbank’s CEO resigns. On Feb. 9, Ukrgasbank’s CEO Andrii Kravets filed his resignation due to deteriorating health.

On Feb. 10, the supervisory board accepted Kravets’s resignation and appointed Rodion Morozov as the acting CEO, effective Feb. 13.

Morozov was Ukrgasbank’s deputy CEO. He has worked at Ukrgasbank since October 2009. From 2013 to 2016, he was an advisor to the CEO. From 2016 to 2020, he worked as director of the bank’s green finance department. In 2020, Morozov was appointed as a member of the executive board and deputy CEO.

According to the licensing regulations of the National Bank of Ukraine (NBU), a bank may have an acting CEO for no longer than six months. After that, a permanent CEO – to be approved by the NBU – must be appointed.

Ukrgasbank gets a new supervisory board. On Feb. 10, Ukrgasbank’s general meeting of shareholders terminated the powers of supervisory board chair Teimour Bagirov and independent board members Shrenik Davda, Slawomir Konias, and Oksana Volchko.

Taras Yeleiko, former deputy head of the State Property Fund, was appointed as the new board chair. In addition to Yeleiko, the new independent members of the board are Per Anders Fasth, Sanela Pasic, and Dariusz Gafka.

At the same time, independent member Yuriy Blashchuk and two state representatives – Yana Bugrimova (former chief of the reform office at the Ministry of Finance) and Maryna Lazebna (former minister of social policy of Ukraine) – were re-appointed for a new term.

In SOE Weekly (Issue 73), we reported that, on Jan. 27, the Cabinet of Ministers approved the candidacies of five independent members of Ukrgasbank’s supervisory board, based on the results of a competitive selection.

The competitive selection to find supervisory board members for the other three Ukrainian state-owned banks – PrivatBank, Oschadbank, and Ukreximbank – started simultaneously on Oct. 11, with application deadlines of Nov. 11.

In SOE Weekly (Issue 69), we reported that, on Dec. 27, the Cabinet of Ministers dismissed almost all independent members of PrivatBank’s supervisory board and appointed new ones after a competitive selection.

There have not yet been any public updates on the selections for Oschadbank or Ukreximbank.

The State Property Fund changes CEOs at 47 SOEs, including UMCC. On Feb. 14, the State Property Fund of Ukraine (SPFU) announced that it had begun dismissing SOE managers found to be lacking integrity.

According to the SPFU, seven companies have already received new CEOs, and another 40 are awaiting approval from local military administrations.

The SPFU’s analysis of SOEs’ performance revealed that most SOEs were not fulfilling their financial and economic plans and were taking losses, First Deputy Head of the State Property Fund Dmytro Klimenkov said. According to him, the SPFU is already looking for new managers for SOEs.

The SPFU has developed KPIs (key performance indicators) for the new managers to ensure that they properly prepare SOEs for privatization at the highest possible prices, Klimenkov added.

On Feb. 15, the SPFU announced the dismissal of the acting CEO of United Mining and Chemical Company (UMCC), Vladyslav Itkin. 100% of UMCC’s shares are held by the SPFU, and the company is slated for privatization.

According to the SPFU, this dismissal decision was based on a thorough internal financial and economic audit of the company. The SPFU team is also working closely with law enforcement agencies on the UMCC.

In SOE Weekly (Issue 33), we reported that the UMCC privatization auction was scheduled to take place on Aug. 31, 2021. Later, in SOE Weekly (Issue 41), we reported that the SPFU cancelled that privatization auction, which had only one qualified bidder.

The media then published a list of participants allegedly interested in the UMCC assets. Some of them said that the asset was not well prepared for privatization, and they did not consider the auction terms fair. Others claimed that the starting price was inadequate. It was reportedly impossible to estimate the company’s mineral deposits.

The SPFU’s Auction Commission set Oct. 29, 2021, as the new auction date.

In SOE Weekly (Issue 49), we reported that SPFU cancelled the Oct. 29, 2021, auction as well. The SPFU then explained that it only received two auction applications, one of which did not meet the requirements. The SPFU’s Auction Commission then set a new auction date again, Dec. 20, 2021.

