MP Yaroslav Zhelezniak: Developments in Ukraine’s parliament on economic reforms, international obligations — Issue 64

Editor’s note: This is issue 64 of Ukrainian lawmaker Yaroslav Zhelezniak’s weekly “Ukrainian Economy in Brief” newsletter, covering events from July 8-14, 2024. The digest highlights steps taken in the Ukrainian parliament related to business, economics, and international financial programs.

The Kyiv Independent is republishing with permission.

Benchmarks and soft commitments in the memorandum with the IMF

A working group agreed to design the draft law on customs reform in line with the key provisions of the draft law on the restart of the Bureau of Economic Security.

A working group of the Tax Committee has started to prepare draft law #6490-d on the restart of the State Customs Service for the second reading. The working group agreed to finalize the draft law and all key provisions in line with the adopted draft law on the restart of theureau of Economic Security which was supported by all international partners.

In particular, draft law #6490-d suggests a relaunch of the competitive procedure for the selection of the bureau's director which will be conducted by a commission of six people, three of whom will be international experts with a casting vote.

The final text of the draft law on the customs reform to be considered in the second reading will be prepared in the near future.

The Parliament will consider a draft law to restore medium-term local budgets.

During the plenary week scheduled for July 16-19, the Verkhovna Rada will consider in the first reading draft law #11131 with the amendments to the Budget Code to restore medium-term planning of local budgets. This step is mentioned as an intention of Ukraine in the Memorandum with the International Monetary Fund (IMF).

As we reported in Issue 63, the draft law restores medium-term planning of local budgets except for occupied territories or war zones, expands opportunities to use remaining funds, gives right for local councils to provide a financial guarantee for refinancing previously taken loans upon agreement with the Finance Ministry, allows local authorities not to apply the provisions of the Budget Code regarding the total volume of local debt for another six years until 2030.

Obligations to the EU

Next plenary week the Verkhovna Rada will consider several draft laws from the Ukraine Plan.

Several draft laws which are among requirements in the Ukraine Plan within Ukraine Facility program of financial support were rescheduled for this plenary week on July 19. The Parliament will consider in the first reading draft law #11063-d on the State Agrarian Register and draft law #11310 on the basic principles of state climate policy.

Moreover, the Verkhovna Rada will consider draft law #11355 on prevention and control of industrial pollution in the second reading. As we reported in Issue 61, draft law #11355 was submitted to replace the draft law #6004-d which was accidentally rejected due to the lack of lawmakers from coalition faction during voting.

The Verkhovna Rada will increase excise taxes on fuel.

The Verkhovna Rada will consider in the second reading draft law #11256-2 on the gradual increase of excise taxes on fuel to the EU level.

As we reported in Issue 63, the Committee approved a provision to establish higher excise, the idea of which was rejected in the first reading by the Parliament. The Committee suggests to the Verkhovna Rada to adopt the increase of excise taxes on liquefied gas up to 150 euros instead of the minimum EU level of 70 euros.

Other key economic issues

The Cabinet of Ministers submitted to the Verkhovna Rada a draft law on taxation of cashback for purchasing Ukrainian goods.

Last week the Cabinet of Ministers approved and submitted draft law #11400 regarding the tax on cashback for purchasing Ukrainian-made goods. As we know, it suggests not to apply income tax to the money received as a cashback for purchasing Ukrainian-made goods. However, the text hasn’t appeared yet on the official website of the Parliament, so the Tax Committee hasn’t even considered the draft law.

It’s worth to mention that in case of dismissal of the prime-minister and eventually of all the Cabinet of Ministers, all draft laws submitted by the Cabinet which haven’t been considered in the first reading will be automatically rejected, including the draft law with the amendments to the Tax Code for a cashback program.

The Verkhovna Rada will try to forbid SOEs to hide prices of procurements for construction works.

The parliamentarian agenda for July 16-19 includes draft law #11057 on changes in public procurement procedures for state-owned enterprises (SOEs) submitted by Anastasiia Radina, Head of the Anti-Corruption Policy Committee, and other lawmakers including myself. It will be considered in the first reading.

Draft law #11057 obliges the state contracting authorities to publish the detailed cost estimate of construction works under the signed contracts.

As we reported in Issue 48, currently several provisions, including those adopted due to the martial law, give the SOEs a right not to show the detailed cost estimate within the procurements related to construction works. Numerous journalists’ investigations show that it’s an opportunity for corruption and fraud as the SOEs often buy overpriced construction materials. For example, Energoatom purchased concrete for construction at twice the market price.

Next plenary week the Verkhovna Rada will address issues regarding changes in the Cabinet of Ministers.

