Russia’s war machine has shown remarkable stamina despite the hundreds of thousands of troops it is estimated to have lost in Ukraine. But under the hood, it may be less resilient than it looks.

With its high oil export revenues, Russia has been able to replace its losses and give its soldiers enough equipment and ammunition to keep on pushing. To achieve and maintain this, the Kremlin has put the whole country on a military footing for the foreseeable future, Russia observers say.

“I have repeatedly said that for me it looks like the economy of a country that’s preparing for a large war,” Russian sociologist Greg Yudin told the Kyiv Independent. “By large war, I mean a war far exceeding Ukraine.”

With Ukraine on the back foot, in both manpower and equipment, Russia can press its advantages to inflict a lot of damage.

And yet, Russia’s current manufacturing rate and troop quality are about as high as they’re ever going to get, analysts believe. A review of economic and social data also shows that serious vulnerabilities plague Russia’s personnel and materiel pipelines.

“The quality has decreased since (2022),” Kirill Mikhailov, a researcher with the Conflict Intelligence Team, told the Kyiv Independent in reference to Russia’s troops.

The Kremlin makes up for the lack of skilled and experienced soldiers with numbers, which is likely to endure as long as its high oil revenue does.

Petro-ruble budget

By exploiting sanctions’ loopholes, Western reluctance to crack down, and a shadow fleet of decrepit oil tankers, Russia was projected to make around $180 billion from oil exports in 2023, compared to $110 billion in 2021. Russia's total state revenue for 2023 was reported to be 2.85 trillion rubles ($260 billion).

According to the Wilson Center, a D.C.-based think tank, Russia’s military expenditures have tripled compared to pre-war times.

Experts spoken to for this article estimate that Russia spends up to 40% of its budget and up to 10% of its GDP on the war. A U.S. defense official told Reuters in mid-February that Moscow has spent $211 billion on the war since February 2022.

Russia actually struggles to predict its military budgets a year in advance, according to Russia expert Pavel Luzin — military spending was 50% higher than planned in 2023; ruble spending on weapons doubled to 3.2 trillion rubles from before the war. But in dollars, that’s lower than it was in 2013-2014, he said.

In spite of these cost overruns, Russia’s hydrocarbon income sustains it for now. Some of it goes to pay exorbitant salaries and bonuses for soldiers and people involved in weapons manufacturing. Some of it goes toward manufacturing vehicles and munitions themselves.

Experts said Russia’s cash flow allows it to paper over some serious issues with both its human capital and its military-industrial complex.

Buying lives

Per a Ukrainian military intelligence (HUR) statement in January, Russia’s entire ground force of about 462,000 fighters is deployed to Ukraine. Most Russian units are at 92-95% strength. This lets them conduct operations and rotate units to the rear when they fall below 50%.

“They’re fine, we’re killing them slower than they’re picking up new personnel,” said Viktor Kevliuk, a retired Ukrainian colonel now working for the Center for Defense Strategies.

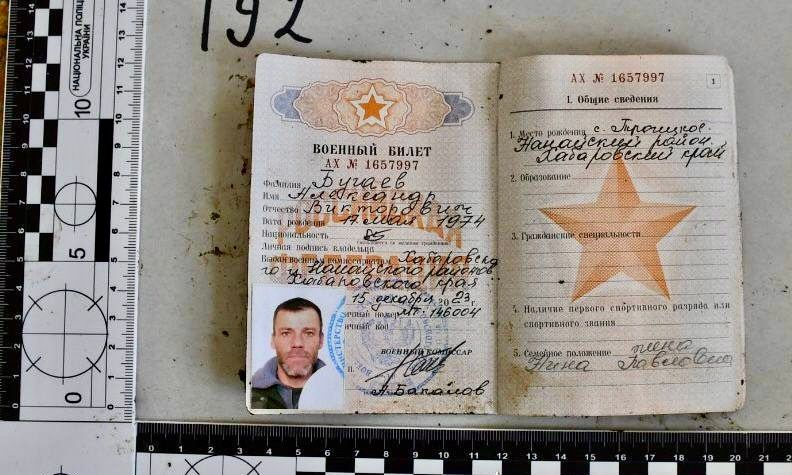

HUR has estimated that Russia is losing 20,000 men per month but recruiting up to 30,000. Vladimir Osechkin, director of Russian watchdog group Gulagu.net said recruitment can reach up to 1,500 men per day.

