Chart of the week: Will Ukraine’s central bank weaken the hryvnia?

Editor's note: This chart of the week is part of our Ukraine Business Roundup newsletter, published weekly. Subscribe here.

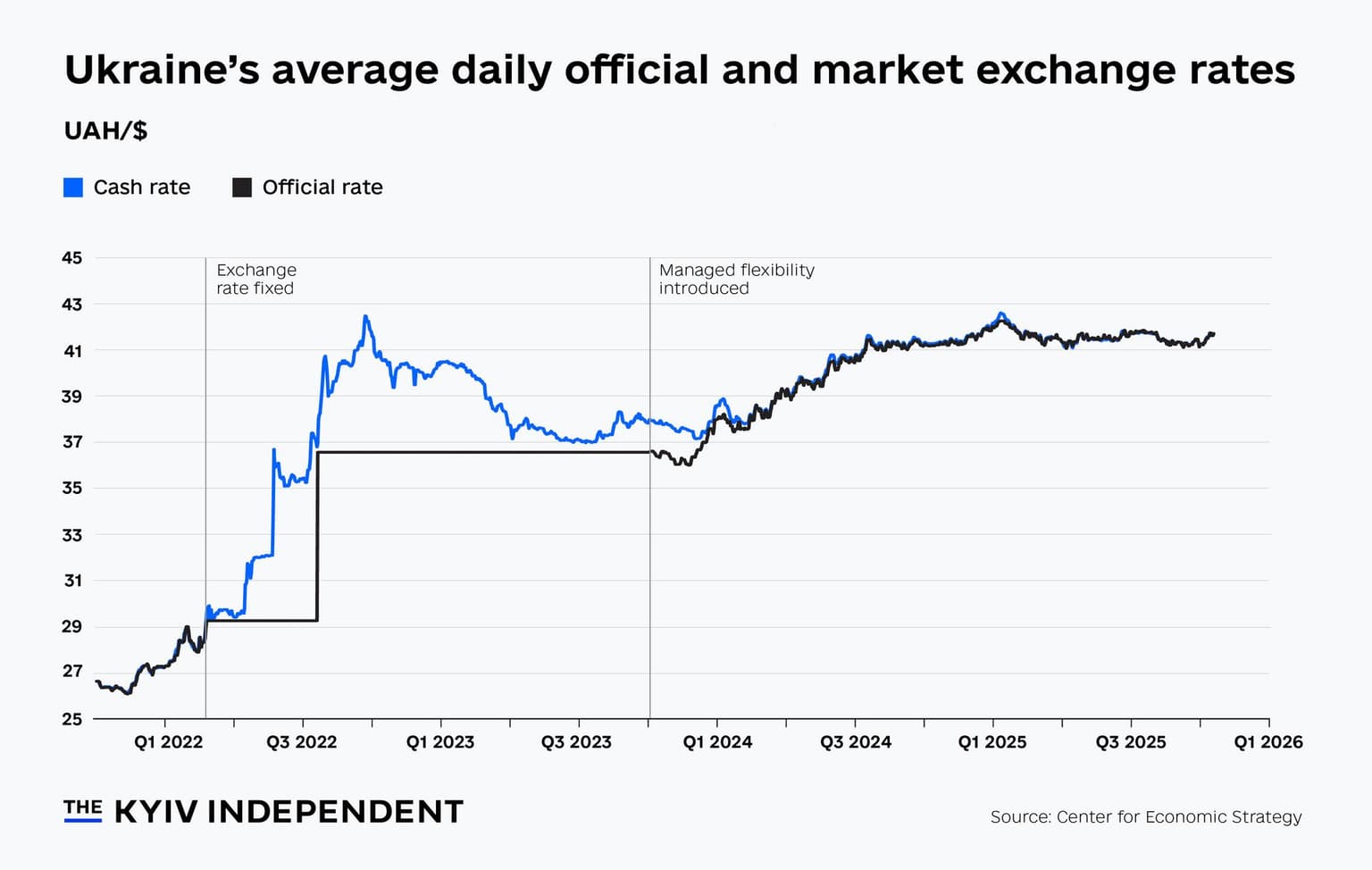

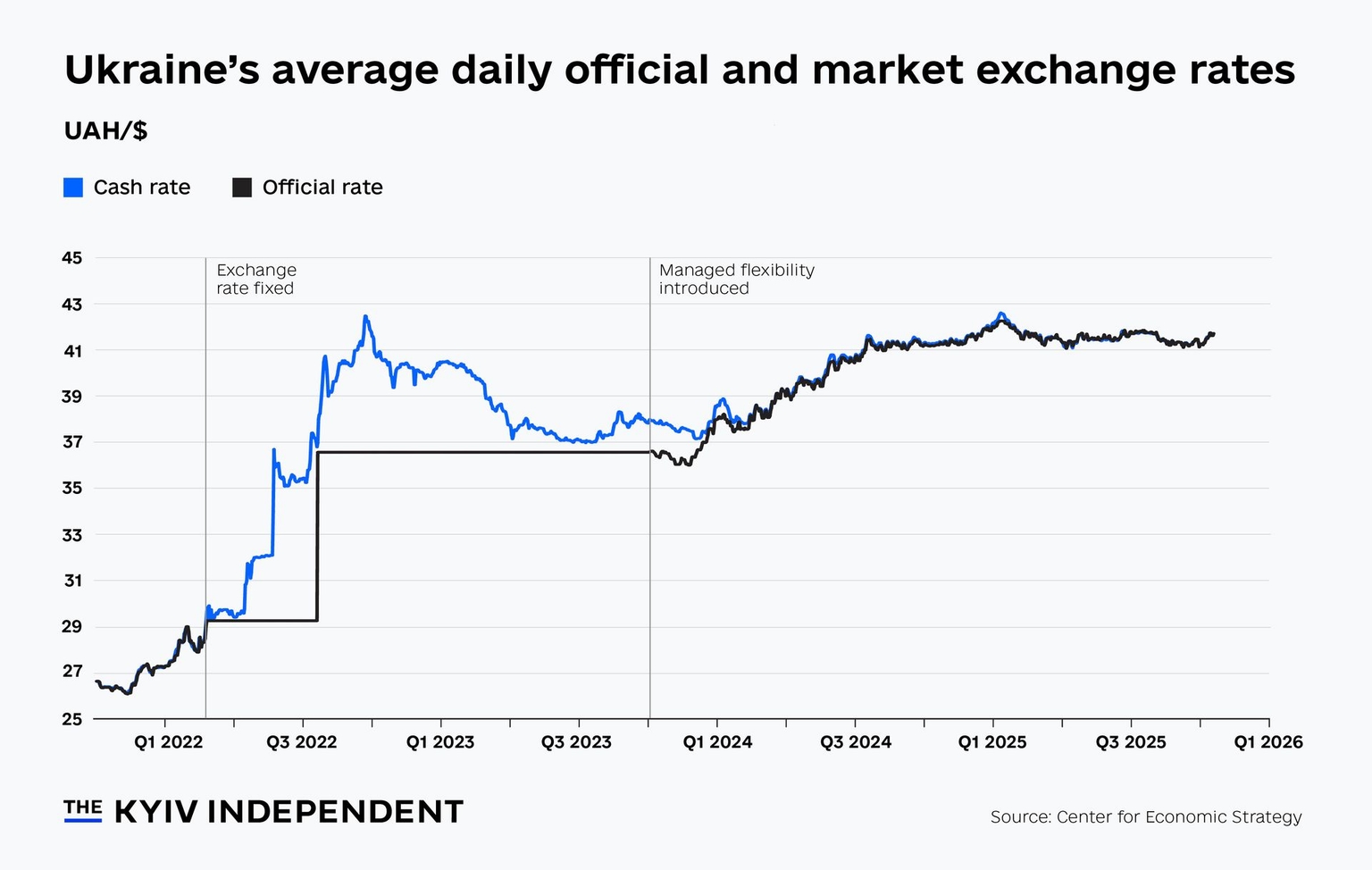

Ukraine's central bank has held the country's exchange rate relatively stable in the last year after the initial volatility caused by Russia’s full-scale invasion. But that might be about to change.

Recent reports suggest that the International Monetary Fund wants the bank to weaken its currency, the hryvnia, ahead of negotiations for a new loan program. A devaluation would mean Ukrainians get less bang for their buck, and the National Bank of Ukraine is so far reportedly resisting the move.

Ukraine faces a gaping hole in its finances — $60 billion for 2026 and 2027, according to finance minister Serhii Marchenko — and is under pressure to secure financing from foreign partners and find durable ways of raising more revenue domestically.

"Foreign assistance is approximately one half of our budget, so a devaluation means that we could convert one dollar of assistance into more hryvnias, helping us to fund our defense," says Yeleazar Levchenko, economist at the Kyiv-based Center for Economic Strategy (CES).

"It would also address our worsening trade deficit," Levchenko added.

A combination of reduced exports and increasing imports is worsening Ukraine’s trade deficit, which hit a historic low of $5.1 billion over the summer, according to CES. Russia’s full-scale invasion destroyed or occupied some of Ukraine’s main export-oriented industries, including coal mines in Donetsk and steelworks in Mariupol. Exports have not recovered since.

Ukraine’s imports are also increasing as the country purchases goods critical to the country’s war effort and replacements for critical infrastructure damaged by Russian air strikes, such as batteries and transformers.

A devaluation would boost Ukraine’s exports, since they would be relatively cheaper. But they would also make imports more expensive for Ukrainians, potentially causing unrest.

"A devaluation in the exchange rate could start to fuel an inflationary spiral, where Ukrainians start to expect higher inflation, which requires further devaluation, and therefore higher inflation," Levchenko says.

Given the high uncertainty induced by the war and the sensitivity of Ukrainians to inflation due to recent financial crises, the central bank will likely be very cautious if it pursues a devaluation.

The hryvnia has been repeatedly devalued since Russia’s full-scale invasion, but for the last year, it has remained relatively stable between 41 and 42 hryvnias per dollar. A weaker hryvnia would mean the rate would rise above 42 — i.e., more hryvnias would be needed to purchase one dollar.