Small Estonian fintech to take on big Ukrainian banking sector

Representative from the Iute Group signs an agreement with Ukrainian partners, allowing the group to move forward with establishing a fully digital bank in Ukraine, as shown in a photo published on Jan. 15, 2026. (Iute Group / Facebook)

Ukraine's wartime banking sector will get a new player after an obscure fintech's bid to enter the country's market was finalized on Jan. 15.

Iute Group, headquartered in Estonia, signed the final stage of acquiring a Ukrainian banking license during an upbeat press conference held in Kyiv on Jan. 15. It's reportedly the first foreign bank to enter Ukraine since 2021.

"Since 2008, it's pretty much been only one direction — foreign banks leaving the country," Mykhaylo Demkiv, financial analyst at Ukrainian investment firm ICU, told the Kyiv Independent.

"But now we have one entering the country. So it's a pretty big deal."

Half of Ukraine's banks were liquidated, and several others were nationalized during a massive banking cleanup in the aftermath of the 2014 EuroMaidan Revolution and Russia's annexation of Crimea and invasion of eastern Ukraine.

A decade later, Iute is breaching a competitive retail bank sector with big incumbent players, advanced digital products, and record profits — albeit as Russia's full-scale invasion approaches its fifth year.

"This demonstrates not only the trust in Ukraine's banking sector, but in the future of the Ukrainian state," Olha Bilai, managing director of Ukraine's Deposit Guarantee Fund, said during the press conference.

The Estonian company won a tender to acquire the assets of RVS Bank, which was declared insolvent and liquidated by the National Bank of Ukraine (NBU) in November last year.

The NBU had earlier declared RVS as "problematic" for engaging in risky activities and violating regulations.

Iute Group purchased a bridge bank — the 'skeleton' of RVS bank — from Ukraine's guarantee fund for Hr 7 million ($160,000), Bilai said during the press briefing.

"It's a healthy bank, with carefully selected assets and corresponding liabilities, which needs to be developed into a fully operational bank," Tarmo Sild, the CEO of Iute Group, said during the press conference.

After additional capitalization and adapting to the requirements of Ukraine's central bank, Iute will provide digital banking services for retail clients. Iute has committed to invest 15 million euros ($17.5 million) under the agreement, Sild said.

Founded in 2008, Iute Group featured on the Financial Times' 2024 Long Term Growth Champions shortlist, which highlights European companies with sustained revenue growth over the previous decade.

Competition is fierce as Ukraine has a wealth of sleek digital products.

A potential expansion into Ukraine would mark the fifth country in their portfolio, centered around southeastern Europe. The company currently serves customers in Moldova, Albania, North Macedonia, and Bulgaria.

But they are still small and relatively unknown.

"The market perceives them as a risky company," says Demkiv, pointing out that in a recent corporate bond sale, Iute issued Eurobonds with a 12% interest rate.

"It's a risky endeavor given Ukraine's competitive market, we'll see how they fare," Demkiv says.