Some of the experts agree that the majority of Russia’s most skilled and motivated fighters have already been expended. Their replacements tend to be people whose livelihoods suffered from the war. The economic upheaval had an uneven impact, leading to higher salaries for some, while ruining the financial opportunities of others.

While the Kremlin talks a big game about how many people volunteer to fight, Yudin said “there is not much difference in terms of profile between mobilization and volunteering.” Both target the most desperate and vulnerable, who are “paradoxically… the least sympathetic to the whole war adventure.”

Yudin said that many Russian recruits are aware they could die in a mass banzai charge, but may feel their lives are miserable anyway and joining the military at least gives them a chance to make money.

Many people join because they have no other options and tend to skew a little older and less skilled, Mikhailov said. He added that training remains rudimentary, with two to three weeks considered “good.”

All these qualities, plus rock bottom morale, limit the new troops’ combat quality and what Russia can do with them, experts said. Russian commanders often default to human wave attacks in these situations, keeping casualties high, along with the need to replace them.

There are many witness reports of brutal treatment, such as Russian soldiers being beaten, mock-executed, or thrown into pits by superior officers. Military scholar Michael Kofman said that threats of summary execution, once a feature of Wagner-like units, have become widespread.

Active, yet hollowed-out industry

Russia’s military-industrial complex also faces problems, despite appearing relentless. D.C.-based defense policy think tank Jamestown Foundation wrote in February that “Russian arms manufacturing is facing more challenges than its top managers and high-ranking Russian officials are willing to admit.”

The economy has been retooled toward war. Kevliuk said that in addition to official military procurements, state bodies like the defense ministry, internal affairs, or Russia’s Federal Security Service (FSB) invest in ammunition, food, fuel, and other resources. As do some private corporations, Osechkin said.

Many companies have been plugged into the war effort through Kremlin-linked people working there. Yudin said many people he knows “are now facing a situation when they are forced to do something for the army in one way or another.”

In other words, they are told “This is your job now. If you don’t like it, you can go.”

And yet, multiple analytical reports and Russia watchers point to some serious problems. Military spending is skyrocketing. There is a skilled labor shortage. Russian factories have little room to scale up capacity, throttled by available machinery and hours in the day. High-technology assets take longer to replace.

Jamestown says that Russia's manufacturing output does not reflect a proportional rise in actual production. “The apparent growth in aircraft and spacecraft supplies should be attributed more to inflation than actual increased production.”

Industrial assembly equipment for factories is a limiting factor, as they are hard to make and just about impossible for Russia to procure from the countries that normally make or service it. This puts expiration dates on factories, Luzin wrote. Russia’s electrical output isn’t growing enough to fuel a growing military industry.

The workforce is another bottleneck. Russia was short 400,000 workers and engineers, according to a June 2022 statement by Russian official Yuriy Borisov. Mikhailov said that Russia has its lowest unemployment rate on record. Salaries were raised but output is a function of more shifts, not more productivity. Many Russian factories already run triple shifts, six days a week.