In SOE Weekly (Issue 56), we said that BDO Corporate Finance, the SPFU’s adviser on the privatization of the UMCC, said that international companies were not prepared to participate in the UMCC auction despite their interest in these assets. The BDO said that this was because there were no warranties that would protect the prospective buyers’ investments. As of Dec. 14, 2021, the Cabinet of Ministers had not approved the privatization terms of the UMCC auction that would include such warranties.

In SOE Weekly (Issue 57), we reported that the SPFU postponed the UMCC’s privatization auction for the third time. Just like in October 2021, the SPFU said that it received two auction applications, one of which did not meet the requirements of the applicable law.

Holding an auction with only one participant is not allowed by the privatization law. For that reason, the UMCC privatization auction was declared invalid (for the third time). At that time, the SPFU noted that a new date for the UMCC auction would be set on a separate occasion.

Energy sector

Naftogaz discusses Eurobond restructuring with creditors – bondholders oppose the new proposal. On Feb. 10, Naftogaz announced consultations on the restructuring of its Eurobond liabilities with financial advisor Lazard and legal advisor Freshfields Bruckhaus Deringer. This concerns Eurobonds maturing in 2022 and 2026.

The company failed to reach a restructuring agreement with its creditors and defaulted on its payments on these bonds in 2022. At the time, the bondholders were offered a two-year deferral of payments under the same terms as those previously agreed upon by the state of Ukraine for its sovereign debt and a number of state-owned entities, such as Ukravtodor.

According to the company’s notice to noteholders, on April 15, Naftogaz is prepared to pay the overdue July 19 coupon plus interest on its 2022 Eurobonds. As for its 2026 Eurobonds, the company offers to pay a 0.5% exchange fee and repay the principal in November 2027 and November 2028, instead of paying 100% in November 2028 as before.

According to Bloomberg, creditors advised by Cleary Gottlieb Steen & Hamilton LLP oppose the company’s restructuring proposal, as they believe that Naftogaz has the ability to make the payments.

According to the media, this group of creditors has enough influence to prevent Naftogaz from getting the support of 75% of creditors needed to approve the restructuring.

The group presented its own plan that takes into account Naftogaz’s financial condition as well as legitimate concerns about its need to fully support Ukraine’s economy and its vital infrastructure.

Bloomberg said that while the group’s opposition may delay the remedying of the defaults, the creditors have not initiated any payment acceleration or asset seizure process.

In SOE Weekly (Issue 68), we reported that on July 26, Naftogaz defaulted on its Eurobonds due to the Cabinet of Ministers’ refusal to approve payments on them.

Earlier, on July 21, acting in the capacity of Naftogaz’s general meeting, the Cabinet issued an order formally instructing Naftogaz to seek the Cabinet’s approval before executing any transactions related to the company’s Eurobonds.

Under previous CEO Yuriy Vitrenko, Naftogaz then reached an agreement with bondholders on the restructuring of the Eurobond issues maturing in 2024 (€ 600 million), while restructuring of Eurobond issues maturing in 2022 ($ 350 million) and in 2026 ($ 500 million) was still being negotiated.

Naftogaz’s new CEO Oleksiy Chernyshov, who was appointed on Nov. 3, expected that in early 2023, the company would reach an agreement on the restructuring with the holders of the 2022 and 2026 Eurobonds.

Ukrenergo’s CEO interviewed. Ukerenergo’s CEO Volodymyr Kudrytskyi was interviewed by Bloomberg this week. We selected the key messages.

On the situation with Ukrainian energy system:

- “The worst is over with Russia’s attacks on the Ukrainian energy system. The adversary has largely lost the ability to inflict significant damage.”

- “One shouldn’t relax and believe that Russia’s air strike campaign is over.”

- “Spring and summer won’t be easy. If the shelling is over and we are provided with an opportunity to restore (the damaged infrastructure) without interruption, we will likely achieve a long-term non-shortage period, but we can’t rely on that.”

On the damage to Ukraine’s power grid:

- “Direct damage to Ukraine’s power grid will run into the hundreds of millions of dollars, with economic losses ranging in the billions. A preliminary estimate will emerge in the coming weeks.”