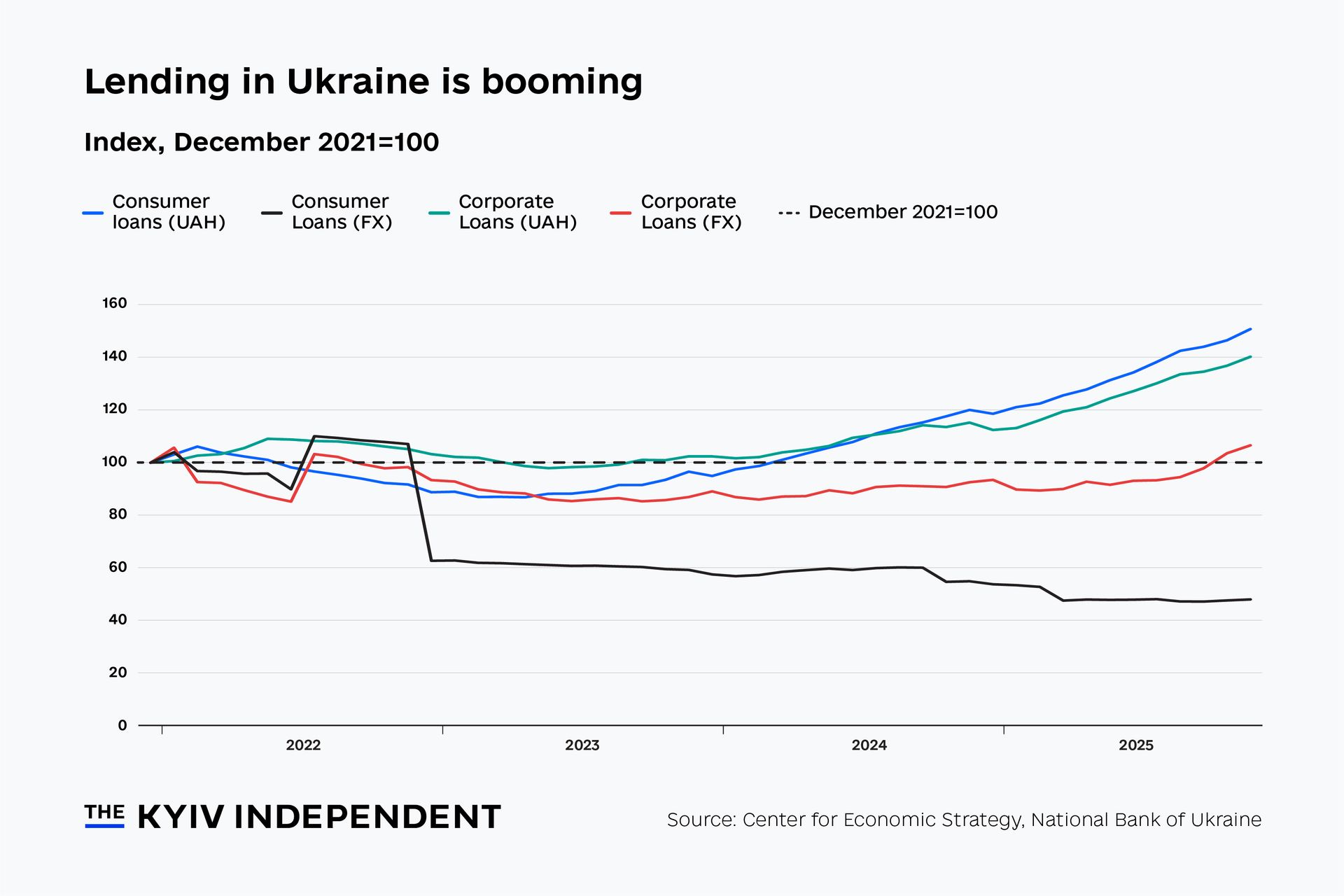

Sixty banks operate in Ukraine, which reaped almost Hr 150 billion ($3.4 billion) in post-tax profits in the first 11 months of 2025, according to the NBU. High interest rates and deposits are key factors.

A looming competitor is Ukrainian state-owned giant PrivatBank, which serves 19 million customers and is home to just under 40% of all deposits held by Ukrainian households.

Smaller players dominate other areas. Monobank, a digital-only neobank founded in 2017, has amassed a large following by offering exclusive digital products. One such product is the Monobank "jar," a popular way of donating to the military.

One of the founders of Monobank, Serhii Tihipko, also bid to acquire the assets of RVS Bank, Forbes reported earlier this year.

But Iute is confident that their know-how on digital banking and data-science capabilities will serve them well. Sild said during the press conference that their strategy will involve digital payments, digital lending, digital insurance, digital investments, and providing tailored products to consumers.

"A lot will depend on their product," Hlib Vyshlinsky, director of Ukrainian think tank Center for Economic Strategy, told the Kyiv Independent.

"Competition is fierce as Ukraine has a wealth of sleek digital products. The only way to differentiate will be proposing something completely new or focusing on a specific segment with specific needs," Vyshlinsky added.

One such area could be the 4 million Ukrainians who currently live in the European Union under temporary protection.

"If we succeed, then we also aim to serve Ukrainians who are not residing in Ukraine," Sild said, pointing out that Iute has the opportunity to leverage its Bulgarian subsidiary, which is inside the European Union.

When asked by the Kyiv Independent how Iute will distinguish itself from the competition, Sild reiterated that there is a large population of Ukrainians living abroad.

"In one year and three months from now, ask us again what we have done for Ukrainians not living in Ukraine," Sild said.

For now, Arthur Muravitsky, who will lead the bank in Ukraine, said that the bank is aiming for 300,000 customers.