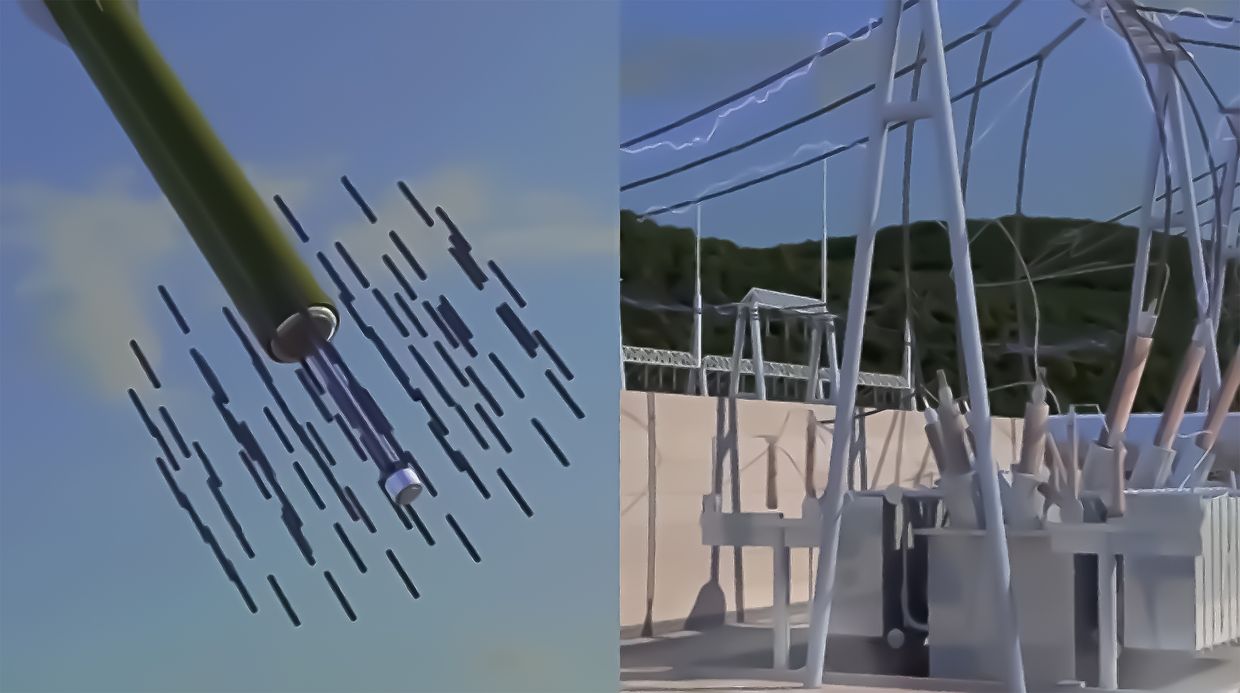

Russia claimed that in 2023 its military received 1,500 tanks, 3,700 vehicles, 22,000 drones and over 500 missiles.

The details sound less impressive. To start with, the tanks range from modern T-90Ms to World War II era T-55s, Mikhailov said. Swedish defense research agency FOI estimated that Russia makes 520 tanks per year, of which only 62 are T-90Ms and 62 are T-90As, an earlier modification. The rest of the tanks are older models most of which have been refurbished from older chasses.

“The supplies of arms and their components from the storage bases (including the cannibalizing of systems in storage) remain the main source of filling the needs of the Russian armed forces,” Jamestown Foundation wrote.

“These trends will likely follow into 2024 and will affect Russia’s performance in Ukraine and other conflicts.”

Luzin wrote that faced with all these issues, one would think Russia would focus down on producing a few weapons as well as possible and as cheaply as possible. Instead, he said, Russia is doing the opposite, building a plethora of different weapon systems, which is more expensive.

With production hitting the ceiling, Russia was forced to turn to Iran and North Korea for missiles and artillery shells. Ukraine’s General Staff and military intelligence said the North Korean ammunition is decades old and a lot of it is defective, either failing to fire or exploding inside the barrel. Testimonials on Telegram channels purported to be Russian seem to agree.

As for Russia's much-hyped, next-generation T-14 tank, it won’t be showing up to the Ukrainian battlefield after all, because Russia can’t actually afford it as a fighting vehicle.

"The Armata, it is, generally, expensive,” Sergey Chemezov, head of Rostec, said in an interview. “In terms of its functionality, of course, it is much superior to existing tanks, but it is too expensive, so the army is unlikely to use it now."