- On the restoration of damaged power infrastructure:

- “Ukrainian repair teams have cut the time it takes to replace highly coveted transformers to a quarter of the duration in the fall.”

- “At this point we’ve reached a plateau – further degradation is not happening. We are able to restore at the same pace as the destruction is made, sometimes even faster.”

In SOE Weekly (Issue 74), we reported that Russia launched another missile and drone attack on Ukraine’s energy infrastructure. This was Russia’s 14th attack in its series of mass missile attacks and 16th in the series of drone attacks (since Oct. 10), Ukrenergo said.

After every Russian mass missile attack on Ukraine’s vital infrastructure, emergency outages take place, lasting for days due to the ongoing repair works. During such outages, people in Ukraine are often left without electricity, heating, water supply, or access to mobile phone networks.

Privatization

The state budget receives Hr 645 million from privatization since the beginning of 2023. On Feb. 16, lawmaker Roksolana Pidlasa (Servant of the People faction), the chair of the parliamentary state budget committee, wrote on her Facebook page that since the beginning of 2023, the state budget had received Hr 645 million ($17.6 million) from the privatization of state property.

Since the re-launch of small-scale privatization in September, the state budget has received an average of Hr 470 million ($12.8 million) per month. In total, the budget has received Hr 1.7 billion ($46.5 million) from small-scale privatization auctions in 2022, Pidlasa said.

In SOE Weekly (Issue 68), we reported that from Aug. 19 to the end of 2022, Prozorro.Sale conducted 220 privatization auctions. As a result, the state and local budgets expected to receive Hr 1.5 billion ($41 million).

The most expensive assets sold during the war in 2022 include the Lviv Jewellery Factory (Hr 185 million); Maryliv alcohol distillery (Hr 150 million); Vuzliv alcohol distillery (Hr 130 million); and Zalozetsk alcohol distillery (Hr 120 million).

Confiscation of the aggressor state’s assets, nationalization, and asset seizure

SBU stops Russian oligarchs Shelkov and Chemezov from preventing nationalization of their assets in Ukraine. On Feb. 15, the Security Service of Ukraine (SBU) exposed attempts by sanctioned Russian oligarchs Sergei Chemezov and Mikhail Shelkov to prevent the nationalization of the assets of the companies that Chemezov and Shelkov formerly owned in Ukraine.

These are the Demurinsky Mining and Processing Plant and the agricultural holding Invest Agro, which were confiscated in favour of the Ukrainian state by the High Anti-Corruption Court (HACC).

According to the SBU, after the court ruling, the former Russian owners of these companies tried to illegally “hide” the following assets:

- more than 100 units of automotive and specialized equipment;

- 6 railcars of agricultural products;

- more than 5,500 containers with ilmenite ore, which is used in the production of titanium;

- almost 1,200 tonnes of fertilizers and agricultural products.

The total value of these goods is Hr 150 million ($4.1 million).

In SOE Weekly (Issue 74), we reported that, on Feb. 3, the HACC satisfied an appeal by the Ministry of Justice and confiscated the Demurinsky Mining and Processing Plant owned by Russian oligarch Mikhail Shelkov.

Confiscated Russian assets to be auctioned. On Feb. 10, the Cabinet of Ministers approved the sale of confiscated Russian assets via electronic auctions.

According to Prime Minister Denys Shmyhal, all the proceeds from these sales will be transferred to a special fund towards mitigating the damage of the Russian aggression. The auctions will follow the same procedure as small-scale privatization auctions.

HACC seizes property of Russian oligarch Deripaska. On Feb. 16, the High Anti-Corruption Court (HACC) satisfied the claim of the Ministry of Justice and ruled to transfer companies owned by sanctioned Russian oligarch Oleg Deripaska to Ukrainian state ownership.

According to the HACC, the following assets were recovered for the state:

- the corporate rights of 13 legal entities, including Mykolaiv Alumina Plant LLC and Hlukhiv Quartzite Quarry LLC;

- integral property complexes (such as production sites along with real estate and equipment located there);

- real estate, such as apartments and buildings;

- cars, trucks, and specialized equipment; and

- Hr 32 million ($875,000) in cash.