The Verkhovna Rada will hold plenary meetings two weeks in a row. During plenary meetings scheduled for July 23-26 the Parliament will likely consider personnel decisions regarding members of the current Cabinet of Ministers.

However, the latter will be possible only if Ukrainian authorities decide to dismiss the prime minister with the entire Cabinet. According to our information, it’s one of the most likely scenarios. However, martial law prohibits the termination of powers of the Cabinet of Ministers. Therefore, to implement such a scenario, the authorities must either change the martial law or break it.

Recent NABU case regarding the corruption in Rivne customs office proved total control of the law enforcement state bodies over customs.

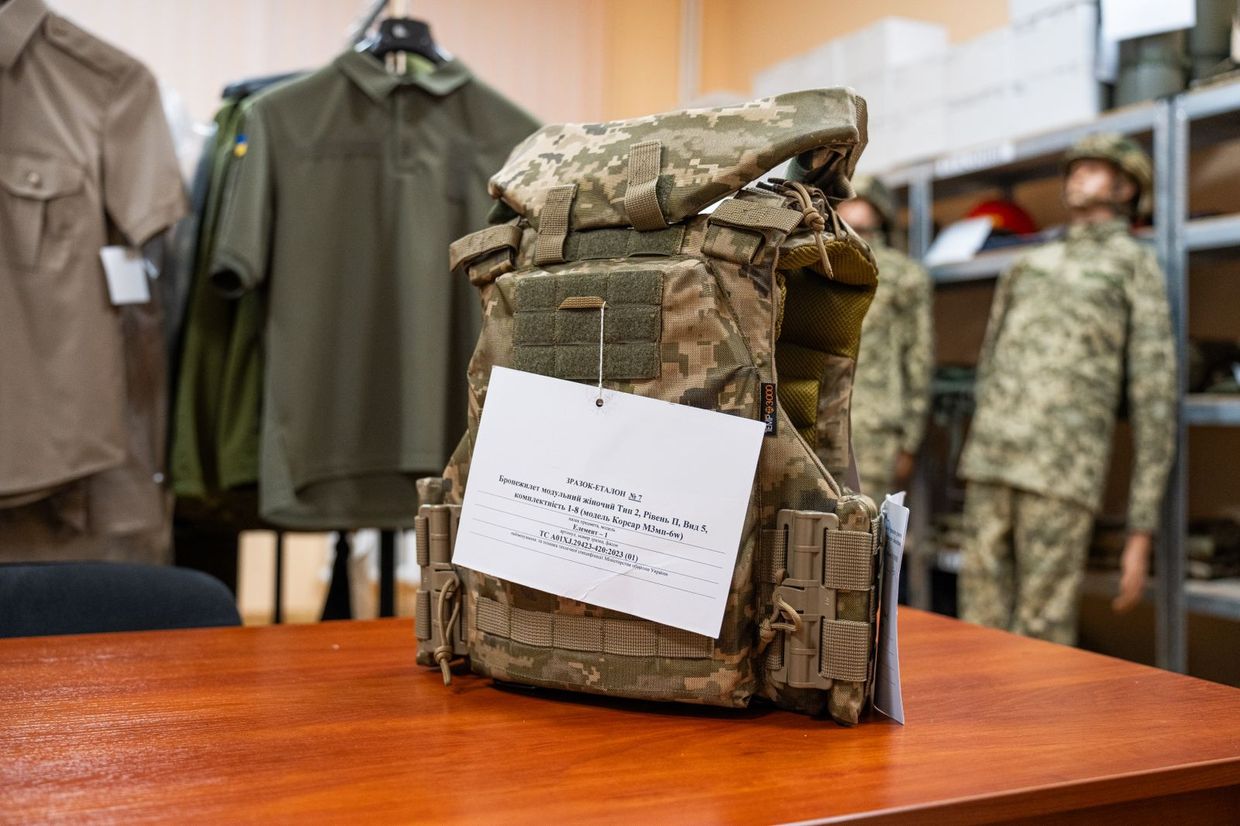

Last week a court made a decision in the National Anti-Corruption Bureau of Ukraine (NABU) case regarding bribes up to $300,000 to Rivne customs officers.

According to the court’s decision, the illegal benefit for illegal assistance in customs clearance at the Rivne customs office was meant to be shared among representatives of the National Police, the State Bureau of Investigation and the Security Services of Ukraine.

Such a court’s decision proves that as of now the law enforcement state bodies lead all corruption-related activities on customs. Moreover, it reveals that above-mentioned law enforcement agencies work on cases of tax evasion which are not under their responsibility according to the law. In contrast, the Bureau of Economic Security which has to be responsible for such crimes doesn’t provide investigations regarding relevant articles of the Criminal Code.