The ruling may be challenged in the HACC’s Chamber of Appeals within five days from the date of the ruling, the court added.

According to the SBU, Deripaska’s seized assets are worth Hr 10 billion ($274 million).

Deripaska is part of Russia’s inner military and political leadership circles. He had tried to conceal his ownership of assets in Ukraine through controlled commercial structures.

In SOE Weekly (Issue 73), we reported that on Jan. 30, the Prosecutor General’s Office announced the seizure of Hr 32 million ($875,000) from Deripaska’s Mykolaiv Alumina Plant LLC, the largest producer of metallurgical alumina and aluminium hydroxide in Ukraine.

Previously, the courts had seized Deripaska-controlled assets including 12 plots of land, a seaport complex, apartments, administrative buildings, production workshops, 46 vehicles, and 240 units of special equipment, all worth more than Hr 1 billion ($27.3 million) in total.

Apparently, these are the same assets as the assets later confiscated by the HACC as described above.

In SOE Weekly (Issue 70), we reported that the Ministry of Justice filed a lawsuit with the HACC, seeking to seize assets belonging to Deripaska.

Most Popular

Journalist Roshchyna's body missing organs after Russian captivity, investigation says

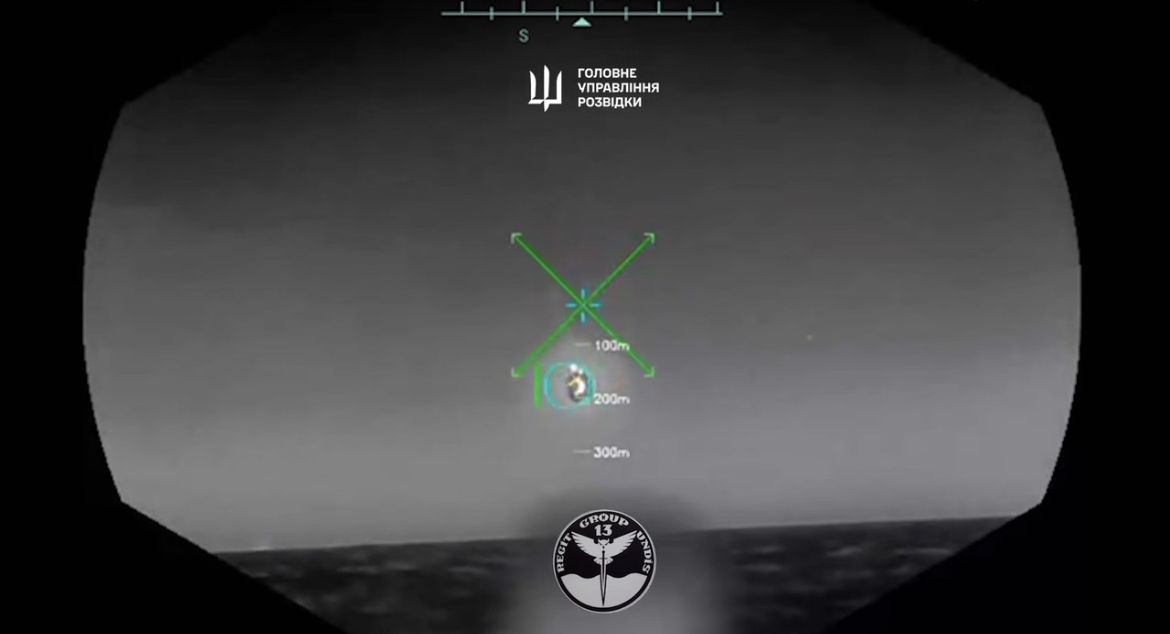

Ukrainian sea drone downs Russian fighter jet in 'world-first' strike, intelligence says

Ukraine is sending the war back to Russia — just in time for Victory Day

'Justice inevitably comes' — Zelensky on deaths of high-ranking Russian officials

Editors' Picks

How medics of Ukraine’s 3rd Assault Brigade deal with horrors of drone warfare

As Russia trains abducted children for war, Ukraine fights uphill battle to bring them home

'I just hate the Russians' — Kyiv district recovers from drone strike as ceasefire remains